- Joined

- 23 October 2005

- Posts

- 859

- Reactions

- 0

Hello everyone,

I'm an EW beginner and would like to have the opinion of accomplished EW users (wavepicker, nick, porper, anyone else) on the weekly chart of Euro.

There are 2 things to about that chart:

1) The 2004-2005 move it stands out as a 5 wave move. But looking at the long term trend it is clearly a correction of the bull trend. I have a difficult time accepting any other count since a 5 wave stands out so well. How would you count it?

2) The bull move since 2005 bottom I can't see any clear count, a long series of hh & hl that would be dangerous to fade. Would you count it? If yes, how?

Thanks!

Hello soso, I bought this point up to Nick Radge on this very chart some years ago. At that time I managed to identify this as a correction NOT an impulse.

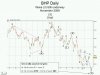

Why?? Have a look at the daily chart attached. Look at the subdivisions in what most people would have called waves 1 and 5. They break down into 3 wave structures(very clearly at that). Thus I labelled this as an WXY correction not an impulse.

There is nothing hard about this, and you don't have to be an expert to pick this up, it's simple EW pattern recognition. Remebver waves 1,3 and 5 must subdivide into 5's otherwise it's corrective. There is your answer, you just have to study your market well to come to the most objective conclusion possible.

Will answer 2nd question at a later time

Hope this helps