You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

The Elliott Wave Analysis Thread

- Thread starter tech/a

- Start date

-

- Tags

- elliott wave

- Joined

- 23 September 2008

- Posts

- 919

- Reactions

- 174

oki heres that count agian, theres a patch of yellow oval that i couldnt count, cos i only have eod. Is there something invalid about this count?

Do u use the Glen Neely method all the way down to the monowaves?

EOD Data is ok for a bigger term view.

Some comments:

You have x3 situations where Waves 2 and 4 overlap - this fails the EW rule that wave 4 price action should never move into the price range of wave 2. You need to re-label the chart.

Whilst waves can overlap it will only happen in wave C's, Wave 5's (as a ending diagonal - 3 wave structure) or sometimes in wave 1 (ending impulse - 5 wave structure).

Hope this helps

As for Glenn Neely, The area that his text helped with was understanding corrections. Before reading his 'Mastering Elliott Wave' text, I was scratching my head on numerous occasions on why my count was wrong. Even after the market action it was still hard to understand where the problem was.

Neely helped specifically with corrections and advanced labeling - Chapter 11. There were some chapters that I thought were unnecessarily complex (eg Chapter 3) and could have been simplified considerably.

Triangles, Irregular flats, Wave relationships, double and triple corrections were certainly areas that contained value for me. I still find myself going back to read up on them.

- Joined

- 23 September 2008

- Posts

- 919

- Reactions

- 174

yea forgot about that rule when i labelled the smaller waves, im gona go read chapter 11 in neelys book nowthanx.

Do u only have one count for BHP?

The XMJ and XAO appear to be following relatively closely at the moment - The posting yesterday on the "How Low can the all ords go" thread goes thru my logic and contains 3 scenarios. The XMJ and to some extent BHP should play along.

- Joined

- 23 September 2008

- Posts

- 919

- Reactions

- 174

Hi EWers

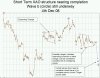

Thought I'd share a possible count on the XAO 5min chart.

As discussed here --> https://www.aussiestockforums.com/forums/showpost.php?p=366078&postcount=5892

it appeared that 5 waves (i)->(v) were complete as of tuesday - so the next step was to identify the impending correction that was to follow.

There was a small a-b-c correction yesterday finishing at (a) on the chart which could certainly be the end of it. The push up today was retraced by just over 61.8%, however it appears that it corrected in 5 small waves.

Therefore it's very possible that the correction of the leg that started last friday is still not complete, and an expanded flat is unfolding.

If true, then more downside to come to complete wave b (circle) then a final push into wave c (circle) should occur. This should complete part of the much larger wave (4) correction.

I find understanding the 2 possible scenarios that may unfold helps significantly in the planning for the next day's trade setups. A break above the high (labelled as (b) on the chart) will invalidate the expanded flat scenario as I will assume a further 5 waves up will unfold (the first 2 waves now complete as part of today's market action).

Thought I'd share a possible count on the XAO 5min chart.

As discussed here --> https://www.aussiestockforums.com/forums/showpost.php?p=366078&postcount=5892

it appeared that 5 waves (i)->(v) were complete as of tuesday - so the next step was to identify the impending correction that was to follow.

There was a small a-b-c correction yesterday finishing at (a) on the chart which could certainly be the end of it. The push up today was retraced by just over 61.8%, however it appears that it corrected in 5 small waves.

Therefore it's very possible that the correction of the leg that started last friday is still not complete, and an expanded flat is unfolding.

If true, then more downside to come to complete wave b (circle) then a final push into wave c (circle) should occur. This should complete part of the much larger wave (4) correction.

I find understanding the 2 possible scenarios that may unfold helps significantly in the planning for the next day's trade setups. A break above the high (labelled as (b) on the chart) will invalidate the expanded flat scenario as I will assume a further 5 waves up will unfold (the first 2 waves now complete as part of today's market action).

Attachments

salsem

salsemelliottwaves.blog

- Joined

- 17 November 2008

- Posts

- 5

- Reactions

- 0

- Joined

- 23 September 2008

- Posts

- 919

- Reactions

- 174

Hi EWers

As discussed here https://www.aussiestockforums.com/forums/showpost.php?p=366789&postcount=165

A possible expanded flat may have completed on the XAO today. The (b) wave pushed further than previously discussed and the (c) wave down has completed in 5 waves. If correct then another 5 waves up needs to occur over the next several days and this will complete one leg of a larger wave (4) correction.

Alternatively, there could be more downside potential if the much larger wave (3) subdivides as show in the 2nd chart.

It should be noted - there are several ways to interpret the current short term wave structure. The top 2 considerations are provided below. The 3rd option could be that a wave (4) triangle is forming and wave b of the triangle will head to a new low.

As discussed here https://www.aussiestockforums.com/forums/showpost.php?p=366789&postcount=165

A possible expanded flat may have completed on the XAO today. The (b) wave pushed further than previously discussed and the (c) wave down has completed in 5 waves. If correct then another 5 waves up needs to occur over the next several days and this will complete one leg of a larger wave (4) correction.

Alternatively, there could be more downside potential if the much larger wave (3) subdivides as show in the 2nd chart.

It should be noted - there are several ways to interpret the current short term wave structure. The top 2 considerations are provided below. The 3rd option could be that a wave (4) triangle is forming and wave b of the triangle will head to a new low.

Attachments

- Joined

- 27 September 2007

- Posts

- 406

- Reactions

- 1

Here is my amateur Elliot Wave Analyst on WPL.

Looks to of completed 5 waves down with waves 1,3 & 4 subdividing into a a-b-c pattern. Wave 1 and Wave 5 are almost exactly the same length which would suggest that we are now in an a-b-c correction. Wave 2 retraced ~ 61% (wave 2's tend to retrace between 50-70% of wave 1). Wave 4 retraced ~ 32% (wave 4's tend to retrace between 30-50% of wave 3). Id now be looking for a retrace to ~$30 (Is there a way to calculate the length of the corrective wave b?) before a wave c back up towards $40 as wave a & c tend to be the same length.

Look forward to some input.

Cheers Johnny.

Looks to of completed 5 waves down with waves 1,3 & 4 subdividing into a a-b-c pattern. Wave 1 and Wave 5 are almost exactly the same length which would suggest that we are now in an a-b-c correction. Wave 2 retraced ~ 61% (wave 2's tend to retrace between 50-70% of wave 1). Wave 4 retraced ~ 32% (wave 4's tend to retrace between 30-50% of wave 3). Id now be looking for a retrace to ~$30 (Is there a way to calculate the length of the corrective wave b?) before a wave c back up towards $40 as wave a & c tend to be the same length.

Look forward to some input.

Cheers Johnny.

Attachments

- Joined

- 23 September 2008

- Posts

- 919

- Reactions

- 174

Here is my amateur Elliot Wave Analyst on WPL.

Looks to of completed 5 waves down with waves 1,3 & 4 subdividing into a a-b-c pattern.

Hi Johnny

Some thoughts for you to consider....

Under EW, impulse waves will contain 5 smaller waves. So waves 1,3 and 5 should be comprised of 5 smaller waves. In the chart posted, waves 1 and 3 have 3 waves - this would be considered incorrect labeling

Using zig-zags in your charting package to identify waves will be hit and miss at best. Feel free to use zig-zags to help identify possible waves, but you'll need to manually identify them to get it right (at least that is my experience)

I also suggest you look at the overall sector index or oil charts and analyze them as well. Individual stocks can be hard for EWers to analyze as EW is more accurate on indexes where mass psychology can be better measured.

For example I will analyze the XMJ and BHP together to determine entry and exit points.

- Joined

- 27 September 2007

- Posts

- 406

- Reactions

- 1

Thanks for the pointers Oz, I manually identified all waves/zig zags on the above chart and will be for awhile yet.

Currently im only starting on the basic rules of EW from Radges book 'Adaptive Analysis' which include -

1 - Wave 2 can never retrace below the start of wave 1

2 - Wave 3 is usually the longest, but can never be the shortest

3 - Wave 4 can never retrace and overlap the top of wave 1

And the guidelines

1 - Impulsive waves tend to be smooth and strong where corrective waves tend to be choppy and messy

2 - wave 2 tends to retrace between 50-70% of wave 1

3 - wave 4 tends to retrace between 30-50% of wave 3

4 - wave 1 and wave 5 tend to be the same length

5 - Correct wave a and corrective wave c tend to be the same length

Id be interested in seeing your chart of WPL if you dont mind and where labeled wrongly.

Cheers. (back to read from the start of the thread)

(back to read from the start of the thread)

Currently im only starting on the basic rules of EW from Radges book 'Adaptive Analysis' which include -

1 - Wave 2 can never retrace below the start of wave 1

2 - Wave 3 is usually the longest, but can never be the shortest

3 - Wave 4 can never retrace and overlap the top of wave 1

And the guidelines

1 - Impulsive waves tend to be smooth and strong where corrective waves tend to be choppy and messy

2 - wave 2 tends to retrace between 50-70% of wave 1

3 - wave 4 tends to retrace between 30-50% of wave 3

4 - wave 1 and wave 5 tend to be the same length

5 - Correct wave a and corrective wave c tend to be the same length

Id be interested in seeing your chart of WPL if you dont mind and where labeled wrongly.

Cheers.

- Joined

- 23 September 2008

- Posts

- 919

- Reactions

- 174

Hi Johnny take a look below. As discussed above individual stocks can be hard to plot against EW. Indexes are far easier.

I've assumed that there is a wave 5 failure, hence the top is slightly below the actual top pricewise. Otherwise, I would have labeled the entire move as a series of a-b-c corrections - which i don't believe is correct.

The WPL tracks very closely to the energy sector, and I found the energy sector was easier to analyze. It too had a 5th wave failure, but only very slightly.

Taking a looking at the longer term chart going back to 1986, I can see a 5 wave advance with a series of subdivisions. The mid point of the previous wave 4 (a double flat with a joining X wave, starting Oct 97 to Mar 2003) is at $10. So this could be a possible target should 5 waves complete, followed by another 5 waves down after an a-b-c correction.

cheers

OWG

I've assumed that there is a wave 5 failure, hence the top is slightly below the actual top pricewise. Otherwise, I would have labeled the entire move as a series of a-b-c corrections - which i don't believe is correct.

The WPL tracks very closely to the energy sector, and I found the energy sector was easier to analyze. It too had a 5th wave failure, but only very slightly.

Taking a looking at the longer term chart going back to 1986, I can see a 5 wave advance with a series of subdivisions. The mid point of the previous wave 4 (a double flat with a joining X wave, starting Oct 97 to Mar 2003) is at $10. So this could be a possible target should 5 waves complete, followed by another 5 waves down after an a-b-c correction.

cheers

OWG

Attachments

- Joined

- 27 September 2007

- Posts

- 406

- Reactions

- 1

Thanks very much for the post Oz, I can see your thinking now as what I have labeled as a wave 5 bottom is actually the end of wave 3. Just going off what you said in your previous post - ' Under EW, impulse waves will contain 5 smaller waves. So waves 1,3 and 5 should be comprised of 5 smaller waves. ' Now I see that you have marked 5 smaller waves which make up Impulse wave 3, however your Wave 1 is not marked and there doesnt seem to be 5 smaller waves that make up the Impulse Wave 1, can you explain this otherwise wouldn't it be considered incorrect labeling or invalidate the count?

- Joined

- 23 September 2008

- Posts

- 919

- Reactions

- 174

Anyone of you keen EWers want to have a stab at what is possibly happening on the XAO?

Today's market action appeared to have or almost completed a very well known pattern, if correct, it will highlight 2 possible scenarios that could unfold in the near term (1 or 2 weeks). It will also highlight in the very near term what should happen in the next few trading days as well.

I suggest using the 5minute chart of the XAO and look at the market since the low on the 21st Nov.

Will post something later tonight or tomorrow morning before market open

Today's market action appeared to have or almost completed a very well known pattern, if correct, it will highlight 2 possible scenarios that could unfold in the near term (1 or 2 weeks). It will also highlight in the very near term what should happen in the next few trading days as well.

I suggest using the 5minute chart of the XAO and look at the market since the low on the 21st Nov.

Will post something later tonight or tomorrow morning before market open

- Joined

- 23 October 2005

- Posts

- 859

- Reactions

- 0

- Joined

- 23 September 2008

- Posts

- 919

- Reactions

- 174

however your Wave 1 is not marked and there doesnt seem to be 5 smaller waves that make up the Impulse Wave 1, can you explain this otherwise wouldn't it be considered incorrect labeling or invalidate the count?

It's a hard one - it can be counted as 5 if you take a small wave 1 and 2 on the first day of the decline. Or wave (1) could contain a 5th wave failure - so possibly ending 7 days later a little higher than the current wave (1) marked on the chart

On the XEJ, wave (1) can be counted as five waves - hence the importance of looking at the index to help with the individual stock wave count.

Hope this helps in clarifying wave (1)

Cheers

OWG

- Joined

- 27 September 2007

- Posts

- 406

- Reactions

- 1

Thanks for your reply Oz, can certainly the W1 count alot better on the XEJ.

Cheers

Cheers

- Joined

- 23 September 2008

- Posts

- 919

- Reactions

- 174

As discussed last night, there is a specific pattern that has been playing out on the XAO over the last couple of days.

A small triangle appears complete after five waves down (i-v). If true, there should be another small 5 waves down to complete the b (circle) leg. Perhaps to 3350 or a Fibonacci support level (61.8% retracement 3382 or 76.8% retracement 3313).

So what happens after wave b (circle) finishes? Either a new short term high will form into wave c (circle) possibly 3800 or higher and a more complex correction could play out to higher levels.

A push higher after wave b (circle) but not to a new short term high. Instead, a leg lower to form part of a larger wave (4) correction.

The primary objective right now is to look for the end of wave b (circle) after 5 waves down (or even an ending diagonal) then we can start to look at the next leg.

A small triangle appears complete after five waves down (i-v). If true, there should be another small 5 waves down to complete the b (circle) leg. Perhaps to 3350 or a Fibonacci support level (61.8% retracement 3382 or 76.8% retracement 3313).

So what happens after wave b (circle) finishes? Either a new short term high will form into wave c (circle) possibly 3800 or higher and a more complex correction could play out to higher levels.

A push higher after wave b (circle) but not to a new short term high. Instead, a leg lower to form part of a larger wave (4) correction.

The primary objective right now is to look for the end of wave b (circle) after 5 waves down (or even an ending diagonal) then we can start to look at the next leg.

Attachments

- Joined

- 23 September 2008

- Posts

- 919

- Reactions

- 174

The wave (b) triangle ended a little sooner than anticipated, so I have labelled a small five waves down I-II-III-IV after the completion of the wave (b) triangle.

Today's market action has completed wave i down, completed wave ii up and commenced wave iii down. The target levels discussed yesterday are in play and 3350 seems a likely target to complete wave b circle.

Trying to find the top of wave ii today so I could open a short position was a little frustrating for me after a few false starts - in the end I didn't end up in a position as I had to go out for a few hrs. The main problem I had was perceiving wave ii up would be a short affair because the S&P500 was down 25points last night, so I suspected there would be high selling pressure early in the day. I should have simply followed the wave count instead of trying to second guess it. Hope others did a little better.

Hope others did a little better.

Have a good weekend

Cheers OWG

Today's market action has completed wave i down, completed wave ii up and commenced wave iii down. The target levels discussed yesterday are in play and 3350 seems a likely target to complete wave b circle.

Trying to find the top of wave ii today so I could open a short position was a little frustrating for me after a few false starts - in the end I didn't end up in a position as I had to go out for a few hrs. The main problem I had was perceiving wave ii up would be a short affair because the S&P500 was down 25points last night, so I suspected there would be high selling pressure early in the day. I should have simply followed the wave count instead of trying to second guess it.

Have a good weekend

Cheers OWG

Attachments

- Joined

- 23 September 2008

- Posts

- 919

- Reactions

- 174

Gooday OZ,

Don't have access to 5 minute XAO Bar Chart, but have attached my take on ASX200 Hourly chart.

Not sure if it's what you see, but looks to be moving higher in the days ahead as per EW count into a wave C upward

Cheers

Hi WP,

I usually struggle with the futures charts for a short term view. Based on the recent market action, there could be a leg to the downside - maybe a forming a wide a-b-c zig-zag with a triangle for b? before the leg up occurs?

- Joined

- 23 September 2008

- Posts

- 919

- Reactions

- 174

The wave (b) triangle ended a little sooner than anticipated, so I have labelled a small five waves down I-II-III-IV after the completion of the wave (b) triangle.

It appears the proposed wave count on the last leg of b circle ended earlier - at the end of wave i on the last chart I last posted. Hence, the final wave b circle comprises of 5 waves down, a Triangle, and then five very small waves down to complete the correction.

There are still several ways to count the whole move from the 21st of Nov - however the simplest way to view the countertrend move is as a 5 waves up and a corresponding 3 wave correction down. Another 5 waves up is required to complete the upwards correction (at a minimum) - there may be other interpretations to consider as well that I'll cover in more detail in the next few days.

Similar threads

- Replies

- 3

- Views

- 979

- Replies

- 31

- Views

- 4K

- Replies

- 12

- Views

- 3K

- Replies

- 323

- Views

- 68K