You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Technical Analysis from "Iced Earth" Point of View

- Thread starter iced earth

- Start date

- Joined

- 4 March 2010

- Posts

- 193

- Reactions

- 0

You are neglecting volume, it is THE critical element in an H&S topping pattern. It is also out of context.

Thanks for comment Mr Z.

I consider the volume, but in bearish patterns volume has much less important than bullish patterns...

- Joined

- 4 March 2010

- Posts

- 193

- Reactions

- 0

Thanks for comment Mr Z.

I consider the volume, but in bearish patterns volume has much less important than bullish patterns...

In a head and shoulders it is the defining feature, without the correct volume pattern it is not an H&S. The price shape is quite common, the supporting volume pattern is not so common.

- Joined

- 4 March 2010

- Posts

- 193

- Reactions

- 0

In a head and shoulders it is the defining feature, without the correct volume pattern it is not an H&S. The price shape is quite common, the supporting volume pattern is not so common.

somehow I agree, specially in bullish patterns, in bearish patterns it has less importance, (Gravity effect).

John Murphy: page 108...

----------------------------------------

I believe nothing in technical is 100% sure, even the h&s with not much volume, still is H&S but with a little chance to complete rather than H&S with high volume...

Thanks for comment again

You have not picked a market top, as I said the context is wrong. Volume is critical to H&S, Mr Murphy is in err. The H&S shape is very common in bull markets and typically represents no more than a continuation of the up trend. H&S at its heart is a simple test of and break of support, for it to be a powerful pattern you need the confirmation in the volume pattern which gives you the insight to how the bulk of traders are feeling about the likelihood of the support level holding. Take away the volume and you have as simple support test and or break.... that can be any shape at all.

tech/a

No Ordinary Duck

- Joined

- 14 October 2004

- Posts

- 20,447

- Reactions

- 6,477

You have not picked a market top, as I said the context is wrong. Volume is critical to H&S, Mr Murphy is in err. The H&S shape is very common in bull markets and typically represents no more than a continuation of the up trend. H&S at its heart is a simple test of and break of support, for it to be a powerful pattern you need the confirmation in the volume pattern which gives you the insight to how the bulk of traders are feeling about the likelihood of the support level holding. Take away the volume and you have as simple support test and or break.... that can be any shape at all.

Seems Martin Pring is also in err.

He also believes volume on the down swing breakout of a H&S pattern is not critical.

HOWEVER

The breakout of a bottom reversal should "Ideally" show a sharp DECLINE in volume INTO the shoulder and a sharp INCREASE to break out.

PG 110 Martin Pring on Price Patterns.

As Ice says still an H&S and nothing---even ideal patterns aren't guaranteed to play out as expected.

It is a setup not to be ignored though!

It is more the total volume pattern than specifically the volume on the downswing. The context is also important, the original chart I responded to has the H&S after an interim top.

Price makes any number of patterns bouncing along support, to assign an H&S shaped pattern any significance over and above the others without the supporting volume pattern is to reduce the patterns usefulness. Correctly formed H&S's are not that common and are a powerful pattern, why muddy the water with what you wish to see? We are simply looking at price testing support.

Kinda surprised Edwards and Magee have not been quoted, they even have it as a continuation pattern... which is more in the context of the chart posted and commented on. Personally I think they where desperate for something to write about at that point, not a pattern I would really be trusting, but to each their own.

But what the heck, I have seen every hack Internet T/A and his dog calling H&Ss in gold and silver this year so why not, yeah its a potential H&S.... I prefer trading the 'horny camel' formation myself.

CYA.

Price makes any number of patterns bouncing along support, to assign an H&S shaped pattern any significance over and above the others without the supporting volume pattern is to reduce the patterns usefulness. Correctly formed H&S's are not that common and are a powerful pattern, why muddy the water with what you wish to see? We are simply looking at price testing support.

Kinda surprised Edwards and Magee have not been quoted, they even have it as a continuation pattern... which is more in the context of the chart posted and commented on. Personally I think they where desperate for something to write about at that point, not a pattern I would really be trusting, but to each their own.

But what the heck, I have seen every hack Internet T/A and his dog calling H&Ss in gold and silver this year so why not, yeah its a potential H&S.... I prefer trading the 'horny camel' formation myself.

CYA.

- Joined

- 24 October 2005

- Posts

- 1,302

- Reactions

- 834

.. I prefer trading the 'horny camel' formation myself.

Lol!

Please don't post a chart of that pattern....

tech/a

No Ordinary Duck

- Joined

- 14 October 2004

- Posts

- 20,447

- Reactions

- 6,477

I prefer trading the 'horny camel' formation myself.

Yes agree I find the single hump far more reliable---the twin hump is overrated in my view.

- Joined

- 4 March 2010

- Posts

- 193

- Reactions

- 0

thanks Mr.Z and tech/a for sharing their views...

========================================

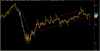

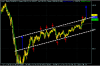

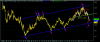

Oil (WTI) 07.04.11

Oil is passing up the important 61.8% Fibo and next resistance will be 78.6% Fibo (around 123$)

in monthly chart, after we had the buy signal we haven't had sell signal

Oil is also testing upper line of the upward channel , if it passes up successfully the target will be around 140$

========================================

Oil (WTI) 07.04.11

Oil is passing up the important 61.8% Fibo and next resistance will be 78.6% Fibo (around 123$)

in monthly chart, after we had the buy signal we haven't had sell signal

Oil is also testing upper line of the upward channel , if it passes up successfully the target will be around 140$

- Joined

- 4 March 2010

- Posts

- 193

- Reactions

- 0

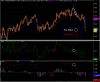

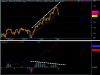

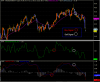

AUD/USD :05.05.11

we had divergence between 4hr price and RSI and MCDI Histogram. also pair has broken the support line.

in daily chart, we also have divergence between price and MACD .

but the most important reason for preventing pair for increasing above 1.10 was the upper (resistance) line of Andrew pitchfork in monthly chart.

the first support level is around 1.05 (fibo %38.2)

we had divergence between 4hr price and RSI and MCDI Histogram. also pair has broken the support line.

in daily chart, we also have divergence between price and MACD .

but the most important reason for preventing pair for increasing above 1.10 was the upper (resistance) line of Andrew pitchfork in monthly chart.

the first support level is around 1.05 (fibo %38.2)

- Joined

- 4 March 2010

- Posts

- 193

- Reactions

- 0

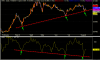

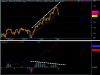

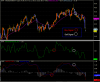

CTX - 17-06-2011

CTX is located in a very important situation, it has the green (upper line of the channel) and red support lines. the target for channel and shown head$shoulders have the same target and the recent drop would be considered a pullback for H&S in weekly chart.

also the shown Andrew pitch fork shows the support line for the price.

in Linear chart we have the Head and shoulders with target around $11.00 (which we are near to this target) at this target price would touch the valid and important support line (which has formed the lower line of the channel)

around 11.00$ (or even the current price) we have strong supports , if these supports cant hold the price , more severe short should be anticipated .

.

CTX is located in a very important situation, it has the green (upper line of the channel) and red support lines. the target for channel and shown head$shoulders have the same target and the recent drop would be considered a pullback for H&S in weekly chart.

also the shown Andrew pitch fork shows the support line for the price.

in Linear chart we have the Head and shoulders with target around $11.00 (which we are near to this target) at this target price would touch the valid and important support line (which has formed the lower line of the channel)

around 11.00$ (or even the current price) we have strong supports , if these supports cant hold the price , more severe short should be anticipated

- Joined

- 4 March 2010

- Posts

- 193

- Reactions

- 0

- Joined

- 4 March 2010

- Posts

- 193

- Reactions

- 0

HVN : 21.10.10 (weekly chart)

The share could not pass the resistance line (white) and recently broke down the support line (Purple) and now testing Fibo 50% . if this can not hold it we should expect the next support level at around 2.96$ (Fibo 61.8 %) Momentum also is near important 0 level and passing down this level could cause more downtrend (Fig 1)

from another point of view share price is testing another support line (yellow). this line can be Neck Line for tilted Head & Shoulders pattern. If the line passed down the target could b around 1.8$ which is the lowest price of HVN in FEB 2009. (Fig 2)

It was 10 month ago(price that day was $3.39) when in my TA I predicted the target of around $1.8 for Harvey Norman. Today it was trading $1.89

- Joined

- 4 March 2010

- Posts

- 193

- Reactions

- 0

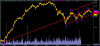

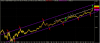

BHP-08 August 2011:

BHP could not passed up the $50.00 (which was the previous peak and resistance level) .now the upward channel has been broken down and the target is around $32.00. But from the Fibo levels, the first support line will be around $35.00 (Fibo 50%) and then around $32.00 (Fibo 32.8%) which is the target of the channel too

From the 20 days EMA , momentum and MACD the sell signal has been sent. Until buy signal not being seen, we cannot be sure about continuous bullish trend.

Also from this picture we could see the bullish Head & Shoulders with the target again around $32.00

BHP could not passed up the $50.00 (which was the previous peak and resistance level) .now the upward channel has been broken down and the target is around $32.00. But from the Fibo levels, the first support line will be around $35.00 (Fibo 50%) and then around $32.00 (Fibo 32.8%) which is the target of the channel too

From the 20 days EMA , momentum and MACD the sell signal has been sent. Until buy signal not being seen, we cannot be sure about continuous bullish trend.

Also from this picture we could see the bullish Head & Shoulders with the target again around $32.00

Attachments

- Joined

- 4 March 2010

- Posts

- 193

- Reactions

- 0

Oil-WTI : 4 August 2011

Oil-WTI is in a very sensitive situation, if the lower line of the channel (support line) and psychological price level at $90 cannot hold the short and channel break down , the target of the short would be around $70.

View attachment 43837

9 August , 12:46 pm WTI CRUDE FUTURE = $76.670 (Not too far from $70.00)

- Joined

- 4 March 2010

- Posts

- 193

- Reactions

- 0

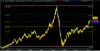

Gold : 9 August 2009

The shorter channel has been passed up successfully with the target around $1900 which is coincidence with the upper line of the longer channel

in monthly chart, we see a continues upward pattern which form kind of a bullish channel, the most important resistance of this channel is the upper line which gold could reach it around $1900-$2000

The shorter channel has been passed up successfully with the target around $1900 which is coincidence with the upper line of the longer channel

in monthly chart, we see a continues upward pattern which form kind of a bullish channel, the most important resistance of this channel is the upper line which gold could reach it around $1900-$2000

- Joined

- 4 March 2010

- Posts

- 193

- Reactions

- 0

HVN(Harvy Norman) 11 August 2011:

========================================

After head &Shoulder pattern (which was predicted 21.10.10 in this topic when share was trading 3.39) Share price reached $1.8.

Now we can see positive divergence between price and CCI

More importantly we can see a very strong support line around $1.8 and it could be a considerable buy at this level ( putting the stop loss below this support line)

========================================

After head &Shoulder pattern (which was predicted 21.10.10 in this topic when share was trading 3.39) Share price reached $1.8.

Now we can see positive divergence between price and CCI

More importantly we can see a very strong support line around $1.8 and it could be a considerable buy at this level ( putting the stop loss below this support line)

- Joined

- 4 March 2010

- Posts

- 193

- Reactions

- 0

Similar threads

- Replies

- 1

- Views

- 2K

- Replies

- 10

- Views

- 2K

- Replies

- 2

- Views

- 2K