- Joined

- 4 March 2010

- Posts

- 193

- Reactions

- 0

Silver & AYN - 12 August 2011

================================

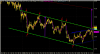

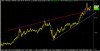

Silver might have Head& Shoulder pattern, but first should have the right shoulder completed and then break up the neckline with a considerable volume, but if it happens , Silver should be again around $50.00.

if it won’t happen and silver goes down the red line is a valid support line to hold it back.

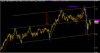

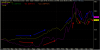

the compare of the Silver price with AYN is interesting. Ayn shows a very strong correlation to Silver price and also has the same pattern , so to follow the AYN we should follow Silver price movement.(Yellow colour is Silver,Purple is AYN)

============================================================

Silver is and interesting commodity, it has both characteristics of Investment and Industrial usage, (Unlike Gold which is almost all Investment purposes) so sometimes it has not the same pattern as gold...

================================

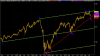

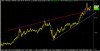

Silver might have Head& Shoulder pattern, but first should have the right shoulder completed and then break up the neckline with a considerable volume, but if it happens , Silver should be again around $50.00.

if it won’t happen and silver goes down the red line is a valid support line to hold it back.

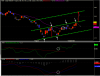

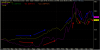

the compare of the Silver price with AYN is interesting. Ayn shows a very strong correlation to Silver price and also has the same pattern , so to follow the AYN we should follow Silver price movement.(Yellow colour is Silver,Purple is AYN)

============================================================

Silver is and interesting commodity, it has both characteristics of Investment and Industrial usage, (Unlike Gold which is almost all Investment purposes) so sometimes it has not the same pattern as gold...