- Joined

- 4 March 2010

- Posts

- 193

- Reactions

- 0

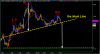

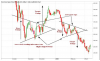

EUR/USD : 25 MAY 2010:

As predicted before( https://www.aussiestockforums.com/forums/showpost.php?p=556153&postcount=27) , the pair is moving in a bearish channel, also in weekly view , we have a pull back after breaking the valid long term resistance line.

As predicted before( https://www.aussiestockforums.com/forums/showpost.php?p=556153&postcount=27) , the pair is moving in a bearish channel, also in weekly view , we have a pull back after breaking the valid long term resistance line.