- Joined

- 4 March 2010

- Posts

- 193

- Reactions

- 0

HVN - 5.11.10

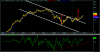

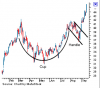

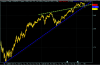

As it was predicted on 21.10.10 (https://www.aussiestockforums.com/forums/showpost.php?p=587249&postcount=56) price fallen below fibo 50% and now we should wait for the next resistance level at fibo 61.8% (around $2.95) (Fig 2)

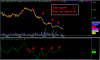

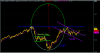

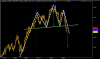

also the neckline (Tilted Head and Shoulder pattern) is break down , the target of this pattern could be around 1.8 $ ,which is the lowest price of HVN in FEB 2009. (Fig 1)

As it was predicted on 21.10.10 (https://www.aussiestockforums.com/forums/showpost.php?p=587249&postcount=56) price fallen below fibo 50% and now we should wait for the next resistance level at fibo 61.8% (around $2.95) (Fig 2)

also the neckline (Tilted Head and Shoulder pattern) is break down , the target of this pattern could be around 1.8 $ ,which is the lowest price of HVN in FEB 2009. (Fig 1)