- Joined

- 23 September 2008

- Posts

- 919

- Reactions

- 174

XAO

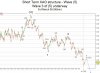

With the break below the levels here cited here--> https://www.aussiestockforums.com/forums/showpost.php?p=402507&postcount=476

and also the break of the Nov 08 low, it does appear (at a minimum) that wave (5) down is underway.

Tomorrow could see some minor upside before reversing.

Wave (5) Possible Downside Targets

Assuming the Wave (4) did finish in early Jan, then:

The unfolding short term waves will provide further guidance over the next several days. So far, the larger upwards corrections since the end of wave (4) on the 7th Jan are considered a series of wave 2's. This would mean some strong downside should now unfold as we work through a set of wave 3's. If this strong downside doesn't unfold, then something else may be about to happen.

In addition, the news for the last few weeks has been particularly bad, so a reversal wouldn't have been out of the question. However, at the moment, adhering to the wave counts is needed as it does appear a 5th wave down is unfolding.

Cheers

OWG

With the break below the levels here cited here--> https://www.aussiestockforums.com/forums/showpost.php?p=402507&postcount=476

and also the break of the Nov 08 low, it does appear (at a minimum) that wave (5) down is underway.

Tomorrow could see some minor upside before reversing.

Wave (5) Possible Downside Targets

Assuming the Wave (4) did finish in early Jan, then:

- if wave (5) = (1), another 1160 points to go on the downside

- if wave (5) = 61.8% of (1) then another 500 points to go on the downside.

The unfolding short term waves will provide further guidance over the next several days. So far, the larger upwards corrections since the end of wave (4) on the 7th Jan are considered a series of wave 2's. This would mean some strong downside should now unfold as we work through a set of wave 3's. If this strong downside doesn't unfold, then something else may be about to happen.

In addition, the news for the last few weeks has been particularly bad, so a reversal wouldn't have been out of the question. However, at the moment, adhering to the wave counts is needed as it does appear a 5th wave down is unfolding.

Cheers

OWG