tech/a

No Ordinary Duck

- Joined

- 14 October 2004

- Posts

- 20,453

- Reactions

- 6,514

So tech/a... what's the verdict on advGET? Is it a "must have" in your toolbox?

Started an AGET thread for Aget Questions.

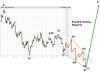

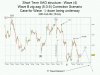

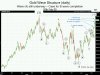

Must have. No I dont think so.

It's been and is a handy analysis tool.

It is very powerful but like most I'm sure I under utilize it.