Sean K

Moderator

- Joined

- 21 April 2006

- Posts

- 22,650

- Reactions

- 12,257

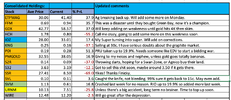

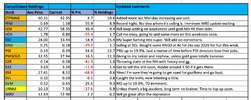

Do you consider @Sean K PMGOLD a long term hold if it slowly appreciates or a sell if it goes ballistic ?

I've bought and sold PMGOLD and my most recent average buyin on my holdings is about the same as yours but a bit diluted by a recent large buy being hammered by the $AUD gain. My intention is not to sell anytime before I cark it.

gg

gg, Medium term, but not a forever hold. Will add on weakness, but not much. I'm adjusting my plan on everything I hold on a day to day basis depending on the macro and micro environment. The short to medium term narrative for gold looks very strong to me. But, no idea how long it's going to last. I am absolutely certain that China is going to go to war over Taiwan in the next 2-5 years, and gold will go bananas. It's only an arse pluck what price gold goes to then and when to take the money and run to the doomsday bunker. SK