Sean K

Moderator

- Joined

- 21 April 2006

- Posts

- 22,438

- Reactions

- 11,853

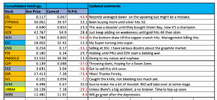

Just woke up and saw that the boat is arriving off Santorini and thought I should buy some SVL. I might be going down with the ship...

View attachment IMG_2674.MOV

View attachment IMG_2674.MOV