- Joined

- 8 June 2008

- Posts

- 13,750

- Reactions

- 20,539

Catching up a bit late on this thread.Still on holidays here. A bit of a luxury to be getting an Army pension and not having to fight for scraps of meat on the street.

I was going to start this FY with a clean slate and allocate $500k to an ASF trading project but the effort to rejig my spreadsheets and account for it is too much for this koala to bear. So, I'm just going to stick with what I've got and continue to comment on any buys or sells and reasons so you can tell when I'm ramping my stocks in the stock threads, or not.

Last FY I was pretty much even in my closed trades having suffered major pain with CTM which in retrospect I should have just held for long term but I was scared off by management mismanagement. I also should have foreseen the collapse in the nickel price due to IndoChina crapping on the market, but I was listening to analysts who were badly wrong. As nickel sulfide is so hated at the moment, it makes me interested in going contrarian. But, I'm still hurting for now.

For the short term traders out there who like to preserve capital with some selling rules, please don't have a cow with the drawdown on CEL, HCH and SSR. I do actually have a cunning plan with those woofers. I'll come up with it at some stage.

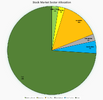

The % holdings probably look pretty random to system traders too, but I'm completely discretionary and weight things towards what I have more or less confidence in. What I would really like to do is have a more concentrated portfolio of 10% in 10 stocks, so I'll work on that for this FY.

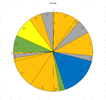

Still about 75% cash, waiting patiently for Wayne's four horsemen to arrive, but I'm also thinking about a yacht. That would be a very smart investment to avoid the apocalypse. Sailing the SW Pacific with a Starlink is very appealing.

View attachment 180167

View attachment 180170

Enjoy your holiday

.and i thought i was too PM focused....

Basically you are cash plus PM?

Any other exposure RE, PPOR, companies..not interested in $ but %

If i am a bit lucky, i might at long last get back to being a bit more cash able and looking at a short/medium term strategy from August onward..

And thanks for posting