You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Hypothetical Monthly Momentum Portfolio vs. Index

Hi Willy,

Thanks for starting a fresh systematic trend following thread. From memory our last TF thread was created by Trendnomics and his portfolios did incredibly well until he/she seemed to get frustrated with the apparent lack of interest.

I think this style of investing is a valid method and tries to exploit the known anomaly of momentum, whilst providing a tool to avoid the pitfalls of the often irrational collective human mind during pullbacks. Trend following is counterintuitive,(buying stocks that have already taken off) so it is not easy to follow and it goes through sometimes longish periods where it just does not work and drawdowns can be ugly, which are eventually followed by a period of strong outperformance. It is not for everyone.

I particularly like the concept of monthly rebalancing, where whatever happens mid month, can have little impact by the end of the month, although when i tried it in Jan 2016 with 25 stocks on a 250 day lookback, I found it too hard to adhere to and now do it weekly on a shorter lookback with around 16 stocks to increase the chance of jagging a few runners. One day when I grow a set, I give it another go.

Imagine that, only being on task for an hour or so each month and little interest in between.

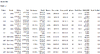

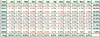

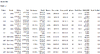

Understandably you have put a lot of time into your system and you want to keep your secret sauce private, but I hope you don't mind me throwing out a bit of food for thought to interested readers. The following backtest are for 5 x 20% positions (not something I would do) on XAO with 125 day lookback with 100ma exit along with a stale (ranking) exit in there with no stops. Curiously we did not share any stocks over the same period, which possibly suggests when conditions are right, momentum systems broadly work well.

The last 12 months have been great theoretically.

The previous 12 months were terrible with a 25%DD thrown in for good measure

Going back another 12 months were again theoretically fantastic

Going back a bit further, the overall results look good, but you would have to be a machine to sleep at night. Nevertheless the results are well above that of the said index XAOA

Willy, I and no doubt others would be curious to see some of your longer period backtests, if you're interested.

Wyatt

Thanks for starting a fresh systematic trend following thread. From memory our last TF thread was created by Trendnomics and his portfolios did incredibly well until he/she seemed to get frustrated with the apparent lack of interest.

I think this style of investing is a valid method and tries to exploit the known anomaly of momentum, whilst providing a tool to avoid the pitfalls of the often irrational collective human mind during pullbacks. Trend following is counterintuitive,(buying stocks that have already taken off) so it is not easy to follow and it goes through sometimes longish periods where it just does not work and drawdowns can be ugly, which are eventually followed by a period of strong outperformance. It is not for everyone.

I particularly like the concept of monthly rebalancing, where whatever happens mid month, can have little impact by the end of the month, although when i tried it in Jan 2016 with 25 stocks on a 250 day lookback, I found it too hard to adhere to and now do it weekly on a shorter lookback with around 16 stocks to increase the chance of jagging a few runners. One day when I grow a set, I give it another go.

Imagine that, only being on task for an hour or so each month and little interest in between.

Understandably you have put a lot of time into your system and you want to keep your secret sauce private, but I hope you don't mind me throwing out a bit of food for thought to interested readers. The following backtest are for 5 x 20% positions (not something I would do) on XAO with 125 day lookback with 100ma exit along with a stale (ranking) exit in there with no stops. Curiously we did not share any stocks over the same period, which possibly suggests when conditions are right, momentum systems broadly work well.

The last 12 months have been great theoretically.

The previous 12 months were terrible with a 25%DD thrown in for good measure

Going back another 12 months were again theoretically fantastic

Going back a bit further, the overall results look good, but you would have to be a machine to sleep at night. Nevertheless the results are well above that of the said index XAOA

Willy, I and no doubt others would be curious to see some of your longer period backtests, if you're interested.

Wyatt

- Joined

- 6 January 2016

- Posts

- 254

- Reactions

- 187

Following this thread with interest.

Please post some long term back-test results for the system.

Please post some long term back-test results for the system.

Going back a bit further, the overall results look good, but you would have to be a machine to sleep at night. Nevertheless the results are well above that of the said index XAOA

View attachment 89935

Wyatt

Hi Wyatt,

Thanks for your interest, you have just proven the point of the thread - the indexes can be beaten - no need for me to continue the thread, lol

I don't wish to take the thread down that path, of comparing backtests, monte carlo, system inputs, etc. Although it could be a very good topic if you wanted to start a new thread to help the forum create more non general chat content

Oh and I don't trade this system in real time nor do I recommend it, it is Hypothetical.

Following this thread with interest.

Please post some long term back-test results for the system.

Hi Trendnomics,

Welcome back.

I don't wish to take the thread down that path, of comparing backtests, monte carlo, system inputs, etc. Although it could be a very good topic if you wanted to start a new thread to help the forum create more non general chat content

Hi Willy,

Fair call.

This is your thread and I respect your wishes and like you say, I or someone else could open a new thread discussing the many aspects of trend following systems any time they like. Maybe even revitalize Trendnomics thread to stimulate conversation on this fascinating subject.

I will be looking forward to your monthly updates.

Fair call.

This is your thread and I respect your wishes and like you say, I or someone else could open a new thread discussing the many aspects of trend following systems any time they like. Maybe even revitalize Trendnomics thread to stimulate conversation on this fascinating subject.

I will be looking forward to your monthly updates.

- Joined

- 17 October 2012

- Posts

- 707

- Reactions

- 1,389

Nice going willy1111, have just been reviewing your thread.

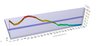

Bit late, but the issue of no of positions and resulting returns is an interesting one, and I've attached a hypothetical "returns versus number of positions" from a weekly trend following system backtest run over many financial years.

Of course total profits is not the only consideration here. You should do some Risk of Ruin calcs and simulations as well - getting under 10 positions for trend following starts to exponentially magnify that risk if you're unlucky enough to start trading in a large market downturn (and we never know what will happen). Trading too many positions can start to drastically dilute returns (position sizing is often the special sauce on any system).

These sorts of backtests often show a tempting spike in returns for a small number of positions (e.g. n=3 below) reflecting the luck of having a small number of big winners, but for the system used for this backtest I'd usually aim for 13 -15 positions (slightly more rather than less for bit extra safety)

Anyhow, many of my weekly systems created in recent years come up with similar graphs to this.

The actual returns is less important here than the shape of the curve BTW - so many things can give over-optimistic return estimations in backtests!

Bit late, but the issue of no of positions and resulting returns is an interesting one, and I've attached a hypothetical "returns versus number of positions" from a weekly trend following system backtest run over many financial years.

Of course total profits is not the only consideration here. You should do some Risk of Ruin calcs and simulations as well - getting under 10 positions for trend following starts to exponentially magnify that risk if you're unlucky enough to start trading in a large market downturn (and we never know what will happen). Trading too many positions can start to drastically dilute returns (position sizing is often the special sauce on any system).

These sorts of backtests often show a tempting spike in returns for a small number of positions (e.g. n=3 below) reflecting the luck of having a small number of big winners, but for the system used for this backtest I'd usually aim for 13 -15 positions (slightly more rather than less for bit extra safety)

Anyhow, many of my weekly systems created in recent years come up with similar graphs to this.

The actual returns is less important here than the shape of the curve BTW - so many things can give over-optimistic return estimations in backtests!

Last edited:

- Joined

- 17 October 2012

- Posts

- 707

- Reactions

- 1,389

- Joined

- 17 October 2012

- Posts

- 707

- Reactions

- 1,389

Hi Peter and willy

I almost ran these Amibroker optimization runs out to 40 positions in the first instance, but.....

- please bear in mind this weekly TF code may not bear any resemblance to willy1111's monthly system, or Skate's hybrid system (and thank you peter for alerting me to Skate's thread in the first place, in your weekly system thread!)

- I still emphasise CARs can be misleading but hopefully the shape of the curves are useful (e.g. no slippage included in this modelling)

- digging back through notes I'm fairly certain I ran a time interval of 1/1/2014 through to 9/2/2019

- the CAR/MDD curve is now slightly different - either I didn't get the dates spot on, OR the weekend database updates from Norgate (that I ran Sunday night) have had an effect - eek - historical bias??

- stock universe is ASX fully paid ordinary (much larger universe than XAO) and again, may have changed slightly during Sunday updates

- this particular system includes PositionScore code to stop me being paralysed by multiple entry signals - otherwise multiple runs could/would be slightly different

- step size for the optimization runs was 2 - tends to smooth out noise if you run and display values for every number of positions 1-50

Would be interested to see anyone else's optimisation runs for weekly or monthly systems by position size.

I almost ran these Amibroker optimization runs out to 40 positions in the first instance, but.....

- please bear in mind this weekly TF code may not bear any resemblance to willy1111's monthly system, or Skate's hybrid system (and thank you peter for alerting me to Skate's thread in the first place, in your weekly system thread!)

- I still emphasise CARs can be misleading but hopefully the shape of the curves are useful (e.g. no slippage included in this modelling)

- digging back through notes I'm fairly certain I ran a time interval of 1/1/2014 through to 9/2/2019

- the CAR/MDD curve is now slightly different - either I didn't get the dates spot on, OR the weekend database updates from Norgate (that I ran Sunday night) have had an effect - eek - historical bias??

- stock universe is ASX fully paid ordinary (much larger universe than XAO) and again, may have changed slightly during Sunday updates

- this particular system includes PositionScore code to stop me being paralysed by multiple entry signals - otherwise multiple runs could/would be slightly different

- step size for the optimization runs was 2 - tends to smooth out noise if you run and display values for every number of positions 1-50

Would be interested to see anyone else's optimisation runs for weekly or monthly systems by position size.

- Joined

- 17 October 2012

- Posts

- 707

- Reactions

- 1,389

Information overload, but this is same stock universe, same time period, using different system code (my Amibroker interpretation of Nick Radge's "Weekend Trend Trader").

Again, also remember trading the "optimal" = "most aggressive" number of positions may give you max theoretical returns but also DRASTICALLY increase your Risk of Ruin (i.e. chance of blowing your account, particularly in the first 2 years).

Suggested reading:

http://bettersystemtrader.com/riskofruin/

Again, also remember trading the "optimal" = "most aggressive" number of positions may give you max theoretical returns but also DRASTICALLY increase your Risk of Ruin (i.e. chance of blowing your account, particularly in the first 2 years).

Suggested reading:

http://bettersystemtrader.com/riskofruin/

- Joined

- 12 January 2008

- Posts

- 7,458

- Reactions

- 18,672

Thanks @Newt for doing that.

For all the system back tests you've shown the sweet spot for RR is 14 - 16 positions. For my position sizing model (fixed fractional) a trade risk of ~0.7% will allow 14 - 16 positions.

@willy1111 Thank you allowing us this small diversion in your thread.

For all the system back tests you've shown the sweet spot for RR is 14 - 16 positions. For my position sizing model (fixed fractional) a trade risk of ~0.7% will allow 14 - 16 positions.

@willy1111 Thank you allowing us this small diversion in your thread.

- Joined

- 17 October 2012

- Posts

- 707

- Reactions

- 1,389

Thanks @Newt for doing that.

For all the system back tests you've shown the sweet spot for RR is 14 - 16 positions. For my position sizing model (fixed fractional) a trade risk of ~0.7% will allow 14 - 16 positions.

@willy1111 Thank you allowing us this small diversion in your thread.

Interesting area, happy to help.

Believe may have seen Captain Black say 17 positions tends to be close to optimal for number of positions for trend following systems in ASX. Not sure I could find it quickly now - think it was halfway through Skate's Dump It Here thread.

- Joined

- 28 December 2013

- Posts

- 6,392

- Reactions

- 24,319

Interesting area, happy to help.

Believe may have seen Captain Black say 17 positions tends to be close to optimal for number of positions for trend following systems in ASX. Not sure I could find it quickly now - think it was halfway through Skate's Dump It Here thread.

I'm sure Skate will add more, but around 20 positions is the sweet spot for a trend following system.

It's never ending isn't it

https://www.aussiestockforums.com/posts/1010538/

Running 3 strategies in one (Hybrid strategy) my position sizing should range between 51 to 60 positions

53 was the sweet spot but I settled on 40 for rounding.

Skate.

Similar threads

- Replies

- 201

- Views

- 37K