- Joined

- 8 June 2008

- Posts

- 13,768

- Reactions

- 20,581

Catching up a bit late on this thread.Still on holidays here. A bit of a luxury to be getting an Army pension and not having to fight for scraps of meat on the street.

I was going to start this FY with a clean slate and allocate $500k to an ASF trading project but the effort to rejig my spreadsheets and account for it is too much for this koala to bear. So, I'm just going to stick with what I've got and continue to comment on any buys or sells and reasons so you can tell when I'm ramping my stocks in the stock threads, or not.

Last FY I was pretty much even in my closed trades having suffered major pain with CTM which in retrospect I should have just held for long term but I was scared off by management mismanagement. I also should have foreseen the collapse in the nickel price due to IndoChina crapping on the market, but I was listening to analysts who were badly wrong. As nickel sulfide is so hated at the moment, it makes me interested in going contrarian. But, I'm still hurting for now.

For the short term traders out there who like to preserve capital with some selling rules, please don't have a cow with the drawdown on CEL, HCH and SSR. I do actually have a cunning plan with those woofers. I'll come up with it at some stage.

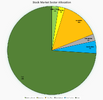

The % holdings probably look pretty random to system traders too, but I'm completely discretionary and weight things towards what I have more or less confidence in. What I would really like to do is have a more concentrated portfolio of 10% in 10 stocks, so I'll work on that for this FY.

Still about 75% cash, waiting patiently for Wayne's four horsemen to arrive, but I'm also thinking about a yacht. That would be a very smart investment to avoid the apocalypse. Sailing the SW Pacific with a Starlink is very appealing.

View attachment 180167

View attachment 180170

Catching up a bit late on this thread.

Enjoy your holiday

.and i thought i was too PM focused....

Basically you are cash plus PM?

Any other exposure RE, PPOR, companies..not interested in $ but %

If i am a bit lucky, i might at long last get back to being a bit more cash able and looking at a short/medium term strategy from August onward..

And thanks for posting

that i can relate to , but i don't really consider it 'a holiday 'On holidays because I just haven't found anything worth adding and actually want to thin it out a bit.

True. Someone said the nation can only afford one Defence Force .I treat my Army pension as my general equities exposure. It's super brought forward and indexed for life. A weird defence force super scam.

Good moves imo @Sean KAdded some more PMGOLD at $36.55 and ETPMAG at $43.07.

Might be a good time for me to convert NST and EVN to GDX in line with consolidating a bit and focussing on junior opportunities and ETFs instead of being somewhere in the middle.

Still working on a more thought out plan instead of throwing darts at the RIH.

View attachment 180915

Great work. Far better than my current property @5% over 15 years and leaving last two years it would have been 1.5 % pa, super 7 % pa.As preempted, in order to further consolidate, I've sold EVN and NST at $4.08 and $14.50 for a 15% and 39% gain after holding for about two years, so OK. I've only managed that by averaging down over time and the recent spike in POG and the GDX.

I think gold has some way to go, so I'm more interested in deploying cash to the gold ETFs, or juniors - that have been completely hated for the last few years of the gold junior bear market.

Apart from PDI, I can't see another gold junior that represents significant upside, if the cards fall the right way.

Great work. Far better than my current property @5% over 15 years and leaving last two years it would have been 1.5 % pa, super 7 % pa.

Did you lose interest on DEG?

Do not hold

Hey SeanSorry for delayed response. Lots of interest in DEG, but been waiting for a proper correction. Looks like we might have one.

Zero trading activity since last posts.

Still 75% ish cash and waiting for opportunities. I know it's not timing, but time-in that's important in the long run, but if all you do is invest, walk the dog and go to the gym, you have the luxury of trying to get the timing right. Maybe that opportunity is about to surface.

With everything going on in the World and the US crossing $35T in debt and the interest payments higher that their military budget, we should all be alarmed.

My response is that I'm travelling to Italy and going on a cruise through the Med in the next two weeks.

Hey Sean

Bon Voyage.

Who knows ? You may run some investors conference for your favourites DEG and CTM.

Travel safe and enjoy the Europe during July/Aug days.

My highly speculative thoughts over a hard drink, DEG has the opportunity to be a shovel ready resources once commissioning starts .

Lets hear the goss from D & D conference from all miners and prospectors

I wish to do something to claim taxThanks mate. Believe it or not, this trip is actually an 'investor conference' of sorts for my other half's business. The cruise ship is a venue for learning how to make money. While at sea there's a number of events on how to invest. I've chosen a drinks package that negates, or probably prevents, my attendance at any of the events. I will be posting from the bar.

Enjoy, thinking Rome and Florence September,/October, pm me if you havd some good tipsNo, 20 years this year after a practice run earlier in life.

We use cookies and similar technologies for the following purposes:

Do you accept cookies and these technologies?

We use cookies and similar technologies for the following purposes:

Do you accept cookies and these technologies?