- Joined

- 15 February 2012

- Posts

- 27

- Reactions

- 0

Thanks for that George. I had a look at their website, but couldn't find any recent newsletters, however.

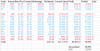

http://www.asx.com.au/asxpdf/20131212/pdf/42lkz8q9xn8vb6.pdf

They are put up on the ASX website as announcements.

http://www.asx.com.au/asx/research/companyInfo.do?by=asxCode&asxCode=WAM

I'm sure most LICs would have those numbers up there for free as well.