- Joined

- 12 January 2008

- Posts

- 7,485

- Reactions

- 18,769

Thanks for the update. It shows your ongoing commitment.

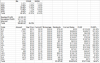

I was thinking that there must have been an indicator to exit some of those losers, but in some cases the divs offset the capital losses (reason to hold). There are a few that haven't paid any div though. Overall you might have been able to save 2K, but this doesn't make up the difference to the benchmark index (XSOAI).

Cutting the losers (that don't pay any div) earlier is only part of the solution to beat your benchmark. How about adding to the winners with the cash from the losers?

There's no easy solution as I think it's likely to require multiple small adjustments. It starts with cutting losers that don't pay a div, adding to winners in dips and then taking partial profits when the prices are too high (overbought) according to your model.

Another view is that your under-performance in the first two years has you behind your benchmark and that it'll take another few years to make up for it. Your changes in strategy have improved your performance in the recent years.

I was thinking that there must have been an indicator to exit some of those losers, but in some cases the divs offset the capital losses (reason to hold). There are a few that haven't paid any div though. Overall you might have been able to save 2K, but this doesn't make up the difference to the benchmark index (XSOAI).

Cutting the losers (that don't pay any div) earlier is only part of the solution to beat your benchmark. How about adding to the winners with the cash from the losers?

There's no easy solution as I think it's likely to require multiple small adjustments. It starts with cutting losers that don't pay a div, adding to winners in dips and then taking partial profits when the prices are too high (overbought) according to your model.

Another view is that your under-performance in the first two years has you behind your benchmark and that it'll take another few years to make up for it. Your changes in strategy have improved your performance in the recent years.