- Joined

- 5 August 2021

- Posts

- 371

- Reactions

- 822

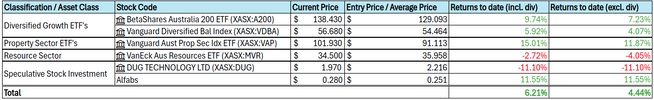

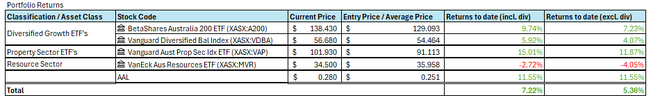

Auto liquidated at 2.30 bought back in at 2.2 order just filled injected sum extra capital to increase position size.

Stop Loss at 2.00 to fully liquidate position. 10% below renewed entry price.

This drop is off no news. Unusual.

Stop Loss at 2.00 to fully liquidate position. 10% below renewed entry price.

This drop is off no news. Unusual.