Had to happen sooner or later KTP. Frankly I'm surprised and impressed at how well your portfolio has done in the short term considering your strategy of looking for deep value in the unloved and hated corners of the market. Looking to the long term the businesses you hold seem to have good assets, cash flow and dividends.

My Investment Journey

- Thread starter KnowThePast

- Start date

- Joined

- 3 June 2013

- Posts

- 457

- Reactions

- 53

Had to happen sooner or later KTP. Frankly I'm surprised and impressed at how well your portfolio has done in the short term considering your strategy of looking for deep value in the unloved and hated corners of the market. Looking to the long term the businesses you hold seem to have good assets, cash flow and dividends.

Thanks robusta,

Yes, at the moment I am not concerned with portfolio's performance. Most value strategies take 3 years on average to show result, until then, I would expect average performance roughly in line with the index, with fluctuations.

I have to admit, though, that in the last 2 months, I had to on occasion remind myself of the difference between investment process and investment outcome.

I am reading "Value Investing" by James Montier, at the moment. While I do not see anything yet that hasn't been written by others, it is a great summary of studies and conclusions of value-based "automatic" strategies. It does do a fantastic job, however, of hamming in the point about investment process, and how it should not be judged by short term outcomes.

Thanks robusta,

Yes, at the moment I am not concerned with portfolio's performance. Most value strategies take 3 years on average to show result, until then, I would expect average performance roughly in line with the index, with fluctuations.

Those fluctuations from the index can be rather large and last a long time. While the market is efficient in pricing assets in the long term there can be lengthy periods with sectors and businesses being under or over valued.

I have to admit, though, that in the last 2 months, I had to on occasion remind myself of the difference between investment process and investment outcome.

I am reading "Value Investing" by James Montier, at the moment. While I do not see anything yet that hasn't been written by others, it is a great summary of studies and conclusions of value-based "automatic" strategies. It does do a fantastic job, however, of hamming in the point about investment process, and how it should not be judged by short term outcomes.

Thank you I will check that book out.

- Joined

- 8 June 2008

- Posts

- 14,101

- Reactions

- 21,271

Hi I notice you still have FGE listed as a profit:

you probably need to be honest with yourself and put the lot at a straight loss.

Not pleasant but at best you will get a few dollars after a class action in 2 years time.

The money is gone

I believe in cases like that (has happened to me in the past) it is better not to hide the figure, even if the miss/lady of the house is not impressed

OOPS My mistake

you sold!!!

great

nice to remember that with the timing on that one, you could have wiped out your whole profit in one go!!

you probably need to be honest with yourself and put the lot at a straight loss.

Not pleasant but at best you will get a few dollars after a class action in 2 years time.

The money is gone

I believe in cases like that (has happened to me in the past) it is better not to hide the figure, even if the miss/lady of the house is not impressed

OOPS My mistake

you sold!!!

great

nice to remember that with the timing on that one, you could have wiped out your whole profit in one go!!

- Joined

- 3 June 2013

- Posts

- 457

- Reactions

- 53

Hi I notice you still have FGE listed as a profit:

you probably need to be honest with yourself and put the lot at a straight loss.

Not pleasant but at best you will get a few dollars after a class action in 2 years time.

The money is gone

I believe in cases like that (has happened to me in the past) it is better not to hide the figure, even if the miss/lady of the house is not impressed

OOPS My mistake

you sold!!!

great

nice to remember that with the timing on that one, you could have wiped out your whole profit in one go!!

Hi qldfrog,

Not a problem

I am proud to say that at the time of making that day trade, I wrote that even at those ridiculously low prices, it was too risky to hold on to. I played what I thought was an almost inevitable bounce, and I am very happy to have been proven right on that one.

- Joined

- 3 June 2013

- Posts

- 457

- Reactions

- 53

Bought KKT, 11891 @ $0.11.

Konekt Limited is a provider of health and safety services. It has 3 main services: return to work injury management services, injury prevention service, and safety consulting service.

It is such an exciting business, that I find there’s little I can write about it. It’s the vibe of it that I like.

Those that follow my posts, of course, know the real reason I buy this – it is cheap on almost any measure. Since I started this thread, most of my investments have been of these kind, but I would usually try to pick what I thought was the most sensible one from my screens, even if it wasn’t the cheapest.

I am now mostly going to run a valuation screen of mine, and just by the cheapest. There’s 3 reasons I am favouring this approach more and more now:

1. It reduces human judgement/preference risk. I’d like to think that my attempts at picking best of the worst produce results. But, in practice, I don’t see much evidence that they’ve added any extra value over the years.

2. My portfolio is diversified to a point where I feel more comfortable with this approach.

3. Almost 50% of my portfolio is currently exposed to mining, although some companies only partially. I am trying to bring this ratio down, it’s a little too much exposure to one sector for my liking. And, looking at my screens, there’s now only a few non-mining companies that meet my valuation targets. None of them have a good story. While KKT is currently the cheapest on my list, this is one of the few reasons where I may still override with a human judgement. It will possibly lower returns, but reduce the impact of some of the black swan events.

When I analyse my performance at end of year, KKT will be listed as a mistake. Had I bought it from the beginning, as my screens told me to, I would have been $5,000+ better off.

I’ve recently mentioned the difference between investment process and investment outcome. $5,000 opportunity cost is, of course, the outcome. But there was a very real error in investment process. It was always one of the cheapest on my screens, but I passed it up in favour of more expensive prospects that I felt were “safer”. In effect, I was doing the average of two perfectly good approaches, whereas I needed to pick one. Either I had to invest businesses with competitive advantage and growing intrinsic value, or the cheapest. Too often, I tried to pick companies that are a little bit of both.

As a result, I know have a few stocks in my portfolio that I still think make good investment sense, but don’t fit into my current investment process. This creates a mess in my head, because I bought them for different reasons, and my sell criteria feels like it should be different. I am still undecided whether I need to take any actions now. But I know which ones will be first to go when I am short of cash.

Konekt Limited is a provider of health and safety services. It has 3 main services: return to work injury management services, injury prevention service, and safety consulting service.

It is such an exciting business, that I find there’s little I can write about it. It’s the vibe of it that I like.

Those that follow my posts, of course, know the real reason I buy this – it is cheap on almost any measure. Since I started this thread, most of my investments have been of these kind, but I would usually try to pick what I thought was the most sensible one from my screens, even if it wasn’t the cheapest.

I am now mostly going to run a valuation screen of mine, and just by the cheapest. There’s 3 reasons I am favouring this approach more and more now:

1. It reduces human judgement/preference risk. I’d like to think that my attempts at picking best of the worst produce results. But, in practice, I don’t see much evidence that they’ve added any extra value over the years.

2. My portfolio is diversified to a point where I feel more comfortable with this approach.

3. Almost 50% of my portfolio is currently exposed to mining, although some companies only partially. I am trying to bring this ratio down, it’s a little too much exposure to one sector for my liking. And, looking at my screens, there’s now only a few non-mining companies that meet my valuation targets. None of them have a good story. While KKT is currently the cheapest on my list, this is one of the few reasons where I may still override with a human judgement. It will possibly lower returns, but reduce the impact of some of the black swan events.

When I analyse my performance at end of year, KKT will be listed as a mistake. Had I bought it from the beginning, as my screens told me to, I would have been $5,000+ better off.

I’ve recently mentioned the difference between investment process and investment outcome. $5,000 opportunity cost is, of course, the outcome. But there was a very real error in investment process. It was always one of the cheapest on my screens, but I passed it up in favour of more expensive prospects that I felt were “safer”. In effect, I was doing the average of two perfectly good approaches, whereas I needed to pick one. Either I had to invest businesses with competitive advantage and growing intrinsic value, or the cheapest. Too often, I tried to pick companies that are a little bit of both.

As a result, I know have a few stocks in my portfolio that I still think make good investment sense, but don’t fit into my current investment process. This creates a mess in my head, because I bought them for different reasons, and my sell criteria feels like it should be different. I am still undecided whether I need to take any actions now. But I know which ones will be first to go when I am short of cash.

- Joined

- 3 June 2013

- Posts

- 457

- Reactions

- 53

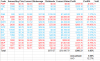

A while ago, when I purchased PMP, a topic of Altman Z score came up (thanks oddson!). I’ve applied it as it was relevant to the purchase of PMP at the time, but didn’t get around to investigating it further in a more general way. Until now.

Altman Z score is a score that is derived of numerous financial measure to establish a risk of bankruptcy, typically within the next 2 years. Ratio greater than 3 means virtually no chance of bankruptcy, while value of less than 1.8 indicates distress. There doesn’t seem to be much debate about it, it has been shown to work reasonably well over many years. It’s been shown that chance of bankruptcy increases in inverse proportion to the Alt Z score.

What is of interest to me, is whether this ratio is actually helpful in making investment decisions. Sure, at first it seems obvious – companies with higher score are highly unlikely to go under and are therefore a better investment. You wouldn’t base your investment on just this score alone, obviously, but it could be a useful screen.

As I’ve mentioned before, I wrote software that performs backtests among other things. So, let’s run a few tests, to see how well the score performs.

A few regular disclaimers:

- I run backtests on a group of ~300 companies manually selected by me. They cover most of stocks that are not resource specs, bio specs, etc.

- There’s some survivorship bias.

- It’s hasn’t been tested independently, could all be wrong for all I know.

- This is not advice!

First step is to establish a benchmark. Simply investing in all companies in my list for the last 10 years would generate a return without dividends of 131.64%.

Let’s now see if buying companies within specific Alt Z ranges can give us a better result. Rules are:

- 4% of capital per trade

- Sell all after a year and buy matching prospects again.

- 4% cash rate for unused capital.

- $100,000 capital, $30 brokerage.

- Companies will be ordered by Alt Z score, ascending.

The results are certainly surprising – it is the distressed companies that provide a greater return. As well as a better hit rate and a smaller number of big losers. The smaller number of big losers is partially explained by only holding companies for 1 year, but there’s still a very consistent correlation between lower score and fewer big losers.

It is interesting that investing in any range of scores above distressed produces roughly the same outcome in all ranges. It is only once it gets into distressed zone that there are statistically significant differences.

Most people, at this point, will probably say that Alt Z score was never meant to be used in isolation. It is rather an addition measure to assess a group of companies. Similar to Piotrovski F score, the theory is that first you select a group of cheap companies, and then you use this ratio to filter out the better prospects.

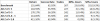

So, let’s do just that. I’ve written previously and Price/Book strategy. Let’s do it again here, and test how it works with different Alt Z scores.

Rules:

- Buy if Price/Book < 1.

- Sell after a year and buy matching prospects again.

- 4% cash rate for unused capital

- $100,000 capital, $30 brokerage.

- Companies will be ordered by Price/Book, ascending.

What jumps out immediately is that the Alt Z score correctly predicts the number of bad losers in this portfolio. The lower the score the more losers.

On the total return front, however, picture is not as clear. Buying in any range of scores produces a lower return than one achieved by simply investing in all cheap stocks. A very high Alt Z score result shows promise, but with only 51 trades over 10 years, there isn’t enough data. Only 22% of capital found a place with that criteria, so the return on the total $100,000 portfolio was only 84%.

It is possible that cheap stock are already priced for a high chance of bankruptcy and doing any further analysis of this is futile. I won’t draw any further conclusions from this because I have none. Alt Z is one of the ratios I often look at when I evaluate companies, but it’s never really been something that I would factor in. I still don’t see anything that convinces me that I should pay more attention to it.

I hope this has been of interest.

KTP.

Altman Z score is a score that is derived of numerous financial measure to establish a risk of bankruptcy, typically within the next 2 years. Ratio greater than 3 means virtually no chance of bankruptcy, while value of less than 1.8 indicates distress. There doesn’t seem to be much debate about it, it has been shown to work reasonably well over many years. It’s been shown that chance of bankruptcy increases in inverse proportion to the Alt Z score.

What is of interest to me, is whether this ratio is actually helpful in making investment decisions. Sure, at first it seems obvious – companies with higher score are highly unlikely to go under and are therefore a better investment. You wouldn’t base your investment on just this score alone, obviously, but it could be a useful screen.

As I’ve mentioned before, I wrote software that performs backtests among other things. So, let’s run a few tests, to see how well the score performs.

A few regular disclaimers:

- I run backtests on a group of ~300 companies manually selected by me. They cover most of stocks that are not resource specs, bio specs, etc.

- There’s some survivorship bias.

- It’s hasn’t been tested independently, could all be wrong for all I know.

- This is not advice!

First step is to establish a benchmark. Simply investing in all companies in my list for the last 10 years would generate a return without dividends of 131.64%.

Let’s now see if buying companies within specific Alt Z ranges can give us a better result. Rules are:

- 4% of capital per trade

- Sell all after a year and buy matching prospects again.

- 4% cash rate for unused capital.

- $100,000 capital, $30 brokerage.

- Companies will be ordered by Alt Z score, ascending.

The results are certainly surprising – it is the distressed companies that provide a greater return. As well as a better hit rate and a smaller number of big losers. The smaller number of big losers is partially explained by only holding companies for 1 year, but there’s still a very consistent correlation between lower score and fewer big losers.

It is interesting that investing in any range of scores above distressed produces roughly the same outcome in all ranges. It is only once it gets into distressed zone that there are statistically significant differences.

Most people, at this point, will probably say that Alt Z score was never meant to be used in isolation. It is rather an addition measure to assess a group of companies. Similar to Piotrovski F score, the theory is that first you select a group of cheap companies, and then you use this ratio to filter out the better prospects.

So, let’s do just that. I’ve written previously and Price/Book strategy. Let’s do it again here, and test how it works with different Alt Z scores.

Rules:

- Buy if Price/Book < 1.

- Sell after a year and buy matching prospects again.

- 4% cash rate for unused capital

- $100,000 capital, $30 brokerage.

- Companies will be ordered by Price/Book, ascending.

What jumps out immediately is that the Alt Z score correctly predicts the number of bad losers in this portfolio. The lower the score the more losers.

On the total return front, however, picture is not as clear. Buying in any range of scores produces a lower return than one achieved by simply investing in all cheap stocks. A very high Alt Z score result shows promise, but with only 51 trades over 10 years, there isn’t enough data. Only 22% of capital found a place with that criteria, so the return on the total $100,000 portfolio was only 84%.

It is possible that cheap stock are already priced for a high chance of bankruptcy and doing any further analysis of this is futile. I won’t draw any further conclusions from this because I have none. Alt Z is one of the ratios I often look at when I evaluate companies, but it’s never really been something that I would factor in. I still don’t see anything that convinces me that I should pay more attention to it.

I hope this has been of interest.

KTP.

- Joined

- 3 June 2013

- Posts

- 457

- Reactions

- 53

Thanks for the update, I take it that you plan to give some more detailed thoughts on your performance and any reservations once the portfolio hits its anniversary date in June?

Obviously a year is probably not long enough, no where near it, with the extended feedback loop of long-term investing, but still useful to reflect and ponder.

Still watching with interest, but haven't had much to add. I see you have have 18,000 thread views now too, so obviously has a few followers.

Obviously a year is probably not long enough, no where near it, with the extended feedback loop of long-term investing, but still useful to reflect and ponder.

Still watching with interest, but haven't had much to add. I see you have have 18,000 thread views now too, so obviously has a few followers.

- Joined

- 25 September 2013

- Posts

- 201

- Reactions

- 0

What broker do you use?

Would cheaper brokerage help?

4 trades cost you $59.90 each, which is more than your annualised profit to date.

And is your annualised return inclusive of dividends?

Is this an IRR (internal rate of return) calculation?

Would cheaper brokerage help?

4 trades cost you $59.90 each, which is more than your annualised profit to date.

And is your annualised return inclusive of dividends?

Is this an IRR (internal rate of return) calculation?

- Joined

- 3 June 2013

- Posts

- 457

- Reactions

- 53

Thanks for the update, I take it that you plan to give some more detailed thoughts on your performance and any reservations once the portfolio hits its anniversary date in June?

Obviously a year is probably not long enough, no where near it, with the extended feedback loop of long-term investing, but still useful to reflect and ponder.

Still watching with interest, but haven't had much to add. I see you have have 18,000 thread views now too, so obviously has a few followers.

Hi Ves,

Yes, certainly planning a post of yearly reflections in July. Technically it will be 13 months, but since I've had mininal funds invested in the first months, it will make no significant difference. Synching it with financial end of year will make it easier in the future.

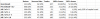

My current results sucks. Things I note at the moment (good and bad):

- companies that I tried to pick purely on numbers performed substantially better so far than ones where I've tried to analyze long term potential. $726.45 vs ($714.92). Even better if I exclude the most recent purchases and didn't have a brain meltdown with PMP.

- I simulate a few different value strategies along side with my live investing. Most are underperforming at the moment.

- My rule of investing once a months has been a huge drag on my portfolio. Had I invested my funds immediately without this limitation, I would have been well above the index. Absolutely no regrets here, it'd be a completely opposite story in a falling market.

- It is surprising that there has been absolutely no significant fundamental changes in any of my companies. And so, I find it easy to continue holding until something happens, regardless of current price.

- A lot value investing literature mentions 3+ years as a typical holding period. So yes, it is way too early to start making any conclusions from results.

18,000 views is nice, if only I had a dollar for each. And I still have a long way to go to catch robusta.

What broker do you use?

Would cheaper brokerage help?

4 trades cost you $59.90 each, which is more than your annualised profit to date.

And is your annualised return inclusive of dividends?

Is this an IRR (internal rate of return) calculation?

I use commsec @ $29.95/trade. $59.90 is for stocks that I sold, so there's brokerage x 2.

Return is inclusive of dividends. Calculation is just a simple XIRR function in Excel. Once I commit all my funds, I do not plan to keep adding to it, so from then on the calclation of return will be as simple as Profit/Portfolio at start of year.

- Joined

- 27 December 2010

- Posts

- 1,729

- Reactions

- 48

I use commsec @ $29.95/trade. $59.90 is for stocks that I sold, so there's brokerage x 2.

Create a CDIA account with CBA/CommSec and fund your trades from there...that should trim the broker down to $20 a side...

- Joined

- 25 September 2013

- Posts

- 201

- Reactions

- 0

I use commsec @ $29.95/trade. $59.90 is for stocks that I sold, so there's brokerage x 2.

Return is inclusive of dividends. Calculation is just a simple XIRR function in Excel. Once I commit all my funds, I do not plan to keep adding to it, so from then on the calclation of return will be as simple as Profit/Portfolio at start of year.

Ok fair enough.

If you are measuring your return inclusive of dividends, then shouldn't you be benchmarking your returns against the All Ords Accumulation Index?

On Apr 25, the All Ords Accumulation Index return was 19.57% for the financial year to date...

galumay

learner

- Joined

- 17 September 2011

- Posts

- 3,594

- Reactions

- 2,483

Ok fair enough.

If you are measuring your return inclusive of dividends, then shouldn't you be benchmarking your returns against the All Ords Accumulation Index?

On Apr 25, the All Ords Accumulation Index return was 19.57% for the financial year to date...

Where can you see that for the financial year to date? I use http://au.spindices.com/indices/equity/all-ordinaries but it only shows 1 year annualized returns, which shows accumulation index having increased 10.43%

EDIT - The reason the return was so high for financial year to date is because of the very sharp drop in the market in june 2013, and shows the danger of comparing to indicies performance over the short term, its a pretty meaningless comparison unless you went from zero to fully invested on 30th June 2013.

It shows the danger of using a single matrix to measure your portfolio performance - and in the case of us long term fundamental investors its probably best avoided until you have been fully invested for a number of years and that sort of comparison becomes more meaningful.

Its also perhaps a function of confusing price and value.

- Joined

- 2 June 2011

- Posts

- 5,341

- Reactions

- 242

Where can you see that for the financial year to date?

It's in Iress, XAOAI.

The RBA publish XJOAI in their monthly F7 report.

http://www.rba.gov.au/statistics/tables/pdf/f07.pdf?accessed=2014-05-01-10-05-57

galumay

learner

- Joined

- 17 September 2011

- Posts

- 3,594

- Reactions

- 2,483

It's in Iress, XAOAI.

The RBA publish XJOAI in their monthly F7 report.

http://www.rba.gov.au/statistics/tables/pdf/f07.pdf?accessed=2014-05-01-10-05-57

Thanks mate, i dont have an Iress account, but i guess i could calculate from the RBA report, also its ASX200 but i suppose that would be near enough to All Ords.

http://www.afr.com/share_tables/

You need to select the dates you want by week and then find the Excel / CSV file for Weekly Roundup - Australian Indices.

All of the major indices are shown. If you scroll to the right it also shows the accumulation index for each.

I checked and confirm that the XJO figures for the ASX 200 match to the RBA reports.

You need to select the dates you want by week and then find the Excel / CSV file for Weekly Roundup - Australian Indices.

All of the major indices are shown. If you scroll to the right it also shows the accumulation index for each.

I checked and confirm that the XJO figures for the ASX 200 match to the RBA reports.

- Joined

- 25 September 2013

- Posts

- 201

- Reactions

- 0

Where can you see that for the financial year to date? I use http://au.spindices.com/indices/equity/all-ordinaries but it only shows 1 year annualized returns, which shows accumulation index having increased 10.43%

It is hard to find, but I get it from Colin Nicholson's website at www.bwts.com.au, he includes it in his weekly portfolio journals.

This index value was 38270.22 at 30/6/13.

On 25/4/14 it was 45760.237, ie a 19.57% increase.

You can get the current value from www.au.spindices.com/indices/equity/all-ordinaries - click on "Fact Sheet", then you will see the current accumulation index value (45389.48) under "Total Returns".

The year-to-date return % figures are not for the financial year-to-date though, but you can work that out using the 38270.22 figure I quoted above.

Of course such comparisons are better made over a number of years, but it is interesting to compare one's progress relative to a benchmark in the short-term.

And make sure you are using the right benchmark in the first place.

An under-performance of 18.97% maybe worth looking into just to make sure your underlying strategy and selection approach is not faulty.

galumay

learner

- Joined

- 17 September 2011

- Posts

- 3,594

- Reactions

- 2,483

Of course such comparisons are better made over a number of years, but it is interesting to compare one's progress relative to a benchmark in the short-term.

And make sure you are using the right benchmark in the first place.

An under-performance of 18.97% maybe worth looking into just to make sure your underlying strategy and selection approach is not faulty.

i think that perfectly illustrates why its actually not very helpful to compare, in this case the "under-performance of 18.97%" is totally irrelevant unless you happened to become fully invested on exactly that week at the end of June when the market hit its low point. Otherwist the distortion is just too great to be meaningful, the fact that the % for the last 12 months (ie April 2013 - 2014) is about half the % for the financial year shows the danger of measuring your performance against an index over the short term.

- Joined

- 25 September 2013

- Posts

- 201

- Reactions

- 0

And make sure you are using the right benchmark in the first place.

Ie. whether it is the All Ords, S&P/ASX200, S&P/ASX300 or some other index, and with or without dividends included.

Similar threads

- Replies

- 2

- Views

- 816