- Joined

- 20 July 2021

- Posts

- 11,892

- Reactions

- 16,559

personally i think Europe is a lunatic clown-show and Germany will have it's revenge via the teachings of Karl Marx ( even if half the leaders seem to impersonate Groucho Marx )EOW Update

What a week, who watched the WTC share price, I sure did and I made a small trade on Tuesday to capitalize on it (not included as a part of this portfolio).

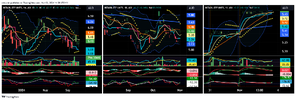

An ASX concern for me has been the continued default in Chinese off-market private bonds, it shows just how weak the Chinese economy is. In the long term even having the state/local governments step in and buy excess property, it simply isn't sustainable. I hold strong concerns about the price of Iron Ore at its current levels (in the absence of some of a global conflict ceasing and a mass rejuvenation process being required). Watching to see if we find Iron Ore fall back below $90.00 and if so, to re-enter into FMG for a swing trade.

Also in sad news, our DUG position was liquidated by a stop loss at $1.90. Have left DUG on the watchlist, all though I feel like we will be washing our hands of this stock in the near term, preferring to allocate the capital in a different direction (more on this later).

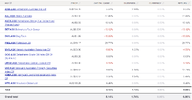

None the less here is how we are sitting;

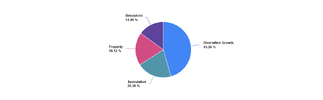

Profit/Loss

View attachment 186555

^important to note that the % return has increased as a result of the decrease in overall portfolio value (all though AAL is performing well.)

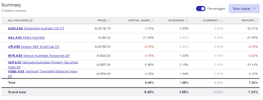

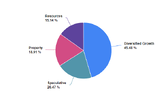

Weightings

View attachment 186556

Looking Forwards

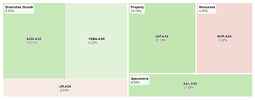

As we can see it is notable that our Diversified Growth allocation is underweight by ~5%, its also important to note that this gap was bigger (prior to the liquidation of DUG). Following November 5th or a major drawdown a position will be entered to gain more exposure externally to Australia.

I have previously lent towards MQEG however I am now heavily considering splitting an approximately 15% position across the S&P500 (7.5%) and Europe (7.5%) evenly, in currency hedged positions (ETFs). Currency hedged as I am confident in the strength of the Australian Dollar in the back half of this year as other neighboring nations cut (especially Europe)

Also I am very happy to be overweight property at the moment, despite the interest rate setting, the following article in the AFR has further reinforced my confidence;

View attachment 186557

As a younger employee who attends the office 5 days a week (by choice), I am seeing the trend move in this direction across the board. Hybrid office attendance is making a comeback whether employees like it or not (by hybrid I am referring to 3 days a week in person).

Onwards and upwards, until next week.

good luck if you play there

i am even uneasy about my exposure via HVN ( which is nicely in profit after a fair bit of work )