You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Futures trading journal - GB

- Thread starter Gringotts Bank

- Start date

- Joined

- 30 June 2007

- Posts

- 7,200

- Reactions

- 1,226

- Joined

- 30 June 2007

- Posts

- 7,200

- Reactions

- 1,226

Timestamped for your viewing pleasure. Gives me goosbumps watching this. Musk is a genius.

- Joined

- 30 June 2007

- Posts

- 7,200

- Reactions

- 1,226

ES tgt 4168.75

Gold tgt 2027.2.

People may wonder why I give away my method. Two reasons. First is that the more you help others to make money, the more money you make yourself (so long as it's a genuine gesture and actually helpful). Second reason is that you have to have trading psychology mastered to use any system, and I can't help with that since I haven't mastered it myself yet. Work in progress. Namaste.

Gold tgt 2027.2.

People may wonder why I give away my method. Two reasons. First is that the more you help others to make money, the more money you make yourself (so long as it's a genuine gesture and actually helpful). Second reason is that you have to have trading psychology mastered to use any system, and I can't help with that since I haven't mastered it myself yet. Work in progress. Namaste.

Last edited:

- Joined

- 30 June 2007

- Posts

- 7,200

- Reactions

- 1,226

- Joined

- 30 June 2007

- Posts

- 7,200

- Reactions

- 1,226

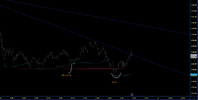

It added another 35 ticks before falling to 4137 (not 4135.5). I guess I read it incorrectly.Just spotted - this upswing is almost completely bare of FVGs. So I'm selling ES early at a profit. I think it's going to dump again and close around 4135.5 or lower. Also dumping gold as it's not moving.

View attachment 156037

Anyone else trade ES? How did you read that section of the chart? What did I miss?

- Joined

- 30 June 2007

- Posts

- 7,200

- Reactions

- 1,226

- Joined

- 30 June 2007

- Posts

- 7,200

- Reactions

- 1,226

Strong angle and buying into the breakout. Predicting it will go straight to 4160.75, pause, then 4161.75.

- Joined

- 30 June 2007

- Posts

- 7,200

- Reactions

- 1,226

ES stopped out at BE.

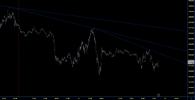

Gold getting smashed. Something around 1978 might be a good entry. Unusual because the run up to the trendline (gold 1 min) had a huge amount of buying, like I've never seen before.

ES long 4146. Same tgt as before.

Gold getting smashed. Something around 1978 might be a good entry. Unusual because the run up to the trendline (gold 1 min) had a huge amount of buying, like I've never seen before.

ES long 4146. Same tgt as before.

Last edited:

- Joined

- 30 June 2007

- Posts

- 7,200

- Reactions

- 1,226

ES is gonna pop, just a matter of when. New target 4171.

- Joined

- 30 June 2007

- Posts

- 7,200

- Reactions

- 1,226

Takes me a good 30-60 minutes to mark up the ES chart for the day, but thath will get quicker. When the RTH starts, I don't like moving to a different chart like gold unless the ES is totally flat and lifeless. So I've narrowed it down to just ES, I think. It allows me to become completely absorbed in one thing.

- Joined

- 30 June 2007

- Posts

- 7,200

- Reactions

- 1,226

Stopped out.ES is gonna pop, just a matter of when. New target 4171.

Will enter long at 4141.5 if it eventuates, but am watching out for a narrow downwards channel. If such a channel develops, I won't.

The avoidance of the trendline (orange arrow) signalled a downwards move, but I didn't give it a lot of weight because the order flow Friday was bullish.

Last edited:

- Joined

- 30 June 2007

- Posts

- 7,200

- Reactions

- 1,226

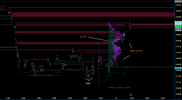

It's at the level now, but the order flow is showing selling and the pattern is a bit narrow. So I'm going to wait for the pattern to broaden out a bit and I see if I can spot some buying.Stopped out.

Will enter long at 4141.5 if it eventuates, but am watching out for a narrow downwards channel. If such a channel develops, I won't.

The avoidance of the trendline (orange arrow) signalled a downwards move, but I didn't give it a lot of weight because the order flow Friday was bullish.

View attachment 156156

More easily seen on the hourly. It's not steep, but it is narrow.

Last edited:

- Joined

- 30 June 2007

- Posts

- 7,200

- Reactions

- 1,226

- Joined

- 30 June 2007

- Posts

- 7,200

- Reactions

- 1,226

- Joined

- 30 June 2007

- Posts

- 7,200

- Reactions

- 1,226

- Joined

- 30 June 2007

- Posts

- 7,200

- Reactions

- 1,226

Short ES 4163.

Stop nearby at 4167.

edit: Scambled out of that. There will be a better opportunity.

Stop nearby at 4167.

edit: Scambled out of that. There will be a better opportunity.

Last edited:

- Joined

- 30 June 2007

- Posts

- 7,200

- Reactions

- 1,226

I did manage to catch it again at the same price. In and out for 40 ticks.

Now there will be a dull period for a while I think.

Now there will be a dull period for a while I think.

- Joined

- 30 June 2007

- Posts

- 7,200

- Reactions

- 1,226

Hoping to buy around 4142.25 if something appears.

- Joined

- 30 June 2007

- Posts

- 7,200

- Reactions

- 1,226

4152.5 level tells me if bulls or bears in control in the short term. Expecting it to pause there as it decides. My tgt is above that.

Similar threads

- Replies

- 0

- Views

- 2K

- Replies

- 75

- Views

- 11K

- Replies

- 141

- Views

- 33K