- Joined

- 30 June 2007

- Posts

- 7,200

- Reactions

- 1,226

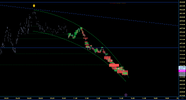

Targeting 4152.Long 4138.5, but I have a feeling there's going to be a fair bit of sideways. May hop out if it doesn't look right.

Second problem is we're now in a downtrend, so going long becomes risky.

No. Have a look at my results.Don't you feel like if all it takes is price retracing a ~10% up move by -2% when VIX is at 19 (implied market move of 1.2% daily move) to switch your thinking to "we're in a downtrend", you might just be trading on noise?

4073.5 provided support, but not exact.First sign of real strength in over a day, circled. That's a long time on a 1 min chart.

Too difficult to tell if there will be any follow through with the TL break. I doubt it.

Looking at next buy around 4088.75, 4078.25 or 4073.50.

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.