Duc's Daily Dozen

- Thread starter ducati916

- Start date

- Joined

- 28 August 2022

- Posts

- 7,529

- Reactions

- 12,364

Gundlach:

Druckenmiller and Tudor-Jones

These are a must read:

I'll be going through these most of the week as their implications pretty much explain the current market action.

View attachment 165242View attachment 165241View attachment 165240View attachment 165239View attachment 165238

jog on

duc

Would even dare to put up an argument against this post.

Carry on Good Sir.

- Joined

- 13 February 2006

- Posts

- 5,428

- Reactions

- 12,693

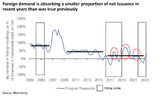

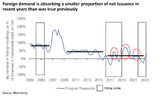

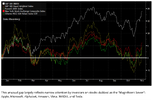

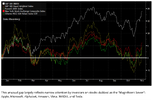

The fall in the USD and this fall in yield are hand in glove, as will be shown:

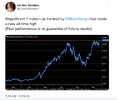

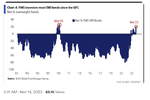

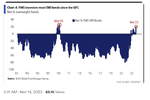

Look at Gundlach's chart of it crossing its moving average. This is the start.

Which is confirmed.

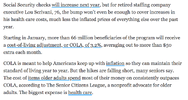

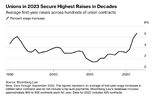

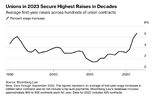

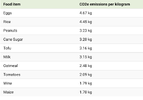

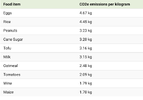

Highlighted a few weeks ago, the onshoring phenomenon. Will be HIGHLY inflationary. It is however in the long run a really good thing for the US. This was really highlighted by the US military indicating that they could not manufacture their own munitions and were dependent on China to do so.

Stunning.

So Mr flippe-floppe-flye is right.

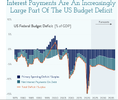

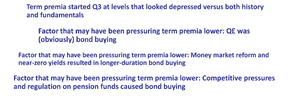

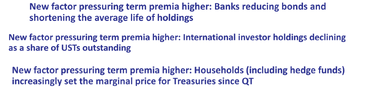

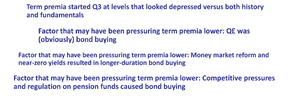

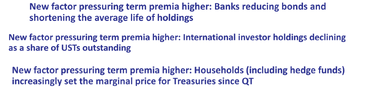

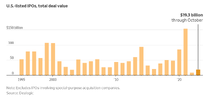

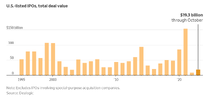

From the TBAC documents.

Yellen could not term out the debt (had to keep issuing predominantly short term debt when rates were low) because had she done so, the 10yr would have collapsed (yields risen when Fed was trying to keep them low). This is why when Druckenmiller criticises her for being stupid, she was far from stupid, her hands were tied.

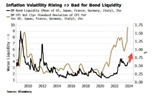

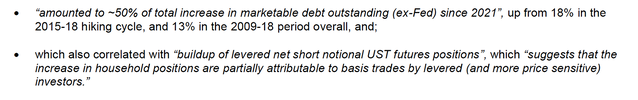

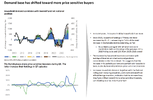

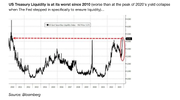

There is no liquidity in the long end, which precludes the Treasury and Yellen from terming out at the long end:

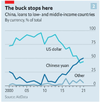

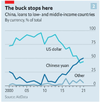

It makes no difference, liquidity is gone. The big buyers, China, Japan, OPEC are all gone. Not only are they not buying, but when the USD rises too high, they become sellers. China in defending the Yuan only needed to sell a few billions to create an effect with yields in UST jumping 80bp.

Yellen NEEDS a weaker USD.

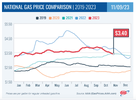

A weaker USD is highly inflationary, particularly if POO concurrently moves higher, which it will. A full blown recession may blunt that rise somewhat, however, the flip side is that Shale producers require higher prices or they do not produce, driving supply shortages. The second issue with Shale is that if they do not produce, it becomes harder to actually produce and a certain % of production is lost each year it sits in the ground.

Go back to the build out in factories: these manufacturing plants will require additional energy and lots of it. Where exactly is that coming from? Not f**king green. Nowhere near able to match the demand. Natural Gas/Oil? Too long to build out sufficient nuclear, although that will be part of it. Would the US return to coal? LOL. China has, as has Germany. Not in the realms of fantasy.

jog on

duc

- Joined

- 13 February 2006

- Posts

- 5,428

- Reactions

- 12,693

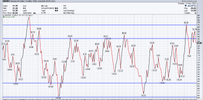

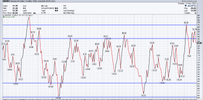

UST volatility remains the #1 issue:

While Mr flippe-floppe-flye is closely focussed on minute-by-minute developments, the longer term picture is dire.

From TBAC Report

The UST market is now essentially an EM market where long term funding due to a total lack of liquidity is no longer possible. Which means that the real reason that Yellen could not term out and is now faced with a massive roll-over problem in 2024, which excluding the deficit ($2T+) includes almost $5T in roll-over that needs to be funded.

The long end of the curve will reignite moving higher. 100%. The only way it stops is when the Fed moves to outright YCC and money printing.

Meanwhile:

Stocks have ignored this today.

Probably a slow burner. For the moment sit back and watch what, if anything, develops.

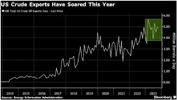

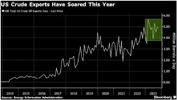

Oil:

At least 48 VLCC tankers are sailing towards the United States to collect oil for exports, the highest in six years, as US exports are set to reach new all-time highs over the winter months.

- According to Kpler data, US crude exports in November are expected to come in around 4.35 million b/d, only slightly below the all-time high of 4.45 million b/d reached in March 2023.

- The weakening of US gasoline cracks has weakened market interest in WTI, the main light sweet grade across the Americas, pushing increasing volumes of the grade into the global markets.

- The ICE Brent-WTI spread widened to some $4.5 per barrel recently as the US benchmark has been gradually weakening, with WTI Midland becoming the cheapest grade within the BFOETM basket for 16 consecutive trading days.

Market Movers

- Saudi Arabia’s NOC Saudi Aramco (TADAWUL:2222) reported a 23% quarter-on-quarter decline in net profits, falling to $32.6 billion on lower production levels, slightly above market expectations.

- US oil major Chevron (NYSE:CVX) is reportedly in talks with European companies to provide them with LNG for up to 15 years, with Europe remaining the largest buyer of US LNG exports.

- Canada’s Crescent Point Energy has agreed to buy Alberta-focused oil producer Hammerhead Energy for a reported sum of $1.9 billion, adding 56,000 b/d of oil equivalent output mostly from the Montney shale play.

Tuesday, November 07, 2023

The brief price rally triggered by OPEC+’s extension of production cuts until end-2023 has swiftly evaporated as a string of bad news from China turned overall sentiment back to bearish. Even though Chinese oil imports remain robust and October demonstrated another month-on-month increase to 11.53 million b/d, the prospects of quotas running out and weaker refinery margins have been the main driver of ICE Brent declining to $84 per barrel.

Saudi Arabia Extends Production Cut. Saudi Arabia extended its voluntary production cut of 1 million b/d to the end of this year, with Russia chipping with its 300,000 b/d reduction to its exports, maintaining the existing voluntary restrictions in place.

US Majors See ESG Pressure Weaken. Climate activist groups such as Follow This have been having a hard time pushing through climate-focused resolutions, receiving minuscule support with ExxonMobil and Chevron shareholders as BlackRock, Vanguard or JPMorgan all voted against them.

Venezuela Eyes Oil Services Revival. Venezuela’s state oil firm PDVSA is in talks with local and foreign oil services companies to restart idled equipment that remains in place across the country’s oil fields, with SLB (NYSE:SLB), Nabors Industries (NYSE:NBR) and Evertson reportedly having equipment that could be revived swiftly.

UK Wants Annual Licensing Rounds. The government of the United Kingdom seeks to mandate yearly North Sea oil and gas licensing rounds after the COVID-triggered “temporary” pause in 2020 led to a hiatus lasting more than 2 years, hindering overall upstream activity and reserve replacement.

US Mulls January SPR Replenishment. The US Department of Energy announced it would seek to buy up to 3 million barrels of crude for delivery in January 2024 to replenish depleted strategic petroleum stocks, to be delivered into the Big Hill storage site.

Investors Shed Crude Futures. The total of short positions in WTI Nymex light sweet crude futures and options held by speculators more than tripled in the week ended 31 October to 95,999 contracts, with speculative short positions now at their highest since August.

Egypt Starts Importing LNG Amid Israel Shutdown. Egypt, a country that traditionally exports LNG, has received a rare import cargo at its Ain Sukhna terminal in the Red Sea, as curbed Israeli supply led to lower feedgas flows and prolonged power outages across the North African country.

China Signs LNG Deal with Qatar. China’s state-owned oil major Sinopec (SHA:600028) signed a 27-year LNG supply deal with QatarEnergy, sourcing up to 3 million metric tonnes of LNG from the North Field expansion project in which the Chinese firm will hold a 5% interest.

Canada’s TMX Mandated to Stop. Canada’s energy regulator CER ordered the Trans Mountain pipeline to stop work in a wetland area near Abbotsford, BC, having found several environmental non-compliances, marking another hold-up in the delay-plagued history of the project.

Iran Exports Drop Lower Amidst Conflict. Iranian oil exports have declined for the second consecutive month to 1.4 million b/d, just as the US House of Representatives passed a bill (abbreviated as SHIP) that would sanction all foreign ports and refineries processing Iranian crude.

OPEC Mulls Brazil Membership Plan. OPEC Secretary General Haitham al-Ghais hinted at OPEC making progress in talks on expanding its membership, saying Brazil could be interested in joining the organization of oil producers, similarly to Azerbaijan, Malaysia or Brunei.

US Refiners Cut Runs Due to Gasoline Glut. US crude oil refiners are expected to average 90-91% in utilization rates in October-December, down from almost maximum capacity in Q2-Q3, as weak gasoline cracks and limited diesel production upside curb their appetite to fire on all cylinders.

Kuwait Needs Funds to Fulfil 5-Year Plan. Kuwait’s national oil company KPC reportedly needs $45.7 billion to plug the gap in missing revenues as it seeks to meet its 5-year spending plan, flagging that retaining annual dividends instead of transferring them to the state is “inevitable” until 2027.

To me that looks like they have fallen from the ATH and getting set to fall further.

Oil supply is another slow burner. It will however become a huge issue.

jog on

duc

While Mr flippe-floppe-flye is closely focussed on minute-by-minute developments, the longer term picture is dire.

From TBAC Report

The UST market is now essentially an EM market where long term funding due to a total lack of liquidity is no longer possible. Which means that the real reason that Yellen could not term out and is now faced with a massive roll-over problem in 2024, which excluding the deficit ($2T+) includes almost $5T in roll-over that needs to be funded.

The long end of the curve will reignite moving higher. 100%. The only way it stops is when the Fed moves to outright YCC and money printing.

Meanwhile:

Stocks have ignored this today.

Probably a slow burner. For the moment sit back and watch what, if anything, develops.

Oil:

At least 48 VLCC tankers are sailing towards the United States to collect oil for exports, the highest in six years, as US exports are set to reach new all-time highs over the winter months.

- According to Kpler data, US crude exports in November are expected to come in around 4.35 million b/d, only slightly below the all-time high of 4.45 million b/d reached in March 2023.

- The weakening of US gasoline cracks has weakened market interest in WTI, the main light sweet grade across the Americas, pushing increasing volumes of the grade into the global markets.

- The ICE Brent-WTI spread widened to some $4.5 per barrel recently as the US benchmark has been gradually weakening, with WTI Midland becoming the cheapest grade within the BFOETM basket for 16 consecutive trading days.

Market Movers

- Saudi Arabia’s NOC Saudi Aramco (TADAWUL:2222) reported a 23% quarter-on-quarter decline in net profits, falling to $32.6 billion on lower production levels, slightly above market expectations.

- US oil major Chevron (NYSE:CVX) is reportedly in talks with European companies to provide them with LNG for up to 15 years, with Europe remaining the largest buyer of US LNG exports.

- Canada’s Crescent Point Energy has agreed to buy Alberta-focused oil producer Hammerhead Energy for a reported sum of $1.9 billion, adding 56,000 b/d of oil equivalent output mostly from the Montney shale play.

Tuesday, November 07, 2023

The brief price rally triggered by OPEC+’s extension of production cuts until end-2023 has swiftly evaporated as a string of bad news from China turned overall sentiment back to bearish. Even though Chinese oil imports remain robust and October demonstrated another month-on-month increase to 11.53 million b/d, the prospects of quotas running out and weaker refinery margins have been the main driver of ICE Brent declining to $84 per barrel.

Saudi Arabia Extends Production Cut. Saudi Arabia extended its voluntary production cut of 1 million b/d to the end of this year, with Russia chipping with its 300,000 b/d reduction to its exports, maintaining the existing voluntary restrictions in place.

US Majors See ESG Pressure Weaken. Climate activist groups such as Follow This have been having a hard time pushing through climate-focused resolutions, receiving minuscule support with ExxonMobil and Chevron shareholders as BlackRock, Vanguard or JPMorgan all voted against them.

Venezuela Eyes Oil Services Revival. Venezuela’s state oil firm PDVSA is in talks with local and foreign oil services companies to restart idled equipment that remains in place across the country’s oil fields, with SLB (NYSE:SLB), Nabors Industries (NYSE:NBR) and Evertson reportedly having equipment that could be revived swiftly.

UK Wants Annual Licensing Rounds. The government of the United Kingdom seeks to mandate yearly North Sea oil and gas licensing rounds after the COVID-triggered “temporary” pause in 2020 led to a hiatus lasting more than 2 years, hindering overall upstream activity and reserve replacement.

US Mulls January SPR Replenishment. The US Department of Energy announced it would seek to buy up to 3 million barrels of crude for delivery in January 2024 to replenish depleted strategic petroleum stocks, to be delivered into the Big Hill storage site.

Investors Shed Crude Futures. The total of short positions in WTI Nymex light sweet crude futures and options held by speculators more than tripled in the week ended 31 October to 95,999 contracts, with speculative short positions now at their highest since August.

Egypt Starts Importing LNG Amid Israel Shutdown. Egypt, a country that traditionally exports LNG, has received a rare import cargo at its Ain Sukhna terminal in the Red Sea, as curbed Israeli supply led to lower feedgas flows and prolonged power outages across the North African country.

China Signs LNG Deal with Qatar. China’s state-owned oil major Sinopec (SHA:600028) signed a 27-year LNG supply deal with QatarEnergy, sourcing up to 3 million metric tonnes of LNG from the North Field expansion project in which the Chinese firm will hold a 5% interest.

Canada’s TMX Mandated to Stop. Canada’s energy regulator CER ordered the Trans Mountain pipeline to stop work in a wetland area near Abbotsford, BC, having found several environmental non-compliances, marking another hold-up in the delay-plagued history of the project.

Iran Exports Drop Lower Amidst Conflict. Iranian oil exports have declined for the second consecutive month to 1.4 million b/d, just as the US House of Representatives passed a bill (abbreviated as SHIP) that would sanction all foreign ports and refineries processing Iranian crude.

OPEC Mulls Brazil Membership Plan. OPEC Secretary General Haitham al-Ghais hinted at OPEC making progress in talks on expanding its membership, saying Brazil could be interested in joining the organization of oil producers, similarly to Azerbaijan, Malaysia or Brunei.

US Refiners Cut Runs Due to Gasoline Glut. US crude oil refiners are expected to average 90-91% in utilization rates in October-December, down from almost maximum capacity in Q2-Q3, as weak gasoline cracks and limited diesel production upside curb their appetite to fire on all cylinders.

Kuwait Needs Funds to Fulfil 5-Year Plan. Kuwait’s national oil company KPC reportedly needs $45.7 billion to plug the gap in missing revenues as it seeks to meet its 5-year spending plan, flagging that retaining annual dividends instead of transferring them to the state is “inevitable” until 2027.

To me that looks like they have fallen from the ATH and getting set to fall further.

Oil supply is another slow burner. It will however become a huge issue.

jog on

duc

- Joined

- 13 February 2006

- Posts

- 5,428

- Reactions

- 12,693

Today:

www.simplify.us

www.simplify.us

klementoninvesting.substack.com

klementoninvesting.substack.com

So essentially the TBAC states: We can’t issue enough to finance our deficits at the long end without spiking the 10y UST rate that serves as the policy rate for the real economy (which would in turn hurt our receipts, sending issuance higher still, triggering a potential UST debt spiral and economic and market calamity), so we are going to shift to the short end, where the Fed’s Reverse Repo (RRP) can serve as a form of “heretofore sterilized prior QE” that can buy T-Bills.

Always inflation. Always.

They (Treasury) need a lower USD.

With oil it is more nuanced. Yes they need a lower POO to rein in inflation in the present. However a lower POO today means less production from Shale. Less production from Shale means that a greater % of that oil becomes lost as shale needs to be extracted or its recoverability reduces.

Therefore a low POO reduces the impact of Shale meaningfully going forward and that means far higher POO as the US cedes total control of the oil market back to OPEC+. Higher inflation tomorrow.

Finishing with Mr fff

I'm trying to get filled on a couple of trades, not much luck atm.

jog on

duc

Demystifying Equity Market Neutral Investing

Introduction The 60/40 portfolio, the bread-and-butter portfolio of today’s wealth management industry, is limited to just two core drivers of returns: equities and bonds. Is there someplace else we can turn to for a compelling yet distinct source of returns? Yes, there are several places to...

Average is not the same as median…

The most read post I ever wrote showed that the distribution of stock market returns is not symmetrical around some average performance. Instead, the longer your time frame, the more asymmetrical market returns become. This is true of the market overall and of individual stocks as well. But if...

So essentially the TBAC states: We can’t issue enough to finance our deficits at the long end without spiking the 10y UST rate that serves as the policy rate for the real economy (which would in turn hurt our receipts, sending issuance higher still, triggering a potential UST debt spiral and economic and market calamity), so we are going to shift to the short end, where the Fed’s Reverse Repo (RRP) can serve as a form of “heretofore sterilized prior QE” that can buy T-Bills.

Always inflation. Always.

They (Treasury) need a lower USD.

With oil it is more nuanced. Yes they need a lower POO to rein in inflation in the present. However a lower POO today means less production from Shale. Less production from Shale means that a greater % of that oil becomes lost as shale needs to be extracted or its recoverability reduces.

Therefore a low POO reduces the impact of Shale meaningfully going forward and that means far higher POO as the US cedes total control of the oil market back to OPEC+. Higher inflation tomorrow.

Finishing with Mr fff

I'm trying to get filled on a couple of trades, not much luck atm.

jog on

duc

- Joined

- 13 February 2006

- Posts

- 5,428

- Reactions

- 12,693

POO currently in contango. OPEC+ still looking to cut production.

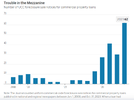

Two hot wars and a currency war are currently underway with a debt/GDP at 120%. LOL.

Europe already in recession.

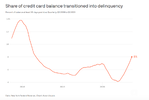

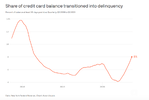

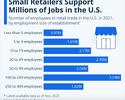

US consumer in trouble. When the US consumer is in trouble, the economy is in trouble.

Even worse:

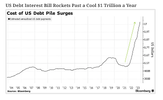

Social Security, Medicare, Medicaid add up to another $200T. A 3.2% bump on the SS entitlements makes it even worse than the indicated $1T in interest payments. The deficits are set to explode higher, even before you factor in falling tax revenues from a recession that is already building.

Mr fff

So the US is now essentially an Emerging Market, so great is the debt load. Uploaded is the White Paper on this phenom. Below are some excerpts:

In summary, quasi-fiscal deficits result from the monetary financing of quasi-fiscal expenditures, or from the debt service of financing fiscal or quasi-fiscal expenditures. Once a debt is issued, the quasi-fiscal impact of its service may take on a life of its own: if market interest rates rise, the Central Bank may be forced to roll-over its existing stock of debt at a higher rate, therefore contributing to a higher potential quasi- fiscal deficit.

So the higher those rates go, the higher the excess reserve rates the Fed must pay to sterilise those excess reserves.

Quasi-fiscal deficits, as well as ordinary fiscal deficits are financed either through money creation or debt issues. From this perspective, the macroeconomic effects of financing quasifiscal deficits is no different from the usual effects found for fiscal deficits. However, the macroeconomic effects of quasifiscal deficits may differ depending on the expenditure that gives rise to them. Interest rate and exchange rate controls may cause Central Bank losses which in addition to requiring deficit financing, may seriously affect resource allocation.

The accrued interest on Central Bank debt, or on the debt of nationalized banks (including deposits) that cannot be served with the return on assets, is normally rolled over in the form of more issues of a similar instrument. This process crowds out the capital market and generates pressure for a rising real interest rate on government paper.

As the Fed makes operating losses, it no longer remits those profits to the Treasury. The Treasury has to run higher deficits, issue more UST and drives real rates higher.

If the real interest rate paid on such debt becomes positive, the system may enter into an explosive path, as every period the Central Bank will be forced to issue a larger real quantity of debt.

As the market perceives the need for a growing real debt path, the required interest rate rises even more and eventually a run against the liabilities of the institution occurs. Such runs have been common in Latin America and have ended up in virtual debt repudiations, macrodevaluations and hyperinflations

Esssentially, perpetual debt.

Last, a research paper on the upcoming (next year) US elections.

jog on

duc

Attachments

- Joined

- 13 February 2006

- Posts

- 5,428

- Reactions

- 12,693

Friday, November 10th, 2023

Battered by inventory build-ups, weaker-than-expected Chinese economic data, and slackening physical demand coming from skyrocketing freight costs, oil prices have struggled this week and ICE Brent is set for a $5 per barrel week-on-week drop, settling around the $80 per barrel mark. With sentiment shifting towards a much more bearish outlook, all eyes will be on OPEC+ which, after a protracted hiatus, meets again on November 26 in Vienna.

Saudi Arabia Blames Speculators, Again. Saudi Energy Minister Prince Abdulaziz bin Salman claimed the recent decline in oil prices is a “ploy” that hides the real strength of the oil markets, adding that speculators are abusing export figures as they fail to distinguish them from production numbers.

US Seeks to Derail Russia’s LNG Project. The US State Department has been seeking to sanction Russia’s new large-scale LNG project Arctic LNG-2 developed by Novatek, giving companies three months until the end of January 2024 to wind down transactions with the liquefaction plant.

Venezuela Welcomes Returning Investors. French upstream company Maurel & Prom agreed to return to Venezuela with its JV partner, the national oil company PDVSA, as it entered the ownership of the Urdaneta Oeste field back in 2018 only to halt operations when sanctions were introduced.

Mexico’s First LNG Cargoes Gets Delayed. The commissioning of Mexico’s first-ever LNG export plant developed by New Fortress Energy (NASDAQ:NFE) will be delayed to December due to delays in receiving the infrastructure, even though the gas pipeline from Texas is already running.

Brimming EU Gas Stocks Depress Prices. European TTF gas prices have been gradually sliding lower to €47 per MWh amidst record gas stocks across the continent, at 189 TWh up 20% compared to the 10-year seasonal average, with a warm autumn so far delaying the start of heating season.

Oil Producers in Kurdistan Moot Export Resumption. International oil producers active in Iraqi Kurdistan – DNO, Genel Energy, Gulf Keystone, or ShaMaran – have started direct talks with Baghdad’s oil marketer SOMO in view of resuming production and selling it directly to the federal authorities.

Environmentalists Turn Against Driftwood LNG. The Sierra Club environmental group has urged the US energy regulator FERC to reject Tellurian’s request for a three-year extension to complete the construction of the $25 billion Driftwood LNG facility, citing emissions and contamination.

Nigeria Launches New Oil Grade. Buoyed by rebounding production across the country, Nigeria’s NNPC and Aiteo have launched a new grade called Nembe, previously fed into the Bonny Light stream through the frequently sabotaged Nembe Creek Trunk Line, eyeing European customers.

Chile Becomes New Battlefield for EV Dominance. Less than a month after China’s BYD presented its expansion into the Chilean market, US carmaker Tesla (NASDAQ:TSLA) has registered its subsidiary in the country and has been looking into direct-extraction lithium projects across the country.

Small Nuclear Reactor Pioneers Give Up the Ghost. The first US company with an approved design for a small-scale nuclear reactor NuScale Power (NYSE:SMR) has cancelled its Carbon Free Power Project in Idaho due to cost overruns and generation breakeven levels surging to almost $90 per MWh.

Weak Demand Drops Palladium Below Key Threshold. Faced with slower car sales and a structural shift towards cheaper platinum, palladium prices have fallen below the $1,000 per ounce mark for the first time in five years, currently at $972/oz, shedding a hefty 42% since the beginning of this year.

Suriname Offers New Offshore Acreage. The government of Suriname is preparing 11 blocks in the nearshore and shallow offshore areas of its territorial waters for a competitive bidding round, to be finalized by May 2024, as it seeks to build on the success of TotalEnergies’ (NYSE:TTE) big oil finds.

North American Homes Confront Power Shortages. As winter approaches, the North American Electric Reliability Corp warned that more than half of the US and parts of Canada, home to some 180 million people, could experience power shortages over the upcoming months due to a lack of gas infrastructure.

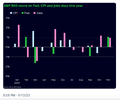

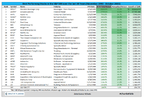

Pretty much all week parsing the TBAC, reasons were given why the Treasury could not sell long dated paper. And so it was.

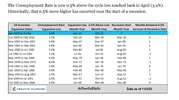

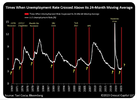

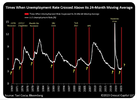

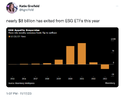

The unemployment chart has also been highlighted by Gundlach. The reason that it is so critical is that it drives deficits higher. I have heard calculations coming in at $7T deficit. A $7T deficit is incomprehensible. The USD is worthless.

Took a while, filled:

UNG (Natural Gas).

I'm a buyer at a 6-handle or less and a seller at a $7-handle or higher. Of course if it explodes higher over some macro event, I'll benefit. But the expectation is that it continues sideways for some considerable time in this range. Easy trading.

Longer term:

Looking ugly for the bulls. If technical support breaks, which I think it will, next technical stop the green line.

Plenty of fuel to move lower:

The internals are ugly.

jog on

duc

Battered by inventory build-ups, weaker-than-expected Chinese economic data, and slackening physical demand coming from skyrocketing freight costs, oil prices have struggled this week and ICE Brent is set for a $5 per barrel week-on-week drop, settling around the $80 per barrel mark. With sentiment shifting towards a much more bearish outlook, all eyes will be on OPEC+ which, after a protracted hiatus, meets again on November 26 in Vienna.

Saudi Arabia Blames Speculators, Again. Saudi Energy Minister Prince Abdulaziz bin Salman claimed the recent decline in oil prices is a “ploy” that hides the real strength of the oil markets, adding that speculators are abusing export figures as they fail to distinguish them from production numbers.

US Seeks to Derail Russia’s LNG Project. The US State Department has been seeking to sanction Russia’s new large-scale LNG project Arctic LNG-2 developed by Novatek, giving companies three months until the end of January 2024 to wind down transactions with the liquefaction plant.

Venezuela Welcomes Returning Investors. French upstream company Maurel & Prom agreed to return to Venezuela with its JV partner, the national oil company PDVSA, as it entered the ownership of the Urdaneta Oeste field back in 2018 only to halt operations when sanctions were introduced.

Mexico’s First LNG Cargoes Gets Delayed. The commissioning of Mexico’s first-ever LNG export plant developed by New Fortress Energy (NASDAQ:NFE) will be delayed to December due to delays in receiving the infrastructure, even though the gas pipeline from Texas is already running.

Brimming EU Gas Stocks Depress Prices. European TTF gas prices have been gradually sliding lower to €47 per MWh amidst record gas stocks across the continent, at 189 TWh up 20% compared to the 10-year seasonal average, with a warm autumn so far delaying the start of heating season.

Oil Producers in Kurdistan Moot Export Resumption. International oil producers active in Iraqi Kurdistan – DNO, Genel Energy, Gulf Keystone, or ShaMaran – have started direct talks with Baghdad’s oil marketer SOMO in view of resuming production and selling it directly to the federal authorities.

Environmentalists Turn Against Driftwood LNG. The Sierra Club environmental group has urged the US energy regulator FERC to reject Tellurian’s request for a three-year extension to complete the construction of the $25 billion Driftwood LNG facility, citing emissions and contamination.

Nigeria Launches New Oil Grade. Buoyed by rebounding production across the country, Nigeria’s NNPC and Aiteo have launched a new grade called Nembe, previously fed into the Bonny Light stream through the frequently sabotaged Nembe Creek Trunk Line, eyeing European customers.

Chile Becomes New Battlefield for EV Dominance. Less than a month after China’s BYD presented its expansion into the Chilean market, US carmaker Tesla (NASDAQ:TSLA) has registered its subsidiary in the country and has been looking into direct-extraction lithium projects across the country.

Small Nuclear Reactor Pioneers Give Up the Ghost. The first US company with an approved design for a small-scale nuclear reactor NuScale Power (NYSE:SMR) has cancelled its Carbon Free Power Project in Idaho due to cost overruns and generation breakeven levels surging to almost $90 per MWh.

Weak Demand Drops Palladium Below Key Threshold. Faced with slower car sales and a structural shift towards cheaper platinum, palladium prices have fallen below the $1,000 per ounce mark for the first time in five years, currently at $972/oz, shedding a hefty 42% since the beginning of this year.

Suriname Offers New Offshore Acreage. The government of Suriname is preparing 11 blocks in the nearshore and shallow offshore areas of its territorial waters for a competitive bidding round, to be finalized by May 2024, as it seeks to build on the success of TotalEnergies’ (NYSE:TTE) big oil finds.

North American Homes Confront Power Shortages. As winter approaches, the North American Electric Reliability Corp warned that more than half of the US and parts of Canada, home to some 180 million people, could experience power shortages over the upcoming months due to a lack of gas infrastructure.

Pretty much all week parsing the TBAC, reasons were given why the Treasury could not sell long dated paper. And so it was.

The unemployment chart has also been highlighted by Gundlach. The reason that it is so critical is that it drives deficits higher. I have heard calculations coming in at $7T deficit. A $7T deficit is incomprehensible. The USD is worthless.

Took a while, filled:

UNG (Natural Gas).

I'm a buyer at a 6-handle or less and a seller at a $7-handle or higher. Of course if it explodes higher over some macro event, I'll benefit. But the expectation is that it continues sideways for some considerable time in this range. Easy trading.

Longer term:

Looking ugly for the bulls. If technical support breaks, which I think it will, next technical stop the green line.

Plenty of fuel to move lower:

The internals are ugly.

jog on

duc

- Joined

- 13 February 2006

- Posts

- 5,428

- Reactions

- 12,693

Pretty quiet start to the week. However under the surface, trouble bubbles away.

Generally speaking spiking volatility means lower prices and higher yields.

Interestingly, Goldman Sachs are very optimistic: https://assets.realclear.com/files/2023/11/2293_goldman.pdf (attached below)

Goldman are famous for putting Goldman first, damn the secondary clients. This is so contrary to everything out there, I wonder.

Treasury has been trying to jawbone the USD lower. It is critical for the Treasury to have a lower USD to take the pressure off of the UST markets, which as the charts above demonstrate are having liquidity issues: lots of supply no demand.

A higher USD increases foreign selling of UST, particularly from Japan.

jog on

duc

Attachments

- Joined

- 13 February 2006

- Posts

- 5,428

- Reactions

- 12,693

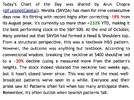

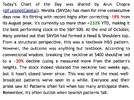

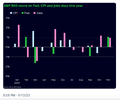

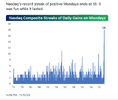

With the CPI unchanged and USD down big...stocks move higher. Inflation is over LOL.

What stocks are saying is that the Fed can now cut rates. Getting in fast ahead of the curve.

So:

After several months of upside surprises, markets were expecting more of the same. Instead, they got the biggest across the board CPI miss in a year, and indeed if one looks at the market reaction to the print it is shaping up as the biggest "positive surprise" response this year.

As shown in the chart below, the spike in stock futures in the first 30 minutes after the release was the largest reaction to a CPI print in 2023 based on data compiled using the Bloomberg’s Market Impact Monitor. For the dollar, this is the largest drop and absolute move since January while gold saw its biggest gain post CPI since July.

Why, if inflation is dead...is gold moving higher?

The largest driver of inflation is the growth of government debt, deficits and interest payments on that debt. True the Fed under the guise of 'falling CPI' can now start to rein in interest rates...or that's what the market believes.

The actual CPI numbers:

CPI Year-Over-Year Details

The market is cheering this data loudly, but other than the huge drop in energy, this was not a benign report.

Energy is in a bull market and only going higher.

... Bloomberg's Chris Antsey made a good point: "if the Fed does stay on hold in December, then by the January meeting, it will have been on hold for half a year. At that point, you would have to assume any move to raise rates again would be effectively a new cycle. Hard to see how they would think one 25 basis point increase would do the trick. We’d be in another cycle of tightening."

And we will be, just as soon as China panics and injects trillions into the economy to avoid a full-blown revolt, some time in late 2024 just in time to send commodities soaring to record levels ahead of the US election. Until then, however, it's time to enjoy the end of the current hiking cycle as the bulk of Wall Street reactions to today's CPI print suggest.

Below we excerpt the reactions to today's CPI from several traders, analysts and strategists.

Win Thin, global head of currency strategy at BBH:

Oil News:

Two weeks before the start of the COP28 summit in the United Arab Emirates, market watchers are bracing for tough talks as even the creation of a World Bank-led climate disaster fund turned out to be too difficult for participating states.

- In the Middle East itself, the energy transition is a distant dream as a mere 1% of power generation in Saudi Arabia, Qatar, or Oman comes from renewable sources. Even in the UAE the same metric stands at just 7%.

- Dependent on hydrocarbon revenue to fund their national budget, Middle Eastern nations would most probably lobby for the tripling of current renewable capacity by 2030, but would want to avoid any restrictive measures on oil investments and production.

- The UAE and Oman aim to reach net zero emissions by 2050; Bahrain, Kuwait, and Saudi Arabia by 2060 and Qatar has so far failed to put forward a net zero target of its own.

Market Movers

- Oklahoma-based drilling firm Mach Natural Resources (NYSE:MNR) said it would buy oil and gas assets in the Anadarko Basin producing 32,000 boepd from privately-held Paloma Partners for $815 million in cash.

- US storage and distribution firm Global Partners (NYSE:GLP) agreed to buy 25 fuel terminals from US refinery Motiva for $306 million, almost doubling the company’s storage capacity to 18.3 MMbbls.

- Canada’s midstream giant TC Energy (NYSE:TRP) said it is looking to spin off its assets in Mexico and Canada, ideally to form joint ventures with partners, as part of its $2.2 billion divestiture program.

Tuesday, November 14, 2023

A relatively upbeat OPEC monthly report was surprisingly backed up by the IEA’s oil demand growth hikes as the international agency lifted both its 2023 and 2024 annual numbers, arguing that a more palatable oil price will boost consumption next year. The prospect of tougher US enforcement of Russian price cap sanctions and potentially renewed SPR purchases helped push Brent past the $83 per barrel mark, despite market fundamentals remaining softer than throughout most of 2023.

OPEC Remains as Optimistic as Ever. Brushing aside fears of recession, OPEC reiterated its bullish view on oil demand growth in 2024 at 2.25 million b/d, only slightly lower than this year’s 2.46 million b/d, saying the market was exaggerating negative sentiments amidst robust demand.

Iraq to Resume Kurdish Oil Exports. Iraqi oil minister Hayan Abdel-Ghani announced that Baghdad reached an understanding with Turkey over the resumption of northern oil exports and expects to reach an agreement with the Kurdish authorities on restarting production over the upcoming days.

US Shale Production to Fall Further. The EIA’s Drilling Productivity Report sees US shale output decline to 9.652 million b/d in December, just a tad below its November forecast, as production is set to edge lower in the Anadarko, Appalachia and Eagle Ford basins.

LNG Prices Defy Seasonality, Trend Sideways. Europe and China are both set to record the highest LNG imports in months, however sufficient inventories combined with adequate supply have so far failed to lift liquefied gas prices into the winter, with JKM still hovering around $17 per mmBtu.

Exxon Aims for 2026 Lithium Start. In its inaugural lithium strategy presentation, US oil major ExxonMobil (NYSE:XOM) confirmed it plans to start production of EV-quality battery metal at its Arkansas "Project Evergreen” venture by 2027, testing direct lithium extraction technologies.

Chinese Major Takes Over Iraq’s Leading Field. Following years of disputes, the Iraqi government has signed a settlement agreement with ExxonMobil (NYSE:XOM) that would allow the US company to fully quit the West Qurna 1 oil field, with PetroChina (SHA:601857) becoming the project’s operator.

Chevron Restarts Key Israel Field. US oil major Chevron (NYSE:CVX) announced it had resumed production from Israel’s offshore Tamar field, a month after hostilities in Gaza prompted it to halt supply altogether, with Egypt and Jordan expected to see higher imports over the upcoming days.

Referendum Puts an End to Ecuador’s Oil Frontier. Ecuador’s national oil company Petroecuador announced it would shut down its 57,000 b/d upstream project in the Yasuni ecological reserve in the midst of the Amazon rainforest, following an August referendum on the issue.

Glencore Comes to the Rescue. Swiss-based international trader Glencore (LON:GLEN) provided Africa-focused driller Tullow Oil (LON:TLW) a $400 million five-year debt facility to help manage its 2026 maturity bonds, in return taking over the marketing of Tullow’s offshore Ghana oilfields.

China Keeps Copper Under Tight Control. The international clout of Chinese players in the copper market is increasing as China is increasing its copper smelting capacity by 45% by 2027, the majority of incremental smelting capacity globally, turning into a net exporter by the end of the decade.

Saudi Arabia Wants to Move into EV Batteries. Saudi Arabia’s Minister of Investment Khalid al-Falih stated that Riyadh is considering investments into the production of EV batteries and hydrogen-powered vehicles, seeking to become the regional carmaking powerhouse in the Middle East.

Pressure Mounts on Venture Global. European energy majors BP (NYSE:BP), Shell (LON:SHEL), or Edison (BIT:EDN) pressed the US-EU Task Force to intervene in Venture Global LNG’s failure to deliver cargoes into their term deals, as the Louisiana plant is still not fully operational due to faulty equipment.

White House Investigates Russian Oil Shippers. The US Treasury Department sent information requests to some 30 ship management companies about 100 oil tankers it suspects of violating Western sanctions on Russian crude exports, aiming to enforce the $60 per barrel oil price cap.

jog on

duc

What stocks are saying is that the Fed can now cut rates. Getting in fast ahead of the curve.

So:

After several months of upside surprises, markets were expecting more of the same. Instead, they got the biggest across the board CPI miss in a year, and indeed if one looks at the market reaction to the print it is shaping up as the biggest "positive surprise" response this year.

As shown in the chart below, the spike in stock futures in the first 30 minutes after the release was the largest reaction to a CPI print in 2023 based on data compiled using the Bloomberg’s Market Impact Monitor. For the dollar, this is the largest drop and absolute move since January while gold saw its biggest gain post CPI since July.

Why, if inflation is dead...is gold moving higher?

The largest driver of inflation is the growth of government debt, deficits and interest payments on that debt. True the Fed under the guise of 'falling CPI' can now start to rein in interest rates...or that's what the market believes.

The actual CPI numbers:

CPI Year-Over-Year Details

- Over the last 12 months, the all items index increased 3.2 percent before seasonal adjustment. The all items index rose 3.2 percent for the 12 months ending October, a smaller increase than the 3.7- percent increase for the 12 months ending September.

- The all items less food and energy index rose 4.0 percent over the last 12 months, its smallest 12-month change since the period ending in September 2021.

- The energy index decreased 4.5 percent for the 12 months ending October, and the food index increased 3.3 percent over the last year.

The market is cheering this data loudly, but other than the huge drop in energy, this was not a benign report.

Energy is in a bull market and only going higher.

... Bloomberg's Chris Antsey made a good point: "if the Fed does stay on hold in December, then by the January meeting, it will have been on hold for half a year. At that point, you would have to assume any move to raise rates again would be effectively a new cycle. Hard to see how they would think one 25 basis point increase would do the trick. We’d be in another cycle of tightening."

And we will be, just as soon as China panics and injects trillions into the economy to avoid a full-blown revolt, some time in late 2024 just in time to send commodities soaring to record levels ahead of the US election. Until then, however, it's time to enjoy the end of the current hiking cycle as the bulk of Wall Street reactions to today's CPI print suggest.

Below we excerpt the reactions to today's CPI from several traders, analysts and strategists.

Win Thin, global head of currency strategy at BBH:

Ian Lyngen of BMO Capital Markets:“I’m not hanging up the ‘Mission Accomplished’ banner just yet. Transportation was a big downside factor (-0.9% m/m). However, food and beverages (0.3%), housing (0.3%), and services (0.3%) are still showing solid gains. 4 cuts by end-2024? Again, ain’t happening. The market sees what it wants to see. It’s been wrong on the Fed this entire cycle.”

Anna Wong of Bloomberg Economics:“This print was good news for the Fed and offers evidence that monetary policy is still effective and impacts the real economy with a lag -- the fundamental things apparently still apply. This takes a rate hike off the table in December and reinforces our call that July was the last hike of the cycle and the process will now shift to the Fed attempting to delay cuts as long as possible.”

Greg McBride, Chief Financial Analyst at Bankrate“October’s surprisingly soft core CPI reading will increase Fed officials’ confidence that rates are sufficiently restrictive. Still, core CPI readings will need to continue on this path for several more months for the FOMC to declare a definitive end to the rate-hike cycle. Looking at the 12-month change in core inflation, it’s still running at twice the pace of the Fed’s 2% target. Overall, inflation is still a long way from the target — and the road there is sure to be bumpy.”

Jay Bryson, Wells Fargo chief economist:“The slower pace of inflation is little comfort to households still dealing with the cumulative effect of rising prices. The strain on household budgets is real with the Consumer Price Index up more than 18% in the past 3 years.”

Bryce Doty, of Sit Investment Associates:“You would need to see a few more months of 0.2 before saying mission accomplished. I think the Fed is going to delay easing at this point.”

Kathy Jones of Charles Schwab:“The Fed looks smart for effectively ending their tightening cycle as inflation continues to slow. Yields are down significantly as the last of investors not convinced the Fed is done are likely throwing in the towel.”

Oscar Munoz, macro strategist at TD Securities“Things are going their way and they probably don’t want to change policy until there is more confidence in the inflation outlook. I think the Fed sticks with it’s on-hold policy until they get a series of low month to month readings over a period of 3 to 6 months and/or the labor market shows a lot more weakness.”

Stuart Paul, of Bloomberg Economics“Core goods still in deflation, that was a surprise for us. We were looking for strength there. New vehicles prices and apparel were surprises to the downside for us. The OER decline was expected, though rents continue to move sideways (some concern there). Lodging away from home was a driver of inflation in Sep, it mean-reverted today. All told, good report for the Fed. They will continue to maintain the odds of another hike on the table, but the market won’t buy it. Higher for longer will be the message Fed officials will try to convey.”

Spencer Hakimian, CEO of Tolou Capital Management:“Lodging away from home again served as a critical swing factor. Whereas a surge in lodging prices boosted shelter costs in the September report, the 2.5% month-on-month decline in October created approximately 3 bps of drag and explains much of the downside surprise in inflation. Measures of homeowners’ equivalent of rent moderated to 0.4% in October from 0.6% in September, creating additional disinflation in reported shelter costs.”

Victor Masotti, Director at Clear Street:“The cumulative effect of 525 basis points of tightening, along with QT, are evidently working. The FOMC must exercise patience and allow last year’s tightening fully flow through the economy. Two-year Treasuries are poised for significantly attractive risk-adjusted returns, due to market pricing for rate cuts as well as a nearly 5.00% yield.”

“Softer than expected CPI data has traders repricing probabilities for the FOMC’s next move as today’s inflation reading supports the view that rates have peaked and the FOMC will need to begin easing sooner rather than later. At close of business yesterday, December FOMC rate hike probabilities were at 15%, while we are now at 0% chance of a hike after CPI YoY came in at 3.2% versus expectations of 3.3% and last month’s print at 3.7%. The narrative has now shifted towards 2024 as to when the first rate cut will come with the market pricing in a 75% chance of a cut in May 2024 and pricing in more than one 25bp rate cut in June 2024. In repo pricing, we have seen 2 and 3mo term repo tighten 2-3bps from last week’s prints. As for year-end funding, general collateral year-end turn (12/29/23 – 01/02/24) has been printing in the 5.60 range.”

Oil News:

Two weeks before the start of the COP28 summit in the United Arab Emirates, market watchers are bracing for tough talks as even the creation of a World Bank-led climate disaster fund turned out to be too difficult for participating states.

- In the Middle East itself, the energy transition is a distant dream as a mere 1% of power generation in Saudi Arabia, Qatar, or Oman comes from renewable sources. Even in the UAE the same metric stands at just 7%.

- Dependent on hydrocarbon revenue to fund their national budget, Middle Eastern nations would most probably lobby for the tripling of current renewable capacity by 2030, but would want to avoid any restrictive measures on oil investments and production.

- The UAE and Oman aim to reach net zero emissions by 2050; Bahrain, Kuwait, and Saudi Arabia by 2060 and Qatar has so far failed to put forward a net zero target of its own.

Market Movers

- Oklahoma-based drilling firm Mach Natural Resources (NYSE:MNR) said it would buy oil and gas assets in the Anadarko Basin producing 32,000 boepd from privately-held Paloma Partners for $815 million in cash.

- US storage and distribution firm Global Partners (NYSE:GLP) agreed to buy 25 fuel terminals from US refinery Motiva for $306 million, almost doubling the company’s storage capacity to 18.3 MMbbls.

- Canada’s midstream giant TC Energy (NYSE:TRP) said it is looking to spin off its assets in Mexico and Canada, ideally to form joint ventures with partners, as part of its $2.2 billion divestiture program.

Tuesday, November 14, 2023

A relatively upbeat OPEC monthly report was surprisingly backed up by the IEA’s oil demand growth hikes as the international agency lifted both its 2023 and 2024 annual numbers, arguing that a more palatable oil price will boost consumption next year. The prospect of tougher US enforcement of Russian price cap sanctions and potentially renewed SPR purchases helped push Brent past the $83 per barrel mark, despite market fundamentals remaining softer than throughout most of 2023.

OPEC Remains as Optimistic as Ever. Brushing aside fears of recession, OPEC reiterated its bullish view on oil demand growth in 2024 at 2.25 million b/d, only slightly lower than this year’s 2.46 million b/d, saying the market was exaggerating negative sentiments amidst robust demand.

Iraq to Resume Kurdish Oil Exports. Iraqi oil minister Hayan Abdel-Ghani announced that Baghdad reached an understanding with Turkey over the resumption of northern oil exports and expects to reach an agreement with the Kurdish authorities on restarting production over the upcoming days.

US Shale Production to Fall Further. The EIA’s Drilling Productivity Report sees US shale output decline to 9.652 million b/d in December, just a tad below its November forecast, as production is set to edge lower in the Anadarko, Appalachia and Eagle Ford basins.

LNG Prices Defy Seasonality, Trend Sideways. Europe and China are both set to record the highest LNG imports in months, however sufficient inventories combined with adequate supply have so far failed to lift liquefied gas prices into the winter, with JKM still hovering around $17 per mmBtu.

Exxon Aims for 2026 Lithium Start. In its inaugural lithium strategy presentation, US oil major ExxonMobil (NYSE:XOM) confirmed it plans to start production of EV-quality battery metal at its Arkansas "Project Evergreen” venture by 2027, testing direct lithium extraction technologies.

Chinese Major Takes Over Iraq’s Leading Field. Following years of disputes, the Iraqi government has signed a settlement agreement with ExxonMobil (NYSE:XOM) that would allow the US company to fully quit the West Qurna 1 oil field, with PetroChina (SHA:601857) becoming the project’s operator.

Chevron Restarts Key Israel Field. US oil major Chevron (NYSE:CVX) announced it had resumed production from Israel’s offshore Tamar field, a month after hostilities in Gaza prompted it to halt supply altogether, with Egypt and Jordan expected to see higher imports over the upcoming days.

Referendum Puts an End to Ecuador’s Oil Frontier. Ecuador’s national oil company Petroecuador announced it would shut down its 57,000 b/d upstream project in the Yasuni ecological reserve in the midst of the Amazon rainforest, following an August referendum on the issue.

Glencore Comes to the Rescue. Swiss-based international trader Glencore (LON:GLEN) provided Africa-focused driller Tullow Oil (LON:TLW) a $400 million five-year debt facility to help manage its 2026 maturity bonds, in return taking over the marketing of Tullow’s offshore Ghana oilfields.

China Keeps Copper Under Tight Control. The international clout of Chinese players in the copper market is increasing as China is increasing its copper smelting capacity by 45% by 2027, the majority of incremental smelting capacity globally, turning into a net exporter by the end of the decade.

Saudi Arabia Wants to Move into EV Batteries. Saudi Arabia’s Minister of Investment Khalid al-Falih stated that Riyadh is considering investments into the production of EV batteries and hydrogen-powered vehicles, seeking to become the regional carmaking powerhouse in the Middle East.

Pressure Mounts on Venture Global. European energy majors BP (NYSE:BP), Shell (LON:SHEL), or Edison (BIT:EDN) pressed the US-EU Task Force to intervene in Venture Global LNG’s failure to deliver cargoes into their term deals, as the Louisiana plant is still not fully operational due to faulty equipment.

White House Investigates Russian Oil Shippers. The US Treasury Department sent information requests to some 30 ship management companies about 100 oil tankers it suspects of violating Western sanctions on Russian crude exports, aiming to enforce the $60 per barrel oil price cap.

jog on

duc

- Joined

- 13 February 2006

- Posts

- 5,428

- Reactions

- 12,693

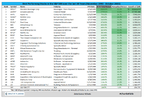

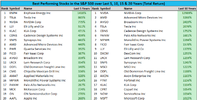

Starting with some commentary from Mr fff:

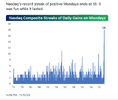

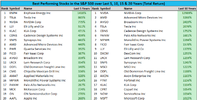

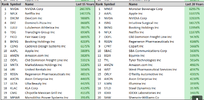

From Bespoke:

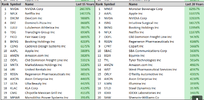

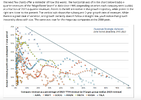

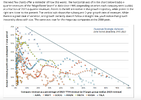

While there's no publicly available real-time data that tells us specifically when shorts are covering their bearish positions, we can try to discern the prevalence of short covering during a rally by looking at the performance of the most heavily shorted stocks versus the least heavily shorted ones.

Yesterday was a huge day for the US stock market following inflation data that came in lighter than expected. Large-cap US index ETFs rallied roughly 2%, while the small-cap Russell 2,000 rallied more than 5%.

So how much of yesterday's rally was due to short covering versus new buyers stepping in? We broke the S&P 500 into deciles (10 groups of 50 stocks each) based on the percentage of each stock's shares that are sold short. (Short interest figures get published by stock exchanges twice per month.) As shown in the snapshot below from last night's Closer, the higher the short interest, the better the performance yesterday. Notably, the decile containing the least shorted stocks in the S&P 500 (the 50 stocks with the lowest short interest as a % of float) gained an average of just 1.42% yesterday, while the decile containing the 50 most heavily shorted stocks saw an average gain of more than 5%.

As you can see in the snapshot, along with short interest, we look at a number of other stock characteristics when running our decile analysis, which helps us identify what's working and not working during big market moves (to both the upside and downside).

As suggested a while back, the USD needed to be weakened. This is the second time this year that the Treasury has managed with the help of other foreign central banks to force the USD lower. A lower USD means less selling of UST by Japan, China, Europe for primarily energy.

The thing is, energy is going higher. Much higher.

With a weaker USD and higher energy, inflation moves higher. Oh, of course, CPI data favoured by the Fed excludes energy.

In any case, the 'inflation' excuse from the Fed has nothing to do with high rates. The US is fighting a currency war with China. Go back to Soros and his theory of the US Imperial Circle and the USD. That is the playbook the US is trying to run. Problem is instead of a debt/gdp ratio of 38% as it was with Reagan, today it is 120% and growing fast.

The US is in the same position as the Asian Tigers in 1997/98. It has (the US) all the characteristics of an emerging market. As such, it is doomed to the same outcome as the Asian Tigers.

The creation of stable macroeconomic environments was the foundation upon which the Asian miracle was built. Each of the Four Asian Tiger states managed, to various degrees of success, three variables in: budget deficits, external debt and exchange rates. Each Tiger nation's budget deficits were kept within the limits of their financial limits, as to not destabilize the macro-economy. South Korea in particular had deficits lower than the OECD average in the 1980s. External debt was non-existent for Hong Kong, Singapore and Taiwan, as they did not borrow from abroad.[8] Although South Korea was the exception to this – its debt to GNP ratio was quite high during the period 1980–1985, it was sustained by the country's high level of exports. Exchange rates in the Four Asian Tiger nations had been changed from long-term fixed rate regimes to fixed-but-adjustable rate regimes with the occasional steep devaluation of managed floating rate regimes.[8] This active exchange rate management allowed the Four Tiger economies to avoid exchange rate appreciation and maintain a stable real exchange rate.

The Tiger economies experienced a setback in the 1997 Asian financial crisis. Hong Kong came under intense speculative attacks against its stock market and currency necessitating unprecedented market interventions by the state Hong Kong Monetary Authority. South Korea was hit the hardest as its foreign debt burdens swelled resulting in its currency falling between 35 and 50%.[14] By the beginning of 1997, the stock market in Hong Kong, Singapore, and South Korea also saw losses of at least 60% in dollar terms. Singapore and Taiwan were relatively unscathed. The Four Asian Tigers recovered from the 1997 crisis faster than other countries due to various economic advantages including their high savings rate (except South Korea) and their openness to trade.

Then we have idiots like this:

investorplace.com

investorplace.com

The thing with bear markets is that their hallmark are rip-your-face-off bull rallies. Which we are in the middle of currently.

As the issue is not actually inflation at all, rather a currency war with China, will the Fed be lowering interest rates in response to CPI data in any case? Unlikely. The higher for longer will be for longer than the market is currently pricing.

Be careful what you wish for. Lower rates will reignite inflation to a significant degree. Look again at the markets between 1969-1976. Huge volatility. If you are a good trader, you'll love it. If not, then a period of pain and losses will be coming your way.

jog on

duc

From Bespoke:

While there's no publicly available real-time data that tells us specifically when shorts are covering their bearish positions, we can try to discern the prevalence of short covering during a rally by looking at the performance of the most heavily shorted stocks versus the least heavily shorted ones.

Yesterday was a huge day for the US stock market following inflation data that came in lighter than expected. Large-cap US index ETFs rallied roughly 2%, while the small-cap Russell 2,000 rallied more than 5%.

So how much of yesterday's rally was due to short covering versus new buyers stepping in? We broke the S&P 500 into deciles (10 groups of 50 stocks each) based on the percentage of each stock's shares that are sold short. (Short interest figures get published by stock exchanges twice per month.) As shown in the snapshot below from last night's Closer, the higher the short interest, the better the performance yesterday. Notably, the decile containing the least shorted stocks in the S&P 500 (the 50 stocks with the lowest short interest as a % of float) gained an average of just 1.42% yesterday, while the decile containing the 50 most heavily shorted stocks saw an average gain of more than 5%.

As you can see in the snapshot, along with short interest, we look at a number of other stock characteristics when running our decile analysis, which helps us identify what's working and not working during big market moves (to both the upside and downside).

As suggested a while back, the USD needed to be weakened. This is the second time this year that the Treasury has managed with the help of other foreign central banks to force the USD lower. A lower USD means less selling of UST by Japan, China, Europe for primarily energy.

The thing is, energy is going higher. Much higher.

With a weaker USD and higher energy, inflation moves higher. Oh, of course, CPI data favoured by the Fed excludes energy.

In any case, the 'inflation' excuse from the Fed has nothing to do with high rates. The US is fighting a currency war with China. Go back to Soros and his theory of the US Imperial Circle and the USD. That is the playbook the US is trying to run. Problem is instead of a debt/gdp ratio of 38% as it was with Reagan, today it is 120% and growing fast.

The US is in the same position as the Asian Tigers in 1997/98. It has (the US) all the characteristics of an emerging market. As such, it is doomed to the same outcome as the Asian Tigers.

The creation of stable macroeconomic environments was the foundation upon which the Asian miracle was built. Each of the Four Asian Tiger states managed, to various degrees of success, three variables in: budget deficits, external debt and exchange rates. Each Tiger nation's budget deficits were kept within the limits of their financial limits, as to not destabilize the macro-economy. South Korea in particular had deficits lower than the OECD average in the 1980s. External debt was non-existent for Hong Kong, Singapore and Taiwan, as they did not borrow from abroad.[8] Although South Korea was the exception to this – its debt to GNP ratio was quite high during the period 1980–1985, it was sustained by the country's high level of exports. Exchange rates in the Four Asian Tiger nations had been changed from long-term fixed rate regimes to fixed-but-adjustable rate regimes with the occasional steep devaluation of managed floating rate regimes.[8] This active exchange rate management allowed the Four Tiger economies to avoid exchange rate appreciation and maintain a stable real exchange rate.

The Tiger economies experienced a setback in the 1997 Asian financial crisis. Hong Kong came under intense speculative attacks against its stock market and currency necessitating unprecedented market interventions by the state Hong Kong Monetary Authority. South Korea was hit the hardest as its foreign debt burdens swelled resulting in its currency falling between 35 and 50%.[14] By the beginning of 1997, the stock market in Hong Kong, Singapore, and South Korea also saw losses of at least 60% in dollar terms. Singapore and Taiwan were relatively unscathed. The Four Asian Tigers recovered from the 1997 crisis faster than other countries due to various economic advantages including their high savings rate (except South Korea) and their openness to trade.

Then we have idiots like this:

Soft Inflation Data Confirms a Powerful Rally Ahead

At its current pace, the overall U.S. inflation rate will hit 2% within four months. And that, of course, is very bullish for stocks.

investorplace.com

investorplace.com

The thing with bear markets is that their hallmark are rip-your-face-off bull rallies. Which we are in the middle of currently.

As the issue is not actually inflation at all, rather a currency war with China, will the Fed be lowering interest rates in response to CPI data in any case? Unlikely. The higher for longer will be for longer than the market is currently pricing.

Be careful what you wish for. Lower rates will reignite inflation to a significant degree. Look again at the markets between 1969-1976. Huge volatility. If you are a good trader, you'll love it. If not, then a period of pain and losses will be coming your way.

jog on

duc

- Joined

- 13 February 2006

- Posts

- 5,428

- Reactions

- 12,693

- Joined

- 13 February 2006

- Posts

- 5,428

- Reactions

- 12,693

Oil News:

Friday, November 17th, 2023

Oil prices declined to their lowest level since July this week, with WTI falling to $73 per barrel on its way toward a fourth consecutive weekly loss. With a combination of weak economic data from the US where the labor market seems to finally be cooling off and CTA trading patterns that aggravated the downward spiral, WTI has shed its previous levels of steep backwardation and is now in contango in the prompt months. Despite the negative sentiment, oil prices did begin to bounce back slightly on Friday morning, with Brent rising to $78.50 and WTI trading at $73.86.

Metal Contamination Triggers WTI Testing. US midstream firms and export terminal operators have been stepping up quality checks on WTI cargoes they export following several cases of vanadium and iron contamination, seeking to placate buyers wary of refinery damage due to excess metals.

Glencore Still “Horny as Hell” for Coal. An international consortium led by trading major Glencore (LON:GLEN), comprising Japan’s Nippon Steel and South Korea’s POSCO, clinched the purchase of Teck Resources’ coking coal business for $9 billion, ending one of the most intriguing M&A sagas of 2023.

Nigeria Drops $1.1 Billion Eni Case. Nigeria’s Justice Ministry decided to waive a batch of civil claims totaling $1.1 billion against Italian oil major ENI (BIT:ENI) “unconditionally” and “with immediate effect” over alleged corruption cases regarding the OPL 245 field, improving upstream prospects.

Chevron to Shed Haynesville Acreage. US oil major Chevron (NYSE:CVX) is reportedly evaluating options for some of its 70,000 net acres of Haynesville shale acreage in East Texas, with a full sale remaining a possible option, a first step in the firm’s $15 billion divestment program on the back of the Hess deal.

Environmentalists Turn Against TotalEnergies, Again. A group of more than 100 environmental organizations spearheaded by Greenpeace and ActionAid called on banks and financial institutions to half the funding of the Mozambique LNG project led by French energy major TotalEnergies (NYSE:TTE).

US Promises to Bring Down Iran Exports. The US President’s energy adviser Amos Hochstein vowed to enforce tighter sanctions on Iran as the Middle Eastern country’s exports have soared above the 1 million b/d mark this year, rejecting the notion that the Biden Administration relaxed its sanctions.

Port Arthur LNG Gets in Trouble. The US Court of Appeals for the Fifth Circuit ruled that the Texas Commission on Environmental Quality didn’t impose the same emission limits on Sempra Energy’s (NYSE:SRE) Port Arthur liquefaction plants as on other projects, halting the construction of the site.

Libya Blocks Oil Tanker. Libya has prevented the crude tanker Proteus Philippa - which recently called at Israel’s port of Haifa - from loading a cargo as Tripoli does not recognize Israel and seems to be stepping up pressure on the shipping market in the Mediterranean amidst the ongoing Israeli-Palestinian conflict.

Venezuela Resuscitates Lost Grades. Venezuela’s state oil company PDVSA has been offering a 1-million-barrel cargo of Corocoro, a grade that has been out of the market since 2021 as production at the shallow water project shrank to an absolute minimum but is now slowly coming back to life.

China Calls on Coal Miners to Do More. As China’s coal production dropped 1% from September to 388.8 million tonnes in October, the National Reform and Development Commission prompted coal companies to strengthen coal production monitoring and ramp up total output.

Ghana Seeks to Sweeten the Deal for Drillers. The government of Ghana aims to introduce a more flexible mechanism of royalties to incentivize investment into its offshore oil production, currently at 160,000 b/d, even though the current royalty regime is a fixed 4%-12.5% of gross oil production.

California Cuts Solar Subsidies. California regulators cut fiscal incentives for schools, apartments, and farmers to install rooftop solar panels, the second time already in 2023, amidst a notable decline in solar installations this year as sales have sagged by 80% compared to last year’s record.

ExxonMobil to Double Down on Indonesia. According to Indonesia’s President Joko Widodo, US oil major ExxonMobil (NYSE:XOM) is set to invest up to $15 billion in a petrochemical plant and a carbon capture and storage project in Indonesia, targeting two underground basins in the Java Sea.

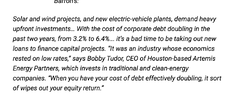

Returning to the $3T in Corporate debt:

(a) Unless the USD revalues lower, the sheer volume of UST issue will push corporate yields (much) higher. That is (obviously) a major problem

(b) Which will investors prefer to hold: (i) high quality asset backed corporate bonds or (ii) unbacked UST? If the preference is (i) then they will trade at a premium (less downside protection)

(c) If (b)(i) then this will accelerate the liquidity issues in the UST market.

Weak Companies’ Low-Yielding Bonds Set to Hit Maturity Wall | Chief Investment Officer

Risk grows as a raft of junk-rated issuers, paying modest interest, must refinance their debt at much higher rates.

For the moment (see above chart) the USD seems to have found a short term low: Another chart (seasonality) suggests USD will fall further. Whatever the answer is, it is a very important outcome to stocks going forward.

The UST 10yr would seem to suggest? With yields falling, it suggests USD weakness. Both of these outcomes the Treasury desperately wants and needs.

The fly in the ointment:

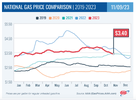

Oil and energy moving higher? Likely, particularly if USD weakens and yields fall.

Which means that inflation is kicked higher. Although the Fed ignore energy, energy impacts almost everything. Energy is the baseline or fundamental currency.

Goldman: https://www.businessinsider.com/rip-goldman-sachs-wall-street-investment-bank-dead-2023-11

Last word to Mr fff:

jog on

duc

- Joined

- 13 February 2006

- Posts

- 5,428

- Reactions

- 12,693

New week:

www.zerohedge.com

www.zerohedge.com

www.zerohedge.com

www.zerohedge.com

www.zerohedge.com

www.zerohedge.com

The best story always wins.

Not the best idea. Not the right idea. Not the facts. Not the rational. Stories are always more powerful, compelling, persuasive than are statistics.

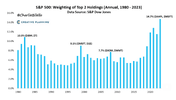

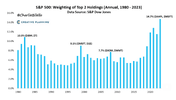

History in the markets always repeats. The current comeback is the Nifty Fifty will protect you. This time it is the Magnificent Seven. In that film (correct me if I'm wrong) didn't they all die save for 1?

The market is priced for a soft landing. At this rate, it will be priced for no landing at all and simply a takeoff back into new heights, having been re-fueled in mid-air.

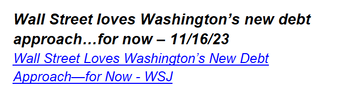

So back to Bonds:

Recently, though, high interest rates have driven investors to eschew longer-term Treasurys. The government has had to adapt, cutting back this month on expected increases in long-term bonds and favoring more short-term debt.

The change, while relatively modest, is a sign that the Treasury is trying to manage the market reaction to U.S. debt as the deficit grows. That has pleasantly surprised investors, sparking a rally in Treasurys that extended this week following a cooler-than-expected inflation reading.

Still, most primary dealers—financial institutions that are required to bid at Treasury debt auctions and are surveyed by the Treasury ahead of refundings—said they thought the U.S. would hew to its August template in its typical “regular and predictable” fashion. A private-sector group that advises the Treasury on its borrowing decisions recommended that it increase auctions by the same amount as in August for all but the 20-year bond.

Treasury defied those expectations. It boosted auctions of two-year to seven-year notes by the same amount as in August, but it increased 10-year and 30-year debt auctions by $1 billion less than in August. It didn’t change the size of 20-year bond auctions, after lifting them by $1 billion three months earlier.

Officials also confirmed Wall Street forecasts that they would let short-term Treasury bills exceed an informal threshold of 20% of total outstanding debt, adding that there was no set time frame for when they would drop below that level.

So with Funds overweighting Bonds at the LONG END, what is being said is: we believe that a recession is on the way and when the Fed pivots (which it has to do or let the Bond market die) long end duration will soar (again).

The only problem with that is: in a recession deficits increase. It is postulated that this recession might move to 12% of GDP, which means another $2.5T or so needing to be financed. We are up in the $5T - $7T deficit range needing to be financed. That does not even consider corporate debt requiring refinancing.

Now I have run out of the ability to load any more charts today, so the other issues will be addressed as we move through the week.

jog on

duc

The White House Does Not Expect Arab States To Weaponize Oil | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

Pictorial: Global Reserve Currency Empires | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

Dutch Central Bank Admits It Has Prepared For A New Gold Standard | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

The best story always wins.

Not the best idea. Not the right idea. Not the facts. Not the rational. Stories are always more powerful, compelling, persuasive than are statistics.

History in the markets always repeats. The current comeback is the Nifty Fifty will protect you. This time it is the Magnificent Seven. In that film (correct me if I'm wrong) didn't they all die save for 1?

The market is priced for a soft landing. At this rate, it will be priced for no landing at all and simply a takeoff back into new heights, having been re-fueled in mid-air.

So back to Bonds:

Recently, though, high interest rates have driven investors to eschew longer-term Treasurys. The government has had to adapt, cutting back this month on expected increases in long-term bonds and favoring more short-term debt.

The change, while relatively modest, is a sign that the Treasury is trying to manage the market reaction to U.S. debt as the deficit grows. That has pleasantly surprised investors, sparking a rally in Treasurys that extended this week following a cooler-than-expected inflation reading.

Still, most primary dealers—financial institutions that are required to bid at Treasury debt auctions and are surveyed by the Treasury ahead of refundings—said they thought the U.S. would hew to its August template in its typical “regular and predictable” fashion. A private-sector group that advises the Treasury on its borrowing decisions recommended that it increase auctions by the same amount as in August for all but the 20-year bond.

Treasury defied those expectations. It boosted auctions of two-year to seven-year notes by the same amount as in August, but it increased 10-year and 30-year debt auctions by $1 billion less than in August. It didn’t change the size of 20-year bond auctions, after lifting them by $1 billion three months earlier.

Officials also confirmed Wall Street forecasts that they would let short-term Treasury bills exceed an informal threshold of 20% of total outstanding debt, adding that there was no set time frame for when they would drop below that level.

So with Funds overweighting Bonds at the LONG END, what is being said is: we believe that a recession is on the way and when the Fed pivots (which it has to do or let the Bond market die) long end duration will soar (again).

The only problem with that is: in a recession deficits increase. It is postulated that this recession might move to 12% of GDP, which means another $2.5T or so needing to be financed. We are up in the $5T - $7T deficit range needing to be financed. That does not even consider corporate debt requiring refinancing.

Now I have run out of the ability to load any more charts today, so the other issues will be addressed as we move through the week.

jog on

duc

- Joined

- 13 February 2006

- Posts

- 5,428

- Reactions

- 12,693

Oil News:

As OPEC+ prepares for its meeting on November 26, African producers are tacitly lamenting the oil group’s recalibration of 2024 production targets that will curb the maximum amount Nigeria or Angola can produce.