- Joined

- 13 February 2006

- Posts

- 5,427

- Reactions

- 12,692

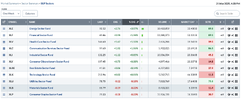

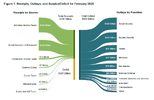

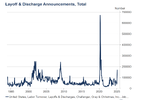

Treasury Secretary Scott Bessent and other Trump administration officials argue that the U.S. job market has been overdependent on government and "government-adjacent" fields, making the economy they inherited weaker than it would appear at first glance.

Two months into his term, President Trump is growing more defiant, creative and ruthless in his pursuit of a central campaign promise: exacting revenge on his political enemies, Axios' Zachary Basu writes.

The big picture: In the final days of the 2024 campaign, Axios identified a list of perceived adversaries who fit what Trump ominously described as "the enemies from within."

The big picture: In the final days of the 2024 campaign, Axios identified a list of perceived adversaries who fit what Trump ominously described as "the enemies from within."

The Biden administration: Trump has revoked security clearances from former President Biden, Secretary of State Tony Blinken, National Security Adviser Jake Sullivan and Deputy Attorney General Lisa Monaco.

The Biden administration: Trump has revoked security clearances from former President Biden, Secretary of State Tony Blinken, National Security Adviser Jake Sullivan and Deputy Attorney General Lisa Monaco.

White House Correspondents' Association: The White House took control of the daily makeup of its press pool from WHCA.

White House Correspondents' Association: The White House took control of the daily makeup of its press pool from WHCA.

Prosecutors: He fired and demoted federal prosecutors and FBI officials involved in the investigation of the Jan. 6 riot, while pardoning thousands of his supporters who were convicted for breaking into the Capitol.

Prosecutors: He fired and demoted federal prosecutors and FBI officials involved in the investigation of the Jan. 6 riot, while pardoning thousands of his supporters who were convicted for breaking into the Capitol.

Big Law: At the start of an extraordinary campaign against private practice law firms, Trump revoked the security clearances of lawyers at Covington & Burling who offered pro bono legal advice to former special counsel Jack Smith.

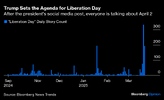

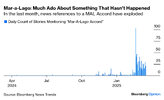

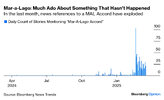

It can be difficult to remember that the Mar-a-Lago Accord hasn’t happened yet. Leaders haven’t been convened to Palm Beach, and there’s no agenda for what such an accord could include. But that hasn’t stopped people talking or journalists writing about it. This shows the total number of stories (from all sources) mentioning a “Mar-a-Lago Accord” each day on the Bloomberg terminal for the last year:

But what is it, and can it really happen? There are huge variations, but the common themes seem to be that an accord would be an international agreement designed to:

These are wholly reasonable aims, for which the administration has a mandate. It’s not clear that they’re achievable, or that other countries have any reason to go along with them. Adam Tooze of Columbia University describes the idea as “on its face a far-fetched policy proposal” in which it’s easy to pick holes. He suggests that the notion is only taken seriously because “we are all struggling to find some kind of rational purchase on the unhinged situation created by the Trump administration.” These are strong words, but the retreat of stocks in the last few weeks is in large part driven by investors coming around to his point of view.

So how does the US propose to make this happen? Various possibilities include:

That’s because, first, the US dollar isn’t as massively overvalued as it was at the time of the 1985 Plaza Accord (struck at a New York hotel that subsequently belonged to Trump for a while), which is the model for an international agreement to weaken the dollar. That makes it harder to bring down in a significant way. On a real trade-weighted basis, the currency is certainly very expensive, but not as extreme as 40 years ago, according to the Fed’s own index:

Further, Plaza involved only the biggest countries in the then-developed capitalist world. The globe has since gotten bigger, making it far harder to find a deal that everyone can live with. While Plaza worked for the US, it wasn’t so great for Japan, which entered a long-lasting slump a few years later. That won’t be lost on those who would stand to lose from a weaker dollar, such as China.

Tiffany Wilding, economist at Pimco, also points to the growth of foreign exchange markets since Plaza:

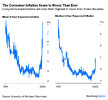

Another problem is inflation. Globalization over time minimized it; and public tolerance for rising prices, we’ve learned in the last four years, is non-existent. Further, the concern is less inflation — slowing the rate at which prices are rising — as much as the price level. There’s a case that tariffs don’t create inflation, and the debate has already entangled the Fed’s Jerome Powell. It’s impossible to deny that they create a one-off rise in the price level. Using tariffs to create leverage, or as a source of revenue, is not the simple call it appears. It might hurt US counterparties more, but it will create much political pain at home.

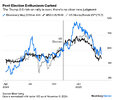

Marko Papic of BCA Research points to a range of polls showing that voters care deeply about prices, while trade doesn’t matter to them. The political difficulty created by a spike in prices after Trump levied tariffs would be hard for the administration to navigate:

The greatest problem for any deal is getting others to agree. This is where the US may have already overplayed its hand. One widely circulating version of a MAL Accord had Europe agreeing to rearm by buying US weapons, in return for avoiding tariffs. But Trump 2.0 has shown itself so willing to withdraw from the Atlantic alliance that now even Germany’s once-staunchly Atlanticist new chancellor says the country needs “independence” from the US. European, not American, arms manufacturers are benefiting. The first act of Canada’s new prime minister has been to discuss defense with European leaders. Rather than accede to US demands, the international response so far has been to look for alternatives. This is understandable, as it grows ever more politically unpalatable for foreign leaders to rely on the US — and a range of countries now appear to be planning their own nuclear deterrents, which makes the security umbrella less important still.

Finally, Trump’s very unpredictability increases his leverage, but also tends to deter people from feeling confident in reaching an agreement with him. Former mentor and colleague Martin Wolf put it this way in the Financial Times:

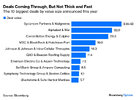

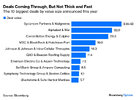

Google’s $32 billion deal to buy the Israeli startup Wiz Inc. this week was an instant head-turner. It’s among the biggest deals so far under a new administration expected to turbocharge dealmaking. It was also about time, as the expected surge hasn’t materialized. Two months into Trump’s second term, the value of announced mergers and acquisitions involving US companies stands at about $387 billion. That’s basically flat, down roughly 2% compared to this point in 2024:

A recent survey of dealmakers by Gladstone Place Partners found that 63% saw the Trump administration as the macro factor that would have the biggest impact on M&A in 2025 — but his aggressive tariff approach has generated enough uncertainty to counteract this.

Tariff confusion also makes it harder for the Fed to cut rates, crucial to the borrowing and debt-servicing costs for the private equity firms at the heart of these deals. But while the growing doubts make sense, SLB Capital Advisors’ Scott Merkle says that private equity firms and investment bankers are talking about upcoming activity:

So far, the Federal Trade Commission isn’t loosening up as hoped. Bloomberg News reported earlier this month that the body is continuing its probe on Microsoft Corp. It’s unclear how this ends, but the optics surrounding the Justice Department’s desire to proceed with a Biden-era goal to break up Google’s business is not encouraging. This shouldn’t be that surprising. A&O Shearman’s report suggests that as much as regulatory easing is expected, a strict approach to M&A in sectors such as technology will remain.

The broader macro backdrop also matters. Rising recession fears and stock market downturns are troubling signs for dealmaking. BofA’s head of US small and mid-cap strategy, Jill Carey Hall, points out that good years for M&A also tend to follow good years for market returns — like 2024. However:

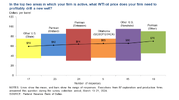

Buoyed by Trump’s continued pressure on Iran and OPEC+’s renewed efforts to send prices higher ahead of its April meeting by committing to additional overcompensation plans, ICE Brent is creeping back closer to the $75 per barrel mark, posting its second weekly gain. The oil markets have become desensitized to US Federal Reserve meetings and with the awkward implementation of the 30-day ban on energy strikes between Russia and Ukraine, there might be further upside ahead for crude.

OPEC+ Rolls Out New Compensation Plans. Confronted with continuous overproduction by its leading members, OPEC+ issued a new compensation plan with voluntary cuts lasting until June 2026, seeing 300-400,000 b/d output curtailments over the summer months with Iraq forced to cut the most.

US Sanctions First Chinese Teapot Refiner. Ramping up the pressure on buyers of Iranian oil, the US Treasury Department announced new sanctions on entities linked to Iranian oil trade, adding a Chinese refiner (Shandong-based Shouguang Luqing Petrochemical) to the SDN list for the first time ever.

Oil Traders Become the New Drillers. Global trading house Vitol agreed to buy stakes in West African oil and gas assets operated by Italy’s oil major ENI (BIT:ENI) for $1.65 billion, taking a 30% minority stake in the largest oil discovery of 2021, the Baleine field in Ivory Coast, as well as in Congolese LNG assets.

Kazakhstan Drops Energy Minister Amid OPEC+ Rows. Kazakhstan’s energy minister Almasadam Satkaliyev will stand down from his role as the Asian country has been increasingly pressured by OPEC+ peers to comply with its production quota, seeing output from the Tengiz field soar to 1 million b/d.

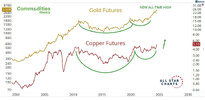

Gold Soars Again on Fed’s Doomsaying. Gold prices rose to another all-time high this week, surpassing the $3,050 per ounce threshold, right after the US Federal Reserve chair Jerome Powell hinted at only two interest rate cuts in 2025 and reiterated that the Fed is in no hurry to adjust borrowing costs.

Guerrillas Blow Up Colombia’s Pipelines. Colombia’s two main pipelines connectingoil fields in the Andean foothills with the country’s Atlantic coast were bombed this week, presumably by Marxist guerillas, with the Cano Limon-Covenas pipeline already paralyzed due to a prior bomb attack.

Trump Mulls U-Turn on Venezuela Sanctions. Having met top executives from the US oil industry, US President Donald Trump is reportedly considering a plan to extend Chevron’s (NYSE:CVX) sanctions waiver in Venezuela, instead rolling out tariffs for non-US buyers of Venezuelan oil.

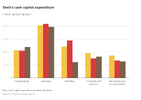

Norway’s Equinor Rolls Back Climate Ambition. Norway’s state oil firm Equinor (NYSE:EQNR) lowered its renewable energy mandates, scrapping a previous 50% capital expenditure target for low-carbon projects by 2030 and lowering its renewable energy target to 10-12 GW instead of 12-16 GW previously.

Niger Expels Overpaid Chinese Oil Bosses. The African nation of Niger expelled three Chinese oil executives working at the Agadem project run by state oil firm Petrochina (SHA:601857) for allegedly earning too much, citing an eightfold difference between Nigerien employees and their Chinese bosses.

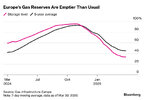

European Gas Surges on Pipeline Attack. Europe’s benchmark TTF natural gas futures rose to €45 per MWh this week after an alleged attack by Ukraine’s Armed Forces on the Sudzha gas metering station in Russia, greatly sapping the possibility of Russian pipeline gas flows resuming to Europe.

Trump Uses Wartime Powers to Boost US Mining. US President Donald Trump hastapped the 1950 Defense Production Act to ramp up production of critical minerals, facilitating the financing and regulatory support of upcoming domestic projects as 70% of rare earth imports still come from China.

Carlyle-Energean Upstream Deal Collapses. A $945 million deal that would see Mediterranean driller Energean (LON:ENOG) sell its gas assets in Egypt, Italy, and Croatia to US equity fund Carlyle has fallen through due to lack of government approvals from Italy and Egypt before the March 20 deadline.

Saudi Aramco Continues 2025 Retail Expansion. After buying a fuel retailer in the Phillippines, Saudi national oil company Saudi Aramco (TADAWUL:2222) agreed to buy Latin American retail firm Primax, which has operations in Peru, Colombia, and Ecuador, for an undisclosed fee.

Europe’s Largest Airport Halts Operations After Blaze. A fire at an adjacent electrical substation debilitated London’s Heathrow Airport, forcing Europe’s busiest airport (84 million passengers in 2024) to shut down altogether on March 21, with the airport operator warning of further disruptions ahead.

jog on

duc

- They have a point.

- Administration officials see this as justification for what Bessent calls a period of "detox" for the economy, and their willingness to risk pain to achieve it.

- Economists attribute disproportionate growth in health care and government jobs to the population's aging and to a catch-up effect from pandemic job losses. But some do see overreliance on these sectors as evidence of underlying weakness.

- Within health care, major drivers of job growth were home health care (employment up 16.2%), nursing and residential care (9.6%), and hospitals (7.6%).

- All other sectors' employment rose by a combined 948,000 jobs, only a 0.9% rise. That's not quite what one would expect in a private-sector recession, as Bessent has put it (employment generally contracts in a recession), but it isn't great, either.

- Medicaid cuts contemplated in House Republicans' budget framework could reduce funding that ultimately is the revenue source for hospitals, nursing homes, and other health care providers.

- Moreover, some of the state and local government hiring was a catch-up effect after the 2021-2022 period when they struggled to attract workers amid a private-sector hiring explosion.

- All of that points to these sectors no longer creating a job growth tailwind. In a note this week, Goldman Sachs economists said they expect hiring in health care, education and government to slow to 15,000 jobs a month in the second half of the year, down from 100,000 now.

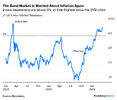

- "Cyclical and rate-sensitive industries are stymied by a Fed that is reluctant to cut rates until they are certain inflation is going to continue lower, which will be difficult due to the day-to-day variation in tariff policy."

- "Meanwhile, job growth in acyclical industries is either slowing, outright negative, or likely to slow later this year."

Two months into his term, President Trump is growing more defiant, creative and ruthless in his pursuit of a central campaign promise: exacting revenge on his political enemies, Axios' Zachary Basu writes.

- Why it matters: From Day One, Trump has delighted in settling scores through the stroke of his pen — breathing life into his MAGA mantra: "I am your retribution."

The big picture: In the final days of the 2024 campaign, Axios identified a list of perceived adversaries who fit what Trump ominously described as "the enemies from within."

The big picture: In the final days of the 2024 campaign, Axios identified a list of perceived adversaries who fit what Trump ominously described as "the enemies from within."- As president, he has taken steps to retaliate against virtually all of them.

- White House principal deputy press secretary Harrison Fields told Axios: "As President Trump has made clear, his only retribution is success — and his historic achievements and soaring approval ratings prove it."

Political opponents

The Biden administration: Trump has revoked security clearances from former President Biden, Secretary of State Tony Blinken, National Security Adviser Jake Sullivan and Deputy Attorney General Lisa Monaco.

The Biden administration: Trump has revoked security clearances from former President Biden, Secretary of State Tony Blinken, National Security Adviser Jake Sullivan and Deputy Attorney General Lisa Monaco.- The Biden family: On Monday, Trump announced he was terminating Secret Service protection for Biden's son and daughter, Hunter and Ashley, "effective immediately."

- Gen. Mark Milley: Trump despises his former Joint Chiefs of Staff chairman, who called the president "fascist to the core" in 2023. Trump yanked both his security clearance and personal security detail.

- Former Rep. Liz Cheney: Trump claimed this week that Biden's preemptive pardons of Cheney and other members of the Jan. 6 committee are "void" because of Biden's alleged use of an autopen.

Media and entertainment

White House Correspondents' Association: The White House took control of the daily makeup of its press pool from WHCA.

White House Correspondents' Association: The White House took control of the daily makeup of its press pool from WHCA.- Associated Press: The White House barred the AP from accessing events in the Oval Office and on Air Force One for refusing to use the name "Gulf of America" in its coverage.

- The FCC also reinstated complaints against ABC for its handling of the presidential debate between Trump and Harris, and NBC for allowing Harris to appear on "Saturday Night Live" without equal time for Trump.

Legal foes and bureaucrats

Prosecutors: He fired and demoted federal prosecutors and FBI officials involved in the investigation of the Jan. 6 riot, while pardoning thousands of his supporters who were convicted for breaking into the Capitol.

Prosecutors: He fired and demoted federal prosecutors and FBI officials involved in the investigation of the Jan. 6 riot, while pardoning thousands of his supporters who were convicted for breaking into the Capitol.Big Law: At the start of an extraordinary campaign against private practice law firms, Trump revoked the security clearances of lawyers at Covington & Burling who offered pro bono legal advice to former special counsel Jack Smith.

- Trump then targeted Perkins Coie, stripping security clearances and blacklisting the firm's lawyers because of the firm's commission of the Steele Dossier and other work on behalf of Democrats in 2016.

- Last week, Trump signed an executive order targeting New York firm Paul, Weiss for its former employment of Mark Pomerantz, who was involved in the Manhattan DA's Trump investigation.

- He then withdrew that order yesterday after Paul, Weiss agreed to "dedicate the equivalent of $40 million in pro bono legal services" to support the Trump administration on "mutually agreed projects."

It can be difficult to remember that the Mar-a-Lago Accord hasn’t happened yet. Leaders haven’t been convened to Palm Beach, and there’s no agenda for what such an accord could include. But that hasn’t stopped people talking or journalists writing about it. This shows the total number of stories (from all sources) mentioning a “Mar-a-Lago Accord” each day on the Bloomberg terminal for the last year:

But what is it, and can it really happen? There are huge variations, but the common themes seem to be that an accord would be an international agreement designed to:

- Weaken the dollar, and

- Prompt far more foreign direct investment into the US.

These are wholly reasonable aims, for which the administration has a mandate. It’s not clear that they’re achievable, or that other countries have any reason to go along with them. Adam Tooze of Columbia University describes the idea as “on its face a far-fetched policy proposal” in which it’s easy to pick holes. He suggests that the notion is only taken seriously because “we are all struggling to find some kind of rational purchase on the unhinged situation created by the Trump administration.” These are strong words, but the retreat of stocks in the last few weeks is in large part driven by investors coming around to his point of view.

So how does the US propose to make this happen? Various possibilities include:

- Threats of tariffs.

- A sovereign wealth fund to manipulate the currency and replace flows of capital from abroad.

- Coercion on defense; those who agree can benefit from the US security umbrella while those who don’t cannot, or as Stephen Miran, chair of the Council of Economic Advisers, put it: “Countries that want to be inside the defense umbrella must also be inside the fair trade umbrella.”

- Big cuts to the federal budget to reduce the deficit.

- Putting pressure on the Federal Reserve (under new leadership next year) to cut rates. (The president opined on Truth Social that “The Fed would be MUCH better off CUTTING RATES as US Tariffs start to transition (ease!) their way into the economy.”)

- And possibly Tobin transaction taxes, to create a cost for holding US dollars as reserves.

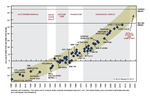

That’s because, first, the US dollar isn’t as massively overvalued as it was at the time of the 1985 Plaza Accord (struck at a New York hotel that subsequently belonged to Trump for a while), which is the model for an international agreement to weaken the dollar. That makes it harder to bring down in a significant way. On a real trade-weighted basis, the currency is certainly very expensive, but not as extreme as 40 years ago, according to the Fed’s own index:

Further, Plaza involved only the biggest countries in the then-developed capitalist world. The globe has since gotten bigger, making it far harder to find a deal that everyone can live with. While Plaza worked for the US, it wasn’t so great for Japan, which entered a long-lasting slump a few years later. That won’t be lost on those who would stand to lose from a weaker dollar, such as China.

Tiffany Wilding, economist at Pimco, also points to the growth of foreign exchange markets since Plaza:

Any agreement at Mar-a-Lago will not be able to weaken the dollar anything like as much as Plaza did by intervention alone.The sheer scale of the interventions required to create a meaningful dollar devaluation is staggering. Currency markets today see daily average turnover of some $7.5 trillion, according to the Bank for International Settlements. Even after adjusting for inflation, that’s about five times greater than the volume in 1989, in the years after the Plaza Accord.

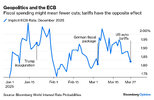

Another problem is inflation. Globalization over time minimized it; and public tolerance for rising prices, we’ve learned in the last four years, is non-existent. Further, the concern is less inflation — slowing the rate at which prices are rising — as much as the price level. There’s a case that tariffs don’t create inflation, and the debate has already entangled the Fed’s Jerome Powell. It’s impossible to deny that they create a one-off rise in the price level. Using tariffs to create leverage, or as a source of revenue, is not the simple call it appears. It might hurt US counterparties more, but it will create much political pain at home.

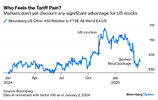

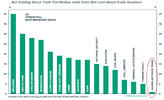

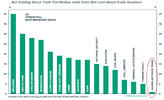

Marko Papic of BCA Research points to a range of polls showing that voters care deeply about prices, while trade doesn’t matter to them. The political difficulty created by a spike in prices after Trump levied tariffs would be hard for the administration to navigate:

The greatest problem for any deal is getting others to agree. This is where the US may have already overplayed its hand. One widely circulating version of a MAL Accord had Europe agreeing to rearm by buying US weapons, in return for avoiding tariffs. But Trump 2.0 has shown itself so willing to withdraw from the Atlantic alliance that now even Germany’s once-staunchly Atlanticist new chancellor says the country needs “independence” from the US. European, not American, arms manufacturers are benefiting. The first act of Canada’s new prime minister has been to discuss defense with European leaders. Rather than accede to US demands, the international response so far has been to look for alternatives. This is understandable, as it grows ever more politically unpalatable for foreign leaders to rely on the US — and a range of countries now appear to be planning their own nuclear deterrents, which makes the security umbrella less important still.

Finally, Trump’s very unpredictability increases his leverage, but also tends to deter people from feeling confident in reaching an agreement with him. Former mentor and colleague Martin Wolf put it this way in the Financial Times:

The upshot is that while the US plainly would prefer some help weakening the dollar, the chances are that it will actually impose the tariffs. Trump refers to April 2, when his plan for reciprocal tariffs will be unveiled, as “Liberation Day.” Peter Tchir of Academy Securities argued that global tariffs will mean a “rocky road ahead for the economy”:He has, after all, abandoned Ukraine, put the commitment to NATO into doubt and mounted an assault on Canada. Is this administration capable of making a deal any sane person or country should trust? I think not.

Quite. Plenty of people on Wall Street are attracted to the various versions of the Mar-a-Lago Accord that have been circulated. Very few share the president’s enthusiasm for tariffs. It’s best to brace for them to happen.There is a lot of “chatter” about uncertainty. My fear is that the market isn’t pricing in what seems more and more certain — global tariffs shocking global supply chains.

Google’s $32 billion deal to buy the Israeli startup Wiz Inc. this week was an instant head-turner. It’s among the biggest deals so far under a new administration expected to turbocharge dealmaking. It was also about time, as the expected surge hasn’t materialized. Two months into Trump’s second term, the value of announced mergers and acquisitions involving US companies stands at about $387 billion. That’s basically flat, down roughly 2% compared to this point in 2024:

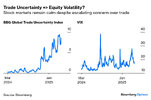

A recent survey of dealmakers by Gladstone Place Partners found that 63% saw the Trump administration as the macro factor that would have the biggest impact on M&A in 2025 — but his aggressive tariff approach has generated enough uncertainty to counteract this.

Tariff confusion also makes it harder for the Fed to cut rates, crucial to the borrowing and debt-servicing costs for the private equity firms at the heart of these deals. But while the growing doubts make sense, SLB Capital Advisors’ Scott Merkle says that private equity firms and investment bankers are talking about upcoming activity:

While Trump can’t cut rates, his influence on easing regulatory constraints is unmatched. But progress has been painfully slow. Meaningful deregulation would make a big difference. A&O Shearman found that despite last year’s M&A recovery, more deals were frustrated by antitrust authorities than in any of the previous four years, with a striking 50% rise in transactions abandoned due to antitrust concerns. Trump’s unbridled executive power should make it easy for him to restore confidence.Deals in the pipeline that are viable at prevailing rates should move to closing, and the possibility of lower rates ahead may provide another push for M&A activity down the road.

So far, the Federal Trade Commission isn’t loosening up as hoped. Bloomberg News reported earlier this month that the body is continuing its probe on Microsoft Corp. It’s unclear how this ends, but the optics surrounding the Justice Department’s desire to proceed with a Biden-era goal to break up Google’s business is not encouraging. This shouldn’t be that surprising. A&O Shearman’s report suggests that as much as regulatory easing is expected, a strict approach to M&A in sectors such as technology will remain.

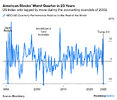

The broader macro backdrop also matters. Rising recession fears and stock market downturns are troubling signs for dealmaking. BofA’s head of US small and mid-cap strategy, Jill Carey Hall, points out that good years for M&A also tend to follow good years for market returns — like 2024. However:

With some clear-cut action on deregulation, this might still be a big year of deals. Resolving the tariffs uncertainty would also help. Untile then, dealmaking won’t deliver for smaller companies as had been hoped.Deal activity tends to be higher when growth expectations for small caps are higher. And while growth expectations have improved, they’re still below average, so not as many great growth prospects in small caps relative to history. M&A is also correlated with economic growth, and economists expect growth to remain healthy but to moderate in 2025.

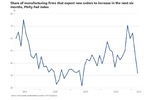

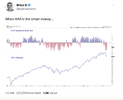

I’m not a huge fan of seasonal trends in the stock market. Not all of it is entirely useless, but a lot of it is. |

Today I want to shine a light on one particular brand of signal that I do find compelling. I like data that is based on our behavior, not the calendar. |

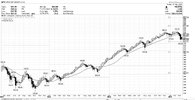

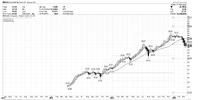

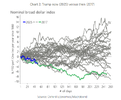

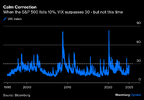

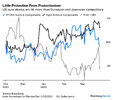

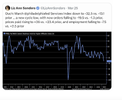

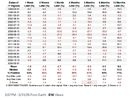

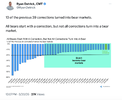

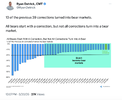

This chart is Exhibit A (sorry, couldn’t help it) of what I’m talking about, and it comes from SentimenTrader via Daily Chartbook. It shows what happens when the S&P 500 closes at a 6-month low and then experiences consecutive days where 90% of the index is positive. |

Why do I pay attention to stuff like this? Because the crowd behaves the same today as it did one hundred years ago. It’s the only data from the 30s and 40s that has any relevance. |

The table shows an environment where the collective mindset of the crowd goes from, “Oh ****. Things are bad and getting worse,” to, “Everyone back in the pool!” |

This type of price action has happened 17 times in the past. So pretty rare, but not so rare that the forward-looking data is meaningless. What caught my attention about the chart is that the stock market was higher 100% of the time two months later. |

While I respect this type of work, like everything else, past performance is no indicator of future returns. Things that never happened before happen all the time in the market. |

Plenty of backtests had a 100% hit rate until they didn’t. |

Buoyed by Trump’s continued pressure on Iran and OPEC+’s renewed efforts to send prices higher ahead of its April meeting by committing to additional overcompensation plans, ICE Brent is creeping back closer to the $75 per barrel mark, posting its second weekly gain. The oil markets have become desensitized to US Federal Reserve meetings and with the awkward implementation of the 30-day ban on energy strikes between Russia and Ukraine, there might be further upside ahead for crude.

OPEC+ Rolls Out New Compensation Plans. Confronted with continuous overproduction by its leading members, OPEC+ issued a new compensation plan with voluntary cuts lasting until June 2026, seeing 300-400,000 b/d output curtailments over the summer months with Iraq forced to cut the most.

US Sanctions First Chinese Teapot Refiner. Ramping up the pressure on buyers of Iranian oil, the US Treasury Department announced new sanctions on entities linked to Iranian oil trade, adding a Chinese refiner (Shandong-based Shouguang Luqing Petrochemical) to the SDN list for the first time ever.

Oil Traders Become the New Drillers. Global trading house Vitol agreed to buy stakes in West African oil and gas assets operated by Italy’s oil major ENI (BIT:ENI) for $1.65 billion, taking a 30% minority stake in the largest oil discovery of 2021, the Baleine field in Ivory Coast, as well as in Congolese LNG assets.

Kazakhstan Drops Energy Minister Amid OPEC+ Rows. Kazakhstan’s energy minister Almasadam Satkaliyev will stand down from his role as the Asian country has been increasingly pressured by OPEC+ peers to comply with its production quota, seeing output from the Tengiz field soar to 1 million b/d.

Gold Soars Again on Fed’s Doomsaying. Gold prices rose to another all-time high this week, surpassing the $3,050 per ounce threshold, right after the US Federal Reserve chair Jerome Powell hinted at only two interest rate cuts in 2025 and reiterated that the Fed is in no hurry to adjust borrowing costs.

Guerrillas Blow Up Colombia’s Pipelines. Colombia’s two main pipelines connectingoil fields in the Andean foothills with the country’s Atlantic coast were bombed this week, presumably by Marxist guerillas, with the Cano Limon-Covenas pipeline already paralyzed due to a prior bomb attack.

Trump Mulls U-Turn on Venezuela Sanctions. Having met top executives from the US oil industry, US President Donald Trump is reportedly considering a plan to extend Chevron’s (NYSE:CVX) sanctions waiver in Venezuela, instead rolling out tariffs for non-US buyers of Venezuelan oil.

Norway’s Equinor Rolls Back Climate Ambition. Norway’s state oil firm Equinor (NYSE:EQNR) lowered its renewable energy mandates, scrapping a previous 50% capital expenditure target for low-carbon projects by 2030 and lowering its renewable energy target to 10-12 GW instead of 12-16 GW previously.

Niger Expels Overpaid Chinese Oil Bosses. The African nation of Niger expelled three Chinese oil executives working at the Agadem project run by state oil firm Petrochina (SHA:601857) for allegedly earning too much, citing an eightfold difference between Nigerien employees and their Chinese bosses.

European Gas Surges on Pipeline Attack. Europe’s benchmark TTF natural gas futures rose to €45 per MWh this week after an alleged attack by Ukraine’s Armed Forces on the Sudzha gas metering station in Russia, greatly sapping the possibility of Russian pipeline gas flows resuming to Europe.

Trump Uses Wartime Powers to Boost US Mining. US President Donald Trump hastapped the 1950 Defense Production Act to ramp up production of critical minerals, facilitating the financing and regulatory support of upcoming domestic projects as 70% of rare earth imports still come from China.

Carlyle-Energean Upstream Deal Collapses. A $945 million deal that would see Mediterranean driller Energean (LON:ENOG) sell its gas assets in Egypt, Italy, and Croatia to US equity fund Carlyle has fallen through due to lack of government approvals from Italy and Egypt before the March 20 deadline.

Saudi Aramco Continues 2025 Retail Expansion. After buying a fuel retailer in the Phillippines, Saudi national oil company Saudi Aramco (TADAWUL:2222) agreed to buy Latin American retail firm Primax, which has operations in Peru, Colombia, and Ecuador, for an undisclosed fee.

Europe’s Largest Airport Halts Operations After Blaze. A fire at an adjacent electrical substation debilitated London’s Heathrow Airport, forcing Europe’s busiest airport (84 million passengers in 2024) to shut down altogether on March 21, with the airport operator warning of further disruptions ahead.

jog on

duc