- Joined

- 13 February 2006

- Posts

- 5,305

- Reactions

- 12,250

Another early start:

avc.com

avc.com

www.wsj.com

www.wsj.com

www.priceactionlab.com

www.priceactionlab.com

informationisbeautiful.net

informationisbeautiful.net

www.insidehook.com

www.insidehook.com

In its latest 2023 Net Zero Roadmap, the International Energy Agency softened its stance on upstream projects, changing its 2021 wording of "no new oil and gas fields” to a more nuanced "no new long-lead-time upstream projects”.

- Setting the stage for COP28 in Dubai from November 30 to December 12, the IEA has hailed electricity as the new oil, calling on all countries to speed up the permitting and modernization of power grids.

- The IEA’s repeated calls on fossil fuels to peak before 2030, followed closely by global carbon dioxide emissions, have done little to stop emissions from jumping to an all-time high of 36.8 billion gigaton CO2e last year.

- The IEA bemoaned the slow progress seen in the hydrogen and CCUS industries, pointing out that so far it is only the solar segment and electric car sales that are growing in accordance with 2050 net-zero targets.

Market Movers

- US shale producer Devon Energy (NYSE VN) said it expects 2024 capital expenditure to be lower than this year due to falling production costs, aiming to maintain production levels around 650-660,000 boepd.

VN) said it expects 2024 capital expenditure to be lower than this year due to falling production costs, aiming to maintain production levels around 650-660,000 boepd.

- Italy’s oil major ENI (BIT:ENI) landed the most exploration deals in Egypt’s recently finalized oil and gas licensing round, taking two blocks by itself and one in a consortium with BP (NYSE:BP) and QatarEnergy.

- UK-based energy major Shell (LON:SHEL) spudded a much-anticipated exploration well in the largely untapped offshore waters of Mauritania, aiming to unlock some 1 Bbbls of oil with the Panna Cotta-1 wildcat.

Tuesday, September 26, 2023

US bonds surged this week with the 10-year US Treasury yields jumping to 4.55%, adding strength to the US dollar vis-a-vis other currencies and pushing the dollar index to its highest since November last year. The dollar strength has prompted the US Federal Reserve to signal another interest rate hike before year-end, and "higher for longer” rate concerns have been tangibly weighing on oil prices, as ICE Brent fell back to $92 per barrel.

Global Biofuels Production Lags Climate Ambition. According to the IEA, production of biofuels has been increasing by an average annual rate of 4% over the past five years, but its 2050 net zero target would need that growth to be triple what it is currently, at 13% per year.

Chevron Ramps Up Venezuela Drilling. US oil major Chevron (NYSE:CVX) expects to add 65,000 b/d of crude production in Venezuela by the end of next year, as laxer sanctions allow it to start the first major drilling campaign in the country, although sourcing drilling rigs might be a problem.

Russia Eases Export Ban, Exempting Gasoils. Seeking to soften the impact of last week’s diesel and gasoline export ban, Moscow has tinkered with its curbs in a new set of regulations, lifting export restrictions on some bunkering fuels as well as on gasoils with high sulfur content.

TMX Avoids Further Delays after New Route Approval. Canada’s Energy Regulator has approved an updated plan from the Trans Mountain Corporation that changes a 0.8-mile pipeline section south of Kamloops, BC, enabling TMX to come online by the end of next year.

US Drillers Call for Policy Consistency. Shale pioneer Harold Hamm has called for the end of back-and-forth energy policy coming from the White House, arguing that the Biden-era rule of not drilling on federal lands should be overturned as restricted land availability increases energy costs.

Iranian Refining Debilitated by Refinery Blast. Following emergency repairs at an unnamed unit of the 300,000 b/d Bandar Abbas refinery, one of the largest in Iran, a blast killed one worker and injured four. Iran’s state media announced there was no impact on refinery production.

White House Sticks to Wind Energy Plans. Despite mounting calls for a US policy revamp on offshore wind projects, the Biden administration reiterated its intent to hold three promised wind lease sales in the Central Atlantic, off the Pacific coast of Oregon, and in the Gulf of Maine in 2024.

Uruguay’s Untapped Waters Attract Global Majors. Uruguay, A country that has never yielded a commercial hydrocarbon discovery, is finalizing 7 new offshore exploration licenses that will see the arrival of Shell (LON:SHEL) or APA (NASDAQ:APA) in the country, hoping for a new Namibia.

China’s Coal Woes Continue. Merely a month after a deadly coal mine explosion in China’s Shaanxi, 16 people were killed in another coal mine collapse in the southwestern Guizhou province, leading to suspended production in a region that accounts for 5% of the country’s coking coal output.

EU Agrees on Euro 7 Car Emission Rules. EU countries have agreed to a new set of emission rules labeled "Euro 7” that would introduce new standards on particle emissions from brakes and tires, advancing the regional bloc’s collective 2035 target of banning sales of carbon-emitting vehicles.

Iron Ore Slumps on Steel Curb News. Chinese iron ore futures plunged to ¥845 per metric tonne ($115/mt) as weaker-than-expected steel consumption in the peak demand months of September-October might prompt Beijing to mandate lower steel production in the country.

Panama Delays Lift VLGC Freight to Multi-Year Highs. The worsening congestion of tankers idling outside of the Panama Canal has lifted VLGC freight rates from the US into Japan to the highest since 2015, reaching 245 per metric tonne this week, with a two-week demurrage costing shippers almost $2 million.

Indonesia Launches Carbon Trading to Lower Coal Usage. Indonesia launched its own carbon emission trading mechanism as the Asian country aims to limit coal utilization at home and reach net zero by 2060, with prices opening around $4.5 per mtCO2 on the first day of trading.

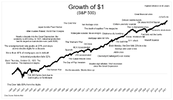

Value investing.

Took quite a long time to enter a batch of bracket orders this morning, so very brief post.

jog on

duc

The Heist

On Saturday, September 9th, the Gotham Gal and I arrived at JFK airport after an eight-hour flight from Paris. While waiting for our luggage, I got pushed a notification in my web3 wallet that there was an NFT drop underway that I could participate in. So I clicked on the link, signed the...

avc.com

avc.com

The Big Pharma Stock Trade: Weight Loss Is In, Covid-19 Is Out

The pharmaceuticals sector is enduring a tough year in the stock market. Companies selling weight-loss drugs are a big exception.

Trend-Following Many Markets Maximizes Sharpe – Price Action Lab Blog

www.priceactionlab.com

www.priceactionlab.com

What is The Most Successful Hollywood Movie of All Time? — Information is Beautiful

Maybe not the film you expect

With Ohtani's Future Uncertain, Trout May Want Out of LA

The three-time MVP has played in three playoff games in 13 seasons

In its latest 2023 Net Zero Roadmap, the International Energy Agency softened its stance on upstream projects, changing its 2021 wording of "no new oil and gas fields” to a more nuanced "no new long-lead-time upstream projects”.

- Setting the stage for COP28 in Dubai from November 30 to December 12, the IEA has hailed electricity as the new oil, calling on all countries to speed up the permitting and modernization of power grids.

- The IEA’s repeated calls on fossil fuels to peak before 2030, followed closely by global carbon dioxide emissions, have done little to stop emissions from jumping to an all-time high of 36.8 billion gigaton CO2e last year.

- The IEA bemoaned the slow progress seen in the hydrogen and CCUS industries, pointing out that so far it is only the solar segment and electric car sales that are growing in accordance with 2050 net-zero targets.

Market Movers

- US shale producer Devon Energy (NYSE

- Italy’s oil major ENI (BIT:ENI) landed the most exploration deals in Egypt’s recently finalized oil and gas licensing round, taking two blocks by itself and one in a consortium with BP (NYSE:BP) and QatarEnergy.

- UK-based energy major Shell (LON:SHEL) spudded a much-anticipated exploration well in the largely untapped offshore waters of Mauritania, aiming to unlock some 1 Bbbls of oil with the Panna Cotta-1 wildcat.

Tuesday, September 26, 2023

US bonds surged this week with the 10-year US Treasury yields jumping to 4.55%, adding strength to the US dollar vis-a-vis other currencies and pushing the dollar index to its highest since November last year. The dollar strength has prompted the US Federal Reserve to signal another interest rate hike before year-end, and "higher for longer” rate concerns have been tangibly weighing on oil prices, as ICE Brent fell back to $92 per barrel.

Global Biofuels Production Lags Climate Ambition. According to the IEA, production of biofuels has been increasing by an average annual rate of 4% over the past five years, but its 2050 net zero target would need that growth to be triple what it is currently, at 13% per year.

Chevron Ramps Up Venezuela Drilling. US oil major Chevron (NYSE:CVX) expects to add 65,000 b/d of crude production in Venezuela by the end of next year, as laxer sanctions allow it to start the first major drilling campaign in the country, although sourcing drilling rigs might be a problem.

Russia Eases Export Ban, Exempting Gasoils. Seeking to soften the impact of last week’s diesel and gasoline export ban, Moscow has tinkered with its curbs in a new set of regulations, lifting export restrictions on some bunkering fuels as well as on gasoils with high sulfur content.

TMX Avoids Further Delays after New Route Approval. Canada’s Energy Regulator has approved an updated plan from the Trans Mountain Corporation that changes a 0.8-mile pipeline section south of Kamloops, BC, enabling TMX to come online by the end of next year.

US Drillers Call for Policy Consistency. Shale pioneer Harold Hamm has called for the end of back-and-forth energy policy coming from the White House, arguing that the Biden-era rule of not drilling on federal lands should be overturned as restricted land availability increases energy costs.

Iranian Refining Debilitated by Refinery Blast. Following emergency repairs at an unnamed unit of the 300,000 b/d Bandar Abbas refinery, one of the largest in Iran, a blast killed one worker and injured four. Iran’s state media announced there was no impact on refinery production.

White House Sticks to Wind Energy Plans. Despite mounting calls for a US policy revamp on offshore wind projects, the Biden administration reiterated its intent to hold three promised wind lease sales in the Central Atlantic, off the Pacific coast of Oregon, and in the Gulf of Maine in 2024.

Uruguay’s Untapped Waters Attract Global Majors. Uruguay, A country that has never yielded a commercial hydrocarbon discovery, is finalizing 7 new offshore exploration licenses that will see the arrival of Shell (LON:SHEL) or APA (NASDAQ:APA) in the country, hoping for a new Namibia.

China’s Coal Woes Continue. Merely a month after a deadly coal mine explosion in China’s Shaanxi, 16 people were killed in another coal mine collapse in the southwestern Guizhou province, leading to suspended production in a region that accounts for 5% of the country’s coking coal output.

EU Agrees on Euro 7 Car Emission Rules. EU countries have agreed to a new set of emission rules labeled "Euro 7” that would introduce new standards on particle emissions from brakes and tires, advancing the regional bloc’s collective 2035 target of banning sales of carbon-emitting vehicles.

Iron Ore Slumps on Steel Curb News. Chinese iron ore futures plunged to ¥845 per metric tonne ($115/mt) as weaker-than-expected steel consumption in the peak demand months of September-October might prompt Beijing to mandate lower steel production in the country.

Panama Delays Lift VLGC Freight to Multi-Year Highs. The worsening congestion of tankers idling outside of the Panama Canal has lifted VLGC freight rates from the US into Japan to the highest since 2015, reaching 245 per metric tonne this week, with a two-week demurrage costing shippers almost $2 million.

Indonesia Launches Carbon Trading to Lower Coal Usage. Indonesia launched its own carbon emission trading mechanism as the Asian country aims to limit coal utilization at home and reach net zero by 2060, with prices opening around $4.5 per mtCO2 on the first day of trading.

Value investing.

Took quite a long time to enter a batch of bracket orders this morning, so very brief post.

jog on

duc