- Joined

- 13 February 2006

- Posts

- 5,487

- Reactions

- 12,985

True:

When extreme fear takes over, fundamentals don’t matter — sentiment does.

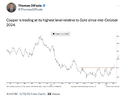

Gold moves higher when there are full moons but also, stocks tend to bottom.

The first firm I worked for was named after a bunch of rocks in Europe.

And let me tell you — some of the people there were just as stubborn as those rocks. Value guys. Fundamental purists. If it wasn’t a discounted cash flow model, they didn’t want to hear about it.

But the CEO? He wanted someone different. Someone who could think outside of that rigid framework. So he paired me with the one guy in the firm who was actually making money — year after year.

This guy was a mystery. He didn’t talk much. He used technicals, sure — but there was something else. Certain days, he’d get really excited about market bottoms, almost like he knew they were coming.

So one day, I asked him about it.

He smirked and said, "Markets bottom the same way, over and over again."

And then he laid it out:

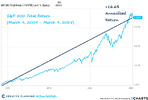

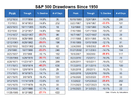

A lot of market bottoms happen in March and October.

A lot of market bottoms happen in March and October.

Stocks tend to V-bottom. Commodities? They consolidate, base, then turn.

Stocks tend to V-bottom. Commodities? They consolidate, base, then turn.

And the last one is weird… full moons.

And the last one is weird… full moons.

Seriously. Full moons.

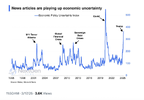

At first, I thought he was joking. But then I started looking into it. Turns out, Paul Montgomery—a legit market analyst—had studied this for years. He found that major market bottoms often coincided with full moons. Not because of astrology or magic, but because of investor psychology.

See, when markets tank, it’s never about the numbers. It’s about sentiment.Panic selling. Extreme fear. The absolute peak of capitulation.

And weirdly enough, these emotional extremes tend to cluster around full moons. Montgomery’s research showed it, and history backs it up—some of the biggest market bottoms formed within a few days of a full moon.

Now, am I saying go out and trade based on moon cycles? No. But if you’re ignoring sentiment, you’re missing half the picture.

This guy I worked with — he didn’t trade off moons alone. He used sentiment, positioning, technicals, price action. The full picture. And he made money while others scratched their heads.

My Own Take:

Patterns like this? They only work when markets are at extremes.

Extreme fear.

Extreme fear.

Extreme offside positioning.

Extreme offside positioning.

Everyone caught leaning the wrong way.

Everyone caught leaning the wrong way.

That’s when sentiment beats fundamentals. That’s when emotions drive price action.

And there’s data to back this up. The University of Basel ran a study on trading strategies using moon phases (yes, a real academic study). And guess what? It led to a 10.9% increase in returns in the S&P 500 over a decade.

Because the market isn’t just about numbers. It’s about human nature.

jog on

duc

When extreme fear takes over, fundamentals don’t matter — sentiment does.

Gold moves higher when there are full moons but also, stocks tend to bottom.

The first firm I worked for was named after a bunch of rocks in Europe.

And let me tell you — some of the people there were just as stubborn as those rocks. Value guys. Fundamental purists. If it wasn’t a discounted cash flow model, they didn’t want to hear about it.

But the CEO? He wanted someone different. Someone who could think outside of that rigid framework. So he paired me with the one guy in the firm who was actually making money — year after year.

This guy was a mystery. He didn’t talk much. He used technicals, sure — but there was something else. Certain days, he’d get really excited about market bottoms, almost like he knew they were coming.

So one day, I asked him about it.

He smirked and said, "Markets bottom the same way, over and over again."

And then he laid it out:

A lot of market bottoms happen in March and October.

A lot of market bottoms happen in March and October. Stocks tend to V-bottom. Commodities? They consolidate, base, then turn.

Stocks tend to V-bottom. Commodities? They consolidate, base, then turn. And the last one is weird… full moons.

And the last one is weird… full moons.Seriously. Full moons.

At first, I thought he was joking. But then I started looking into it. Turns out, Paul Montgomery—a legit market analyst—had studied this for years. He found that major market bottoms often coincided with full moons. Not because of astrology or magic, but because of investor psychology.

See, when markets tank, it’s never about the numbers. It’s about sentiment.Panic selling. Extreme fear. The absolute peak of capitulation.

And weirdly enough, these emotional extremes tend to cluster around full moons. Montgomery’s research showed it, and history backs it up—some of the biggest market bottoms formed within a few days of a full moon.

Now, am I saying go out and trade based on moon cycles? No. But if you’re ignoring sentiment, you’re missing half the picture.

This guy I worked with — he didn’t trade off moons alone. He used sentiment, positioning, technicals, price action. The full picture. And he made money while others scratched their heads.

My Own Take:

Patterns like this? They only work when markets are at extremes.

Extreme fear.

Extreme fear. Extreme offside positioning.

Extreme offside positioning. Everyone caught leaning the wrong way.

Everyone caught leaning the wrong way.That’s when sentiment beats fundamentals. That’s when emotions drive price action.

And there’s data to back this up. The University of Basel ran a study on trading strategies using moon phases (yes, a real academic study). And guess what? It led to a 10.9% increase in returns in the S&P 500 over a decade.

Because the market isn’t just about numbers. It’s about human nature.

jog on

duc