- Joined

- 13 February 2006

- Posts

- 5,493

- Reactions

- 13,012

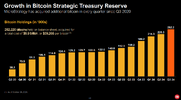

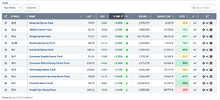

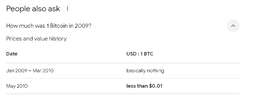

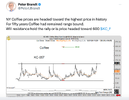

So this is the second MSTR. All they are doing is issuing debt and buying BTC. AKA a 'pureplay'.

How many more useless companies adopt the BTC strategy? Is this the ultimate bootstrap operation on a limited asset? Most Wall St. firms that flood the market with copycat ideas, for example Covered Call strategies or x3 leveraged ETF's etc, have no limit to their creation.

Interesting.

jog on

duc