- Joined

- 13 February 2006

- Posts

- 5,304

- Reactions

- 12,246

Mathematically certain. 100%

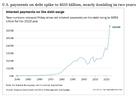

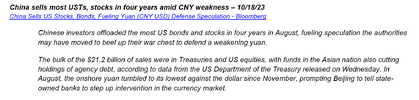

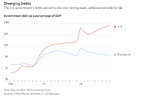

now what i see rarely discussed is the ( US ) Municipal Bonds China holds , how are they going ( i suspect several are struggling )MondayView attachment 164516

View attachment 164517

View attachment 164515View attachment 164514View attachment 164513View attachment 164512View attachment 164511View attachment 164510View attachment 164509

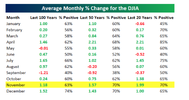

This next set are important:

View attachment 164508View attachment 164507

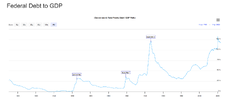

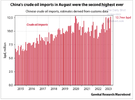

So +/- $21B in sales stabilised the Yuan.

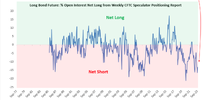

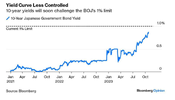

But look what it did to the US Treasury market at the long end

View attachment 164506

It crushed the long end, pushing it up 80bp.

Which is why the TLT chart that I posted all week went down relentlessly.

China is an interesting phenomenon. It is a Mercantilist nation, that concurrently tries to protect its citizens from the worst effects of mercantilism. How? Individuals for 20+ years have been encouraged to save in gold.

When a mercantilist devalues its currency to build exports, usually the citizens are robbed. If however you hold your savings in gold, you are not robbed (as badly): only the cash that you hold for daily transactions (is) are devalued. Interesting.

So $21B collapsed the UST market. How much more does China hold in the UST war chest? Only another $3T +/-.

Who can last longer: the Fed or China?

Without a doubt, China.

jog on

duc

I did read an article about this very matter within the last month but am unable to recollect where.now what i see rarely discussed is the ( US ) Municipal Bonds China holds , how are they going ( i suspect several are struggling )

we already know some cities/counties are bankrupt , but are they a few or in reality dozens ( just too small to be worth a headline )

www.vox.com

www.vox.com

Uranium prices have soared in recent days to $74 per pound, a 50% increase in 2023 to date, as lower production guidance from Cameco and production disruptions in Niger added to worries about the world producing enough U308 to meet the industry’s growing needs.

- Global nuclear capacity currently consists of 440 nuclear reactors in 33 jurisdictions, however by 2030 there will be some 60 reactors more due to a vast build-up in Asian nuclear plants, lifting demand for mined uranium.

- As mines take years to produce at scale and breakeven costs for new mining projects in the West rose to $90 per pound, analysts expect the uranium market to see a supply shortage of some 60-70 million pounds.

- Several hedge funds – Terra Capital, Segra Capital, or Argonaut – have been ramping up their exposure to uranium stocks recently, buoyed by Cameco gaining more than 70% this year to date.

it is by far, well of course not as expensive as solar or wind farm plus batteries....But, #BlackOutBowen says nuclear is the most expensive form of energy?

Fun with Mr flippe-floppe-flye:

View attachment 165139View attachment 165138View attachment 165137View attachment 165136View attachment 165135

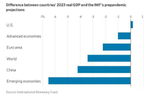

The serious stuff:

View attachment 165134View attachment 165133View attachment 165132View attachment 165131View attachment 165130View attachment 165129

Global liquidity is contracting. At a significant pace. Low liquidity means big trouble.

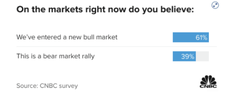

Meanwhile stocks are having a good day/week.

Tomorrow we have the employment data. It needs to be good.

The big boys already have the data. Look for a sell-off at the close if it's likely to be bad. Strong into the close if the numbers are still pretty good.

jog on

duc

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.