- Joined

- 20 July 2021

- Posts

- 12,099

- Reactions

- 16,838

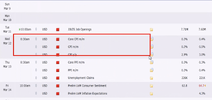

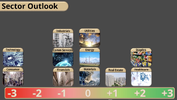

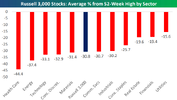

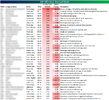

well two words might explain the current stock market ( except in Australia *)

irrational exuberance or alternatively T.I.N.A. ( there is no alternative )

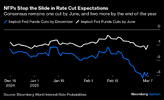

bonds are facing possible official rate cuts ( i think the Fed will bluff not cut , but i am the minority ) and reduced buying from foreign investors

private equity/credit has a reputation of being illiquid , when YOU need the cash immediately

and there is always your bank which MIGHT open Monday

those who DON'T love stocks ( but have money to park ) should start digging a hole in the garage for your new gold/silver safe , because regulations could grab your cache at any time they deem fit ( and can find it )

* Australia may be facing a 'healthy retrace' ( or worse )

i am think a MAJOR DISTRACTION very soon , but i have been wrong before

irrational exuberance or alternatively T.I.N.A. ( there is no alternative )

bonds are facing possible official rate cuts ( i think the Fed will bluff not cut , but i am the minority ) and reduced buying from foreign investors

private equity/credit has a reputation of being illiquid , when YOU need the cash immediately

and there is always your bank which MIGHT open Monday

those who DON'T love stocks ( but have money to park ) should start digging a hole in the garage for your new gold/silver safe , because regulations could grab your cache at any time they deem fit ( and can find it )

* Australia may be facing a 'healthy retrace' ( or worse )

i am think a MAJOR DISTRACTION very soon , but i have been wrong before