Sean K

Moderator

- Joined

- 21 April 2006

- Posts

- 22,583

- Reactions

- 12,103

Everyone is saying this is a copper play but Anglo has much more than copper. Unless BHP's plans are to sell the diamonds and platinum. Maybe they have to due to jurisdictions.

Whatever the case, good for Dr Copper by the looks.

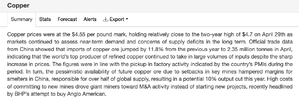

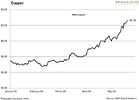

The metal’s resurgence has been fuelled by optimism about a recovery in global manufacturing and booming demand for clean energy technologies including wind turbines and electric vehicle batteries. That has coincided with a string of supply disruptions at major mines which has tightened the physical market.

That has prompted a growing chorus of analysts to upgrade their copper forecasts, with some tipping prices will rocket as high as $US15,000 a tonne over the coming years.

“BHP’s not making a $60 billion bid purely for copper if they don’t think the returns in copper will be as good, if not better, than iron ore for the next 10 years,” said Ben Cleary, portfolio manager of Tribeca’s Global Natural Resources fund.

Whatever the case, good for Dr Copper by the looks.

The metal’s resurgence has been fuelled by optimism about a recovery in global manufacturing and booming demand for clean energy technologies including wind turbines and electric vehicle batteries. That has coincided with a string of supply disruptions at major mines which has tightened the physical market.

That has prompted a growing chorus of analysts to upgrade their copper forecasts, with some tipping prices will rocket as high as $US15,000 a tonne over the coming years.

“BHP’s not making a $60 billion bid purely for copper if they don’t think the returns in copper will be as good, if not better, than iron ore for the next 10 years,” said Ben Cleary, portfolio manager of Tribeca’s Global Natural Resources fund.

Last edited: