- Joined

- 13 February 2006

- Posts

- 5,426

- Reactions

- 12,681

Let's start with Mr fff

So as I pointed out in my previous post, when markets plunge below their 50 day MA, it is only for weeks to a couple of months. Unless it is a recession. How do you actually differentiate? After the fact is easy. At the time, not so much.

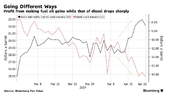

This is true. High energy prices are not good for the overall market.

So a bounce is one thing. A resumption of the trend higher is something else.

The next pivot will be pretty important in trying to determine which is the case.

Not great for stocks.

Bonds bad news for stocks.

There will be endless speculation on what will be announced.

Rest assured, the spin will TRY to be positive for stocks. All need a rising market.

The Treasury NEEDS lower rates. Powell has lost control (if he ever had control) of inflation. That loss of control mandates higher for longer (even though higher rates = higher inflation) and no cuts. Higher rates will impact in a really negative way those companies that need to roll-over and refinance debt that they have been holding out on for lower rates. They will start to have major issues.

Housing market is frozen.

BTC had it's halving on Friday:

A lot of hype around these.

Fact: it is now more expensive for the miners to do the work required.

Speculation: based on previous halvings, speculators expect the price to go up.

Fact: previous halvings occurred without the massive number of ETFs and paper BTC. Does this make a difference?

Next page.

So as I pointed out in my previous post, when markets plunge below their 50 day MA, it is only for weeks to a couple of months. Unless it is a recession. How do you actually differentiate? After the fact is easy. At the time, not so much.

This is true. High energy prices are not good for the overall market.

So a bounce is one thing. A resumption of the trend higher is something else.

The next pivot will be pretty important in trying to determine which is the case.

Not great for stocks.

Bonds bad news for stocks.

There will be endless speculation on what will be announced.

Rest assured, the spin will TRY to be positive for stocks. All need a rising market.

The Treasury NEEDS lower rates. Powell has lost control (if he ever had control) of inflation. That loss of control mandates higher for longer (even though higher rates = higher inflation) and no cuts. Higher rates will impact in a really negative way those companies that need to roll-over and refinance debt that they have been holding out on for lower rates. They will start to have major issues.

Housing market is frozen.

BTC had it's halving on Friday:

A lot of hype around these.

Fact: it is now more expensive for the miners to do the work required.

Speculation: based on previous halvings, speculators expect the price to go up.

Fact: previous halvings occurred without the massive number of ETFs and paper BTC. Does this make a difference?

Next page.