Sean K

Moderator

- Joined

- 21 April 2006

- Posts

- 22,572

- Reactions

- 12,092

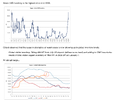

The tough times continue for Dr Copper. The Dr is not seeing many Chinese patients and it looks like the Dr may have caught Covid.

Copper has now fallen >20% from the recent exuberant high.

View attachment 181473

Really hoping that there's some demand at $4.00/lb. Won't mind if it stays at this level for a few months while China works through it's stockpiles. We copper bulls will rub the patina off our copper stocks and they'll shine again next qtr.

Depends on your time frames I think.

Are you turning into a copper bear, P2?

Unless there's a global depression, around $4 looks like long term buy with your ears pinned back to me.