Bill M

Self Funded Retiree

- Joined

- 4 January 2008

- Posts

- 2,132

- Reactions

- 740

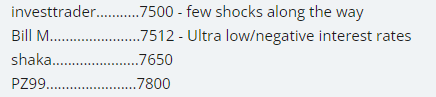

The biggest risk for us retired older people is return of capital, not return on capital. I just reckon that as the share markets being at all time highs it's just going to have to crash at some stage. Probably still going run for a while but we can't risk a massive fall. Even though my prediction is a bit on the high side I am definitely not all in. I can't afford to lose half my money in a stock market crash, so for me return of capital is more important than return on capital. However, if/when that crash comes I'll be straight back in there. Eating a bit of my capital is currently a better option than risking a market crash. If I was working and younger I might be thinking differently. I like your comments, thanks.with low interest rates for the next couple of years ( money in the bank is useless) hence we will see growth in commodities /stock and real estate (residential properties) until we reach the top of the clock which will be represented with energy stocks booming ,then we will see a decline , unfortunately know one knows when,