tech/a

No Ordinary Duck

- Joined

- 14 October 2004

- Posts

- 20,440

- Reactions

- 6,440

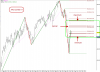

Re: XAO Analysis

Appears I was a day early!

Europe now showing signs of exhaustion in this latest move.

Above analysis now appears set.

Looks as though the 4700 ish analysis for this leg up

may well play out.

looking to see if this gap on the SPI this morning holds.

I expect Europe and US to come off a little tonight.

There always seems to be an exhaustive move that preceeds price and we have seen a few lately.

My bias is now bearish from analysis.

4700+ would alter my view.

Appears I was a day early!

Europe now showing signs of exhaustion in this latest move.

Above analysis now appears set.