- Joined

- 26 February 2007

- Posts

- 358

- Reactions

- 0

Re: XAO Analysis

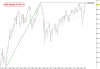

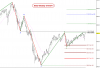

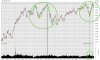

XAO now moved up above both rising supports.

Do these hold any weight? Will they act as resistance going forward?

Interesting that it has broken upwards where the two trend lines cross...

10 of the last 11 days have been green now. Quite a run we've had.

XAO now moved up above both rising supports.

Do these hold any weight? Will they act as resistance going forward?

Interesting that it has broken upwards where the two trend lines cross...

10 of the last 11 days have been green now. Quite a run we've had.

worth.

worth.