Sean K

Moderator

- Joined

- 21 April 2006

- Posts

- 22,645

- Reactions

- 12,247

Re: XAO Analysis

Cheers Tech, always love your posts and effort to share. KennasI'm actually with you on this,the ONLY way I got my head around it was to understand and EXPECT wave counts to alter until they are confirmed.

This is the hardest thing to come to terms with as we all want to have a definitive answer.

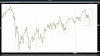

I use it to see where we are in terms of maturity of a move.

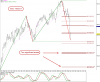

When I see the same or very similar counts occurring in lots of stocks and other indexes sure as hell there is going to be a culmination.

That happened in 2007.Low in March and now.

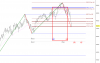

, make what you want of it

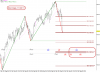

, make what you want of it