Re: XAO Analysis

https://www.aussiestockforums.com/forums/showthread.php?t=4888&p=613895&viewfull=1#post613895

Another excellent call by The Master!:bier:

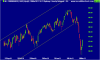

The Feb top is looking suspiciously like a ‘failed 5th wave’ double top.

Yesterday’s wave 3 is 262% of wave 1 and the computer says this is part of a downward sequence.

If so, the XAO should now retrace to 4715 – 4760, then wave 5 could extend down to 4100 (although 4500 seems more likely).

Alternatively, this could have been just a 1 month ABC correction in the upmove, but that seems unlikely since we’ve now gone below wave 1 and that’s not supposed to happen in the cash markets.

As always, I look forward to The Master’s next contribution to confirm or correct my own humble interpretation.

https://www.aussiestockforums.com/forums/showthread.php?t=4888&p=613895&viewfull=1#post613895

Another excellent call by The Master!:bier:

The Feb top is looking suspiciously like a ‘failed 5th wave’ double top.

Yesterday’s wave 3 is 262% of wave 1 and the computer says this is part of a downward sequence.

If so, the XAO should now retrace to 4715 – 4760, then wave 5 could extend down to 4100 (although 4500 seems more likely).

Alternatively, this could have been just a 1 month ABC correction in the upmove, but that seems unlikely since we’ve now gone below wave 1 and that’s not supposed to happen in the cash markets.

As always, I look forward to The Master’s next contribution to confirm or correct my own humble interpretation.