- Joined

- 27 February 2008

- Posts

- 4,670

- Reactions

- 10

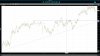

Re: XAO Analysis

uh?

ahha gotya....yeah sorry m8 , it does seem my comments of late always seem to disagree with yours ...... take a bow, because at least i find 90% of your comments worth reading and hence me commenting ...... currently i have 77% of ASF members on ignore so hence the lack of ppl i argue with these days ......hahahah

lol i always figure everyone else is wrong anyways

I'm always long compared to you it seems.

uh?

ahha gotya....yeah sorry m8 , it does seem my comments of late always seem to disagree with yours ...... take a bow, because at least i find 90% of your comments worth reading and hence me commenting ...... currently i have 77% of ASF members on ignore so hence the lack of ppl i argue with these days ......hahahah

lol i always figure everyone else is wrong anyways