- Joined

- 30 June 2007

- Posts

- 7,200

- Reactions

- 1,226

Re: XAO Analysis

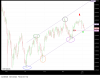

All eyes now starting to turn to that support trendline, begun in March 2009.

It's been respected 4 times already which in my mind is an awful lot. I just can't see it being bounced off a 5th time, not with sentiment the way it is at the moment.

Looks like we are going to creep towards it, rather than drop. If support fails, 4646 is the likely test point.

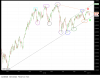

Amazing the lack of matching between the US markets and ours at the moment.

All eyes now starting to turn to that support trendline, begun in March 2009.

It's been respected 4 times already which in my mind is an awful lot. I just can't see it being bounced off a 5th time, not with sentiment the way it is at the moment.

Looks like we are going to creep towards it, rather than drop. If support fails, 4646 is the likely test point.

Amazing the lack of matching between the US markets and ours at the moment.