- Joined

- 26 February 2007

- Posts

- 358

- Reactions

- 0

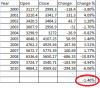

XSO made a pretty strong move today and is now at a 2 year high.

A little squiggly line I like to follow to see whats happening under the 6 Stock All Ords.

Best that can be said about this rise during December is that at least its not over brought!

The closer story is more like a very select few are masking weakness in many.

5000 looks MASSIVE on this chart.

Trading since July suggests we are moving upward in a bullish channel. However we seem to be stalling arround the 4850 mark and I wonder if todays outcome is not the first of one of T/A's "black crows".

My above 50% indicator is also showing the same thing TH, can't post it up atm though as the computer with that data is in the shop getting some minor repairs

That support zone indicates to me that we have seen the bottom and moving sideways at worst. I'm surprised that the markets have found a way out in the short term really. I expected another failure after it became obvious that the money printing with no real substantial change in mind set was established. Maybe the next crash will be so severe to cause the change.Chart with info as discussed.

That support zone indicates to me that we have seen the bottom and moving sideways at worst.

No 'January Effect' this year I'm afraid. The big spec run happened in Nov/Dec. That, plus everyone was gearing up for it with huge expectation.

Got some biomeds running - ADO, PRR. Normally heralds the end of the run, yes?

Sell off in specs, big caps to trundle sideways. SDL looks toppy to me.

My 2c.

You're calling a W5 down from somewhere around here Tech?I still think its floating in Na na land.

Will change my mind if the regression channel is broken to the downside!!

Weekly Elliott.

So most probable is that the May 'bottom' wasn't a bottom at all?Kenna's

Yes there is likely to be a wave 5 down at some point.

The count will alter if the high at the wave 4 pivot is taken out,

The Regression channel is very tight and been well respected so a break below would have me running for my shorts.

The depth of the retracement back towards wave 4 indicates to me that the correction is complex and wont be as clear cut as a clearly trending market. (In my opinion of course).

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.