Whiskers

It's a small world

- Joined

- 21 August 2007

- Posts

- 3,266

- Reactions

- 2

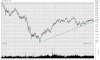

Re: XAO Analysis

I took a bit of guidance from the US markets and some FA analysis, especially that they have made recent higher highs of late as we have faded.

I put that down to the currency/trade war the US has been waging with adverse effects on our export trade. I can't see the US keeping the war up for too long or even wanting it for too long because of the extra import costs it will impose on their import reliant economy.

I'm becoming more confident that the US has lost the fight on the USD for the time being and assuming they have all learnt something in recent years and are keeping a close eye on the ball, but let the market rule, we should see our terms of trade improve in the near future.

In that scenerio, a larger degree wave 3 up for the XAO with a bit of gusto is my plan A.

Whether that is a wave 3 or (c) up, doesn't worry me for the time being cos it will be a good trade with conformation, or not relatively soon.

Anyway, I've put my money where my mouth is and picked up my first' bottom pick' for this cycle today.

for this cycle today.

Wow

Based on wave 3 being approx 1.618 of wave 1 that makes Wave 3 at around 8305 or around a 3250 pt Bull Run.

Must check that GFC thing again!

I took a bit of guidance from the US markets and some FA analysis, especially that they have made recent higher highs of late as we have faded.

I put that down to the currency/trade war the US has been waging with adverse effects on our export trade. I can't see the US keeping the war up for too long or even wanting it for too long because of the extra import costs it will impose on their import reliant economy.

I'm becoming more confident that the US has lost the fight on the USD for the time being and assuming they have all learnt something in recent years and are keeping a close eye on the ball, but let the market rule, we should see our terms of trade improve in the near future.

In that scenerio, a larger degree wave 3 up for the XAO with a bit of gusto is my plan A.

Whether that is a wave 3 or (c) up, doesn't worry me for the time being cos it will be a good trade with conformation, or not relatively soon.

Anyway, I've put my money where my mouth is and picked up my first' bottom pick'