- Joined

- 16 February 2008

- Posts

- 2,906

- Reactions

- 2

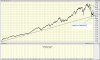

Re: XAO Analysis

Stick with the trend I say!

Keep the banks shorted and the precious metals and base metals long!

Set tight stops. Once the trend changes, get out and look for the next market/sector movement.

Thats my method at least. Pretty simple, but very effective so far.

See how we go, dont want to get too far ahead of myself and end up with my fingers burnt!

Its this, or CASH! Only two ways I see profitable in this market.

Too low to short... conditions are slightly oversold...

Too uncertain to long... medium trend is still down...

Tonight could be just as volatile as last night with the US Emplyoment report out 830am NY Time

http://www.econoday.com/clients/bas...ment_situation/year/2008/yearly/03/index.html

It's gonna either be:,

or

Stick with the trend I say!

Keep the banks shorted and the precious metals and base metals long!

Set tight stops. Once the trend changes, get out and look for the next market/sector movement.

Thats my method at least. Pretty simple, but very effective so far.

See how we go, dont want to get too far ahead of myself and end up with my fingers burnt!

Its this, or CASH! Only two ways I see profitable in this market.