IFocus

You are arguing with a Galah

- Joined

- 8 September 2006

- Posts

- 7,676

- Reactions

- 4,772

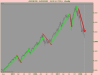

Re: XAO Analysis

Sam as I was reminded the other day H&S patterns are a reversal patten, to be of significance they need to be at the top of a move or trend. Conversely a reverse H&S are at the bottom of a move or trend.

As a pattern they may fail as often as work just depends on the market cycle look at BHP or XMJ on a weekly chart lovely H&S's.

For the pattern to work price must break below the base normally a line drawn across the lows in this case the 5224 area then the pattern is confirmed and price is expected to move to a projected distance.

Hope this helps

Sam as I was reminded the other day H&S patterns are a reversal patten, to be of significance they need to be at the top of a move or trend. Conversely a reverse H&S are at the bottom of a move or trend.

As a pattern they may fail as often as work just depends on the market cycle look at BHP or XMJ on a weekly chart lovely H&S's.

For the pattern to work price must break below the base normally a line drawn across the lows in this case the 5224 area then the pattern is confirmed and price is expected to move to a projected distance.

Hope this helps