Just for the record the futures liedThe Futures say up tomorrow. As I write the UK FTSE100 is up 0.7%.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

XAO Banter Thread

- Thread starter clayton4115

- Start date

- Joined

- 11 September 2008

- Posts

- 844

- Reactions

- 0

Just for the record the futures lied

Futures market didn't lie. The XAO just didn't correspond.

- Joined

- 25 February 2011

- Posts

- 5,689

- Reactions

- 1,233

Futures market didn't lie. The XAO just didn't correspond.

They may not have lied, but my astrologer has been making more accurate predictions regarding the future lately!

Logique

Investor

- Joined

- 18 April 2007

- Posts

- 4,290

- Reactions

- 768

https://encrypted.google.com/url?sa..._fSdAw&usg=AFQjCNEriXlJixskhg7_-MwdR0oxacRmvA - Money Week

How the death cross can tell you when to get out of the market - By Dominic Frisby Jun 30, 2010

..What is a 'death cross'? First, I'll explain what it a 'death cross' actually is.

The 200-day moving average (200 DMA) shows the average price over the last two hundred days. The 50-day moving average (50 DMA) does the same but for the last 50 days.

When the 200-day moving average is sloping down and the 50-day moving average crosses down through it, you have your 'death cross'..

nulla nulla

Positive Expectancy

- Joined

- 24 September 2008

- Posts

- 3,588

- Reactions

- 133

Okay, so today clipped 88 off the xao and we broke through all pretence of support levels.

"The Greeks shall inherit the Earth" seems to be being taken literaly by the Greeks and they think it should be free. The rest of the world seems to be having a problem explaining that it is "The Meek shall inherit the Earth" to the Greeks and they are not having a bar of it. Accordingly the world markets are in decline. If the Greeks aren't going to pay why should anyone else. Anarchy and chaos here we come.

If it doesn't bounce from here, the next support level is 4350 followed by 4250. After that it is anyones guess.

"The Greeks shall inherit the Earth" seems to be being taken literaly by the Greeks and they think it should be free. The rest of the world seems to be having a problem explaining that it is "The Meek shall inherit the Earth" to the Greeks and they are not having a bar of it. Accordingly the world markets are in decline. If the Greeks aren't going to pay why should anyone else. Anarchy and chaos here we come.

If it doesn't bounce from here, the next support level is 4350 followed by 4250. After that it is anyones guess.

Country Lad

Off into the sunset

- Joined

- 11 July 2005

- Posts

- 1,602

- Reactions

- 1,578

..What is a 'death cross'? First, I'll explain what it a 'death cross' actually is.

The 200-day moving average (200 DMA) shows the average price over the last two hundred days. The 50-day moving average (50 DMA) does the same but for the last 50 days.

When the 200-day moving average is sloping down and the 50-day moving average crosses down through it, you have your 'death cross'..

Sounds good and no doubt the inexperienced will grasp it without much research. Looking at its past performance it is well named because you are just about dead by the time they cross. Very much a lagging indicator.

No doubt many of us who have been trading for a long time have been trying to find the holy grail in our spare time to find the signals when we should go long or go short on the market.

tech/a no doubt has some technical systems, others will have their own. I have a very low tech one based on a number market stats and capturing what I consider a measure of sentiment. It gives me an indication when to be more vigilant.

So far I am reasonably happy with mine which took only 20 years to develop and tweak. This time it saw my risk management tighten up 12 April and exit a number of stocks as the stops were hit, plus shorting the index beginning of May as a hedge for the long term high dividend yielding investment shares.

My only comment after years of trying various systems is that the ones that don’t really work are the ones you hear about like the “death cross”. Some of my trading buddies have their own system (each quite different) which, like mine, are all worthwhile as an indicator for a change and a signal to take more care. That is probably the best you can ever expect – except maybe for a well functioning crystal ball.

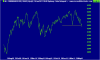

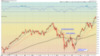

The chart is the All Ords with my system's long and short points.

Cheers

Country Lad

Attachments

skc

Goldmember

- Joined

- 12 August 2008

- Posts

- 8,277

- Reactions

- 329

Okay, so today clipped 88 off the xao and we broke through all pretence of support levels.

"The Greeks shall inherit the Earth" seems to be being taken literaly by the Greeks and they think it should be free. The rest of the world seems to be having a problem explaining that it is "The Meek shall inherit the Earth" to the Greeks and they are not having a bar of it. Accordingly the world markets are in decline. If the Greeks aren't going to pay why should anyone else. Anarchy and chaos here we come.

The day Greek defaults will be the day that markets bounce imo.

Until we start hearing rumbles of Ireland or Spain debt again.

- Joined

- 14 April 2011

- Posts

- 371

- Reactions

- 4

I just read the Buy with Open Arms thread again to cheer myself up.

https://www.aussiestockforums.com/forums/showthread.php?t=19222

I don't know what it is, but over this past month I get out of bed in the morning and always drink from that same half empty glass again. I'm filling it up to the top tonight.

https://www.aussiestockforums.com/forums/showthread.php?t=19222

I don't know what it is, but over this past month I get out of bed in the morning and always drink from that same half empty glass again. I'm filling it up to the top tonight.

Julia

In Memoriam

- Joined

- 10 May 2005

- Posts

- 16,986

- Reactions

- 1,973

Why do you think a Greek default will prompt markets to bounce?The day Greek defaults will be the day that markets bounce imo.

Until we start hearing rumbles of Ireland or Spain debt again.

skc

Goldmember

- Joined

- 12 August 2008

- Posts

- 8,277

- Reactions

- 329

Why do you think a Greek default will prompt markets to bounce?

Here's a slightly dated article (Apr 2010) on lessons from the Russian default.

http://www.marketoracle.co.uk/Article18874.html

Note the 2-day rally on news of actual default announcement. However the bounce was short lived and other contagion crisis (for Russia it was Brazil then LTCM) quickly followed.

Greek default on its own shouldn't be a systemic collapse, but people will soon start to panic about the rest of the PIIGS - and market seems to be more interconnected and moves faster these days...

So history may or may not repeat itself.

Logique

Investor

- Joined

- 18 April 2007

- Posts

- 4,290

- Reactions

- 768

It saved punters a skip load of money in 2008! And the subsequent golden cross brought them back at a pretty good time.Looking at its past performance it is well named because you are just about dead by the time they cross. Very much a lagging indicator.

http://www.moneyweek.com/investment-advice/how-to-invest/death-cross-stock-market-indicator-02609 - How the death cross can tell you when to get out of the market By Dominic Frisby - Jun 30, 2010

..It's not much use for day-traders, but it has proved a reliable indicator for those who look at the intermediate term. So-called 'trend-followers' particularly like it. It won't catch bottoms or tops, but it helps catch the major part of a move..

Attachments

Out of interest does anyone know why it is that the Greek debt problems are now in the forefront? The debt has been impossible to repay for a while now. What is it that forces this particular issue into the media forefront now?

I entirely expect that the news will drift off somewhere else after this, and then it will drift back to Europe etc etc. I get the feeling I should just turn off all news sources - it is probably a distorting effect on ones analysis.

I entirely expect that the news will drift off somewhere else after this, and then it will drift back to Europe etc etc. I get the feeling I should just turn off all news sources - it is probably a distorting effect on ones analysis.

Wysiwyg

Everyone wants money

- Joined

- 8 August 2006

- Posts

- 8,428

- Reactions

- 284

It's almost like an orchestrated squeeze on the financial markets to shake money free from investors/traders. Any excuse will do. The US stock market has kept grinding upwards since March 2009 while we are told there is high unemployment and massive debt. The whole system lives a lie.Out of interest does anyone know why it is that the Greek debt problems are now in the forefront? The debt has been impossible to repay for a while now. What is it that forces this particular issue into the media forefront now?

- Joined

- 25 February 2011

- Posts

- 5,689

- Reactions

- 1,233

The whole system lives a lie.

What's this I hear? Lies? !!

Surely not! So many traders keep assuring me that the market is always right!

Having said this I cannot help but wonder, if the market is always right then why does it keep having corrections?

- Joined

- 25 February 2011

- Posts

- 5,689

- Reactions

- 1,233

Out of interest does anyone know why it is that the Greek debt problems are now in the forefront? The debt has been impossible to repay for a while now. What is it that forces this particular issue into the media forefront now?

I entirely expect that the news will drift off somewhere else after this, and then it will drift back to Europe etc etc.

Don't worry!

There'll be a new global financial scapegoat elected very soon.

The latest rumour is that Italy is shortly to be bestowed this honour!

- Joined

- 14 December 2009

- Posts

- 882

- Reactions

- 2

What's this I hear? Lies? !!

Surely not! So many traders keep assuring me that the market is always right!

Having said this I cannot help but wonder, if the market is always right then why does it keep having corrections?

The market is always right, but sometimes it is more right than other times.

Country Lad

Off into the sunset

- Joined

- 11 July 2005

- Posts

- 1,602

- Reactions

- 1,578

It saved punters a skip load of money in 2008! And the subsequent golden cross brought them back at a pretty good time.

I am not saying it is not useful for people without other ways to judge the market, but most experienced people would have been out long before as stops were hit. The crosses were at a point 20% below the high and 20% above the low which for me is a little late. I assume most people will have their own system ringing the bell a lot earlier than 20%.

Cheers

Country Lad

- Joined

- 3 February 2011

- Posts

- 39

- Reactions

- 0

I am not saying it is not useful for people without other ways to judge the market, but most experienced people would have been out long before as stops were hit. The crosses were at a point 20% below the high and 20% above the low which for me is a little late. I assume most people will have their own system ringing the bell a lot earlier than 20%.

True, but there might be some others that take a (very) long view, have a buy-and-hold strategy, can take a 20% correction but don't want to see their portfolio being dragged in a crash of 50%. I suspect they may still be in a better position if they exit at 20% down and re-enter at 20% up...

cheers,

Country Lad

Off into the sunset

- Joined

- 11 July 2005

- Posts

- 1,602

- Reactions

- 1,578

I am not saying it is not useful for people without other ways to judge the market, but most experienced people would have been out long before as stops were hit. The crosses were at a point 20% below the high and 20% above the low which for me is a little late. I assume most people will have their own system ringing the bell a lot earlier than 20%.

True, but there might be some others that take a (very) long view, have a buy-and-hold strategy, can take a 20% correction but don't want to see their portfolio being dragged in a crash of 50%. I suspect they may still be in a better position if they exit at 20% down and re-enter at 20% up...

Sorry, I don't see the logic in accepting an indicator which is at best lagging when a far better one can be developed, or even better ones are around.

I certainly can not see the logic where you have a very long view buy-and-hold strategy and then sell (and quite happy to wait for a 20% loss before selling). Doesn't make sense to me.

Lets have a look at the last 3 crosses of the so called golden cross with a more readable scale than Logique's chart. The first one triggers pretty well near the bottom, the second one a bit more than halfway through the upturn and the third one has even now not quite triggered the downturn.

By all means defend the "golden cross" and use it as you wish. All I am saying is that I am not happy using something at this level of mediocrity compared to alternatives.

Cheers

Country Lad

Attachments

Logique

Investor

- Joined

- 18 April 2007

- Posts

- 4,290

- Reactions

- 768

No problem with that. Use all tools at your disposal. You don't have to wait until the lines cross.

The XAO is still holding in the down channel. It's starting to feel like 2008 to me, nowhere to earn a dollar, even gold and silver fell last night. Interesting times indeed, could the dreaded double dip be around the corner.

The XAO is still holding in the down channel. It's starting to feel like 2008 to me, nowhere to earn a dollar, even gold and silver fell last night. Interesting times indeed, could the dreaded double dip be around the corner.

Similar threads

- Replies

- 75

- Views

- 11K

- Replies

- 85

- Views

- 28K