You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

XAO Banter Thread

- Thread starter clayton4115

- Start date

- Joined

- 12 January 2008

- Posts

- 7,378

- Reactions

- 18,438

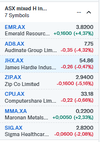

Have ASX tech stocks finally run out of steam?

PME, XRO, 360, HUB, WTC all showing huge down day.

Data-centre stocks down - GMG, MAQ, NXT, IFT,

PME, XRO, 360, HUB, WTC all showing huge down day.

Data-centre stocks down - GMG, MAQ, NXT, IFT,

- Joined

- 15 June 2023

- Posts

- 1,192

- Reactions

- 2,610

The big boys and girls are playing with the market.Have ASX tech stocks finally run out of steam?

PME, XRO, 360, HUB, WTC all showing huge down day.

Data-centre stocks down - GMG, MAQ, NXT, IFT,

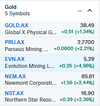

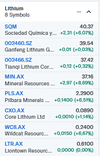

Money seems to jumping from banks and a few other sectors to the already poor-performing mining and Gold stocks.

- Joined

- 20 July 2021

- Posts

- 11,889

- Reactions

- 16,555

well PME management sold 2 million shares 'to aid liquidity ' i guess they were rewarded for that ( sarcasm )Have ASX tech stocks finally run out of steam?

PME, XRO, 360, HUB, WTC all showing huge down day.

Data-centre stocks down - GMG, MAQ, NXT, IFT,

but the rest , most had high valuations already so a pull-back was always possible

and remember no over-eager buyers leave the sellers little choice ( hold onto a loser , or sell for the best price they can get )

- Joined

- 12 January 2008

- Posts

- 7,378

- Reactions

- 18,438

1. Profit taking in the tech's,

2. Bank stocks may dip as their NIMs would be expected to narrow when rates fall, bank rally should stall

3. Current resource stock rally may falter as China is only talking about stimulating their economy while not doing anything.

Leads me to anticipate a market dip (~5% only), considering buying BBOZ or BEAR for a short time. Although I'm not a fan of these two.

It'll be more prudent to reduce exposure now and buy the dip once it's ended.

Sold GEAR, SEMI (will re-buy them at lower prices) and tech stocks. Raising exit stops on the few industrials I own, holding gold, copper, VBTC.

2. Bank stocks may dip as their NIMs would be expected to narrow when rates fall, bank rally should stall

3. Current resource stock rally may falter as China is only talking about stimulating their economy while not doing anything.

Leads me to anticipate a market dip (~5% only), considering buying BBOZ or BEAR for a short time. Although I'm not a fan of these two.

It'll be more prudent to reduce exposure now and buy the dip once it's ended.

Sold GEAR, SEMI (will re-buy them at lower prices) and tech stocks. Raising exit stops on the few industrials I own, holding gold, copper, VBTC.

- Joined

- 8 June 2008

- Posts

- 13,248

- Reactions

- 19,560

I went out of paper gold silver a while back to switch to geared etf and index asx/us looking for a Christmas rally.1. Profit taking in the tech's,

2. Bank stocks may dip as their NIMs would be expected to narrow when rates fall, bank rally should stall

3. Current resource stock rally may falter as China is only talking about stimulating their economy while not doing anything.

Leads me to anticipate a market dip (~5% only), considering buying BBOZ or BEAR for a short time. Although I'm not a fan of these two.

It'll be more prudent to reduce exposure now and buy the dip once it's ended.

Sold GEAR, SEMI (will re-buy them at lower prices) and tech stocks. Raising exit stops on the few industrials I own, holding gold, copper, VBTC.

Got out today.

I do not doubt tomorrow the rally will start but i am now back to gold silver bear and cash.

Even a 6m td at 5.1% in the super.not a bad way to space share entries and decent return while waiting, i also use isec and bill on the asx for cash returns

Market not happy..........red across all sectors at time of posting

US stocks reverse gains after Fed halves rate-cut forecast for next year By Investing.com

US stocks reverse gains after Fed halves rate-cut forecast for next year

www.investing.com

- Joined

- 14 February 2005

- Posts

- 15,347

- Reactions

- 17,679

Santa's either incredibly late or not coming this year so far as the market's concerned.looking for a Christmas rally

That said, yesterday was somewhat more positive for me personally. So maybe......

- Joined

- 8 June 2008

- Posts

- 13,248

- Reactions

- 19,560

Yes so it was for me until the US market crashed this morningSanta's either incredibly late or not coming this year so far as the market's concerned.

That said, yesterday was somewhat more positive for me personally. So maybe......

Dona Ferentes

Pengurus pengatur

- Joined

- 11 January 2016

- Posts

- 16,588

- Reactions

- 22,615

slow openings today ...

- Joined

- 15 June 2023

- Posts

- 1,192

- Reactions

- 2,610

It seems that the US market didn't like the warning that future rate cuts would be minimised because of the continual inflation and that has taken its toll here.

81 point drop on the All Ords isn't that bad at the moment.

81 point drop on the All Ords isn't that bad at the moment.

- Joined

- 15 June 2023

- Posts

- 1,192

- Reactions

- 2,610

- Joined

- 20 July 2021

- Posts

- 11,889

- Reactions

- 16,555

although i have only been interested in the market for about 12 years , Santa often seemed to be a little tardySanta's either incredibly late or not coming this year so far as the market's concerned.

That said, yesterday was somewhat more positive for me personally. So maybe......

but given recent market record highs , some profit-taking was likely

now i would think a 10% retrace ( from the record highs ) would be unlikely before Xmas .. but we we must be getting close to a 5% decline , which might trigger some stop-loss activity

- Joined

- 12 January 2008

- Posts

- 7,378

- Reactions

- 18,438

Took the opportunity to buy some index ETFs, GEAR, GGUS. Half positions only and prepared to buy again at lower prices.

I'm buying this dip as I think the selloff is irrational. The Fed rate cut was very likely and it's very likely to hold for quite some time as inflation stays at this level. US tech and semi-cons still have promising outlooks. US economy in good shape if you ignore the huge gov't debt ( ).

).

Meanwhile in Aust inflation is at a higher level and likely to stay at this level for longer. Inflation must remain high if we pay workers 20% more every six months. No rate cuts for Aust. This'll help the banks but resource prices remain low due to poor economic growth in China. Bar-bell market, banks OK, resources down. Will likely look to US markets for income and capital growth next year.

I'm buying this dip as I think the selloff is irrational. The Fed rate cut was very likely and it's very likely to hold for quite some time as inflation stays at this level. US tech and semi-cons still have promising outlooks. US economy in good shape if you ignore the huge gov't debt (

Meanwhile in Aust inflation is at a higher level and likely to stay at this level for longer. Inflation must remain high if we pay workers 20% more every six months. No rate cuts for Aust. This'll help the banks but resource prices remain low due to poor economic growth in China. Bar-bell market, banks OK, resources down. Will likely look to US markets for income and capital growth next year.

Dona Ferentes

Pengurus pengatur

- Joined

- 11 January 2016

- Posts

- 16,588

- Reactions

- 22,615

- Joined

- 15 June 2023

- Posts

- 1,192

- Reactions

- 2,610

The Fed cut was predicted fairly well, what got people was not to expect 4 rate cuts next year, possibly only 2.Took the opportunity to buy some index ETFs, GEAR, GGUS. Half positions only and prepared to buy again at lower prices.

I'm buying this dip as I think the selloff is irrational. The Fed rate cut was very likely and it's very likely to hold for quite some time as inflation stays at this level. US tech and semi-cons still have promising outlooks. US economy in good shape if you ignore the huge gov't debt ().

Meanwhile in Aust inflation is at a higher level and likely to stay at this level for longer. Inflation must remain high if we pay workers 20% more every six months. No rate cuts for Aust. This'll help the banks but resource prices remain low due to poor economic growth in China. Bar-bell market, banks OK, resources down. Will likely look to US markets for income and capital growth next year.

It was a large pull back on the US markets, which makes me wonder what else is coming.

The markets were trading at highs, we have some excitement with AI in the mix. Am surprised that the live screen isn't blinking away crazily. Volumes not that bad, or am I dreaming? (for those with Commsec, there's a new watchscreen which is live) Came back after 3 hours absence, hardly anything has changed. ??? can't be that bad? Won't it be nice when, if we can ask tomorrow ' what was that all about yesterday?The Fed cut was predicted fairly well, what got people was not to expect 4 rate cuts next year, possibly only 2.

It was a large pull back on the US markets, which makes me wonder what else is coming.

Asian markets aren't that fussed, down slightly

Last edited:

Similar threads

- Replies

- 75

- Views

- 11K

- Replies

- 85

- Views

- 28K