Yeah, hope it works out but those last 2 days are a bit mingy compared to the long takedown bars.What's wrong with Logique's assessment of what has occurred?

They haven't said there's any guarantee as to the future but the comment seems pretty spot on in terms of what's happened thus far. It's a more convincing bounce that anything else since the decline got underway - no guarantees what happens next of course.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

XAO Banter Thread

- Thread starter clayton4115

- Start date

Logique

Investor

- Joined

- 18 April 2007

- Posts

- 4,290

- Reactions

- 768

I can't imagine what it must be like to stand out on the street all day, just to get inside of a Centrelink office, especially if it was someone's the first time ever. There's some real suffering out there in the community.

I just think we need to be careful with our messaging. Factual, but upbeat wherever possible.

Massive stimulus from US & Aust governments has led to a few better days, but we need trend follow through now. Nobody said a V-shape recovery was likely

I just think we need to be careful with our messaging. Factual, but upbeat wherever possible.

Massive stimulus from US & Aust governments has led to a few better days, but we need trend follow through now. Nobody said a V-shape recovery was likely

- Joined

- 8 June 2008

- Posts

- 13,229

- Reactions

- 19,518

That mean common sense and freedom for the employees to act..Well I hope that Centrelink management will soon make a V-shape recovery in realising that each person can be texted a queue number and place in the queue, instead of spilling out on to the street like alphabet soup!

If a local employee does that, it will be against so many rules he she would get sacked, then social media will be full of angry warroers because a pregnant or Aborigines..you name it person will not have been prioritises properly

In time of war and crisis only do we see exposed the worst of people and systems .

All these fake jobs, and Kafkaesque rules

- Joined

- 6 September 2016

- Posts

- 1,260

- Reactions

- 1,597

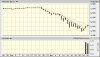

Here's a thought for the weekend now that the market is closed.

This move has been so fast! So let's remove time from the charts.

Here's the range bar chart (each bar is 100 XJO points), with some vertical lines at the end of Dec 2019, end of Jan 2020, end of Feb 2020:

wowsers! Quite a show.

Now let's do the range bar chart for STW (each bar is $1), just to see the diff with no overnight action:

This move has been so fast! So let's remove time from the charts.

Here's the range bar chart (each bar is 100 XJO points), with some vertical lines at the end of Dec 2019, end of Jan 2020, end of Feb 2020:

wowsers! Quite a show.

Now let's do the range bar chart for STW (each bar is $1), just to see the diff with no overnight action:

- Joined

- 6 September 2016

- Posts

- 1,260

- Reactions

- 1,597

Who knows...maybe the announcements out of Europe that they are going to do fiscal stimulus plus whatever the Fed is doing is starting to hold the line?

If, and it's a big if, 4420 is the swing low then there are fib retracements at 5077 ~5% higher, 5483 ~14% higher, 5811 ~20% higher, 6139 ~28% higher...

View attachment 101661

Well, it was a big if @kid hustlr , but 4420 turned out to be the swing low.

5077 we dinged, didn't make it to 5483 yet though. Who knows if we will.

Fib retracement from 4420 to the current minor swing high around 5400 had 5028 as the 0.382 retracement, which along with the confluence of a trendline I pulled out of my arse was where the price bounced this afternoon as the market closed:

enough to get us to 5483 and maybe even 5811?

dunno, but fun to watch.

- Joined

- 9 June 2011

- Posts

- 1,926

- Reactions

- 483

Well said.

Also the fun to watch comment, I'm due for a purchase next week but apart from that it's just making good tv for me

Also the fun to watch comment, I'm due for a purchase next week but apart from that it's just making good tv for me

- Joined

- 6 September 2016

- Posts

- 1,260

- Reactions

- 1,597

- Joined

- 6 September 2016

- Posts

- 1,260

- Reactions

- 1,597

- Joined

- 6 September 2016

- Posts

- 1,260

- Reactions

- 1,597

- Joined

- 17 August 2006

- Posts

- 7,930

- Reactions

- 8,655

What a wiiild day! Bids came in before/on the close again...

FTSE and DAX pre open getting pushed hard to the down side … could also be a wild night!

- Joined

- 3 April 2013

- Posts

- 1,056

- Reactions

- 269

- Joined

- 6 September 2016

- Posts

- 1,260

- Reactions

- 1,597

- Joined

- 3 April 2013

- Posts

- 1,056

- Reactions

- 269

Is what getting "covid under control vs reacting slow to covid" looks like?

XJO vs ES

View attachment 101883

I used this to add to my BEAR.ASX position yesterday, I am now at 'close my eyes and cross my fingers' size.

Woke up to ES down 4.5%, down 1%ish RTH after a fun close? At least I 'shouldn't' blow my account this morning which would be nice

- Joined

- 6 September 2016

- Posts

- 1,260

- Reactions

- 1,597

Activity above the trendline starting to look distribution-y

View attachment 101887

Think there needs to be a bullish US session to keep it alive.

Well, there was no bullish US session.

Where the market closed overnight is riiiiiight right on top of the 0.236 Fib retracement from the Feb highs => March lows, but it doesn't look healthy:

1H chart

Trendline I posted last night got broken and rejected on test, last chance trend line coming right up below that, with a confluence of the 0.382 retracement from the current 4400 swing low => 5400 swing high:

15M chart:

a break down could see us back at 4623, but maybe we will hold?

with bonds getting bid again and gold holding the line, I'll likely be buying equity dips on fresh cashflow again...

Attachments

So I noticed bbus was going up into close yesterday. Day before I think it was down. Is it any good as a prediction tool on the dow?

I basically have app charting capabilities at the moment. So hard to investigate.

It seemed to diverge a bit from our market yesterday. Which seemed to indicate a lot more then the futures were at the time.

I suppose it's only useful if xao follows the dow.

I basically have app charting capabilities at the moment. So hard to investigate.

It seemed to diverge a bit from our market yesterday. Which seemed to indicate a lot more then the futures were at the time.

I suppose it's only useful if xao follows the dow.

- Joined

- 6 September 2016

- Posts

- 1,260

- Reactions

- 1,597

- Joined

- 6 September 2016

- Posts

- 1,260

- Reactions

- 1,597

Is it any good as a prediction tool on the dow?

I basically have app charting capabilities at the moment. So hard to investigate.

It's not a predictor. It just holds short SPX futures...

- Joined

- 6 September 2016

- Posts

- 1,260

- Reactions

- 1,597

Knobby22

Mmmmmm 2nd breakfast

- Joined

- 13 October 2004

- Posts

- 9,877

- Reactions

- 6,895

I don't feel there is a proper floor/base to the recent rise.

Not a chartist but I feel we will get roughly a 10% fall then a 5% rise Then a big 25% fall over the next two weeks.

The existing mood is completely unrealistic, hopelessness will be the next mood.

Not a chartist but I feel we will get roughly a 10% fall then a 5% rise Then a big 25% fall over the next two weeks.

The existing mood is completely unrealistic, hopelessness will be the next mood.

Similar threads

- Replies

- 75

- Views

- 11K

- Replies

- 85

- Views

- 27K