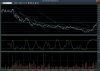

I think (and hope) that this stock is going to rally and head north - mainly because I believe that the removal of Mr Tinkler and the opportunity for an additional payout or takeover bid can only be beneficial to the shares value.

Not a recommendation to buy, my opinion only.

I agree. I sold out a great deal of my portfolio when 5000 broke and am only just about ready to return.

A buy at 1.90 is good business, especially when its highly likely there will be a takeover. IMO of course!