- Joined

- 31 October 2008

- Posts

- 22

- Reactions

- 0

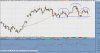

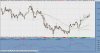

The DX for example, when it was at the trend line, i was alert for a potential trend change on the other pairs. Some of the other pairs had no support/resistance that was obvious, the DX can provide an idea where trends may stall, or resume.

Cheers,

CanOz

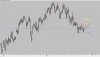

Just the opposite for me. It may sounds crazy or stupid but it is true. I trade EUR/USD and some AUD/USD, but never refer to the US Dollar Index except for the first few months of my forex trading.

Simpler is better. Since the the index is derived from those pairs I will watch closely what I'm trading and find my hints there. I have same opinion towards indicators. the less the better. no macd, no rsi, no bb just price bar and S/R lines. I'm not sure if my way is the best way of trading but I'm sure it is profitable and something I can understand.