CanOz

Home runs feel good, but base hits pay bills!

- Joined

- 11 July 2006

- Posts

- 11,543

- Reactions

- 519

Dollar Gains Show U.S. Leading Shift to Stocks: Chart of the Day

2013-03-15 04:00:00.6 GMT

By David Wilson

March 15 (Bloomberg) -- The dollar’s strength in the midst

of a more stable financial system signals the U.S. will lead a

worldwide shift toward stocks from bonds, according to Michael

Hartnett, Bank of America Corp.’s chief investment strategist.

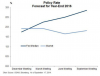

The CHART OF THE DAY tracks the performance of the Dollar

Index, a gauge of the U.S. currency’s value against those of six

major trading partners, and a Bank of America index of global

financial stress. Hartnett used a similar chart in a report

yesterday.

This year’s moves in the indicators helped bring “a

decisive end” to a relationship between them that developed

before the 2008 financial crisis and pointed to deflation, the

New York-based strategist wrote. The Dollar Index has risen as

much as 3.9 percent, while the Bank of America index has shown

below-normal stress levels all year.

“The leadership of the U.S. in the Great Rotation remains

ongoing” because of the decoupling, the report said. Hartnett

was referring to a return to more normal economic growth and

interest rates, which prompts investors to add equities and

reduce debt holdings.

Stocks have room to advance, Hartnett wrote, in the absence

of surging interest rates or falling corporate profit margins. A

“sellers’ strike” by investors concerned about missing a rally

may help lift share prices, he added.

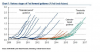

MSCI Inc.’s broadest stock-market gauge, the All-Country

World Index, gained 6.5 percent for the year through yesterday.

U.S. shares were even more rewarding, as the Standard & Poor’s

500 Index climbed 9.6 percent and approached a record set in

October 2007.

For Related News and Information:

BofA Global Financial Stress Index: GFSI <Index> DES <GO>

MSCI-S&P 500 comparison: MXWD <Index> COMP YTD SPX <GO>

Dollar Index intraday movers: DXY <GO>

U.S. stock strategy: TNI USS STRATEGY <GO>

Stock-market top stories: TOP STK <GO>

Charts, graphs home page: CHART <GO>

--Editors: Jeff Sutherland, Michael P. Regan

To contact the reporter on this story:

David Wilson in New York at +1-212-617-2248 or

dwilson@bloomberg.net

Anyway QE is about to end, unemployment/employment figures are getting better, eventually rates will rise supporting the USD.

Cheers for that RY,

Where did you get the graphs from?

Thanks for the in depth take on that too. I am on another subscribed forum (paid) yet its clear that members here have so much broad knowledge.

I feel im the small fish lol

Hi rimtas,

Anyway QE is about to end, unemployment/employment figures are getting better, eventually rates will rise supporting the USD.

USD is not rising because the economy is getting better, it is rising because it is the most sickiest currency in the world.

USD is not rising because the economy is getting better, it is rising because it is the most sickiest currency in the world.

Most of the dollars are debt and USD index represents only those USD that are cash, not debt. Debt is now imploding, so the fight for remaining cash dollars started to emerge at full swing. It is not a good sign, it is actually a very bad sign for markets overall. When market participants who trade stocks start to realize what is happening, they also will join the battle for the remaining dollars selling their shares. So better be prepare for this. Debt implosion is a very bad thing for the markets.

Cheers Rimtas,

Whats your take on the S&P500 rising so much since the GFC?

Too much loose monetary policy, ie QE.

Im not sure what to make of it as the higher implied yields would generally see a rotation of funds from equities to cash for the interest.

However something like 73% of the market is not invested in the markets yet.

Interesting times and while ive not been in the game that long, im not sure theres been a time like this before.

A lot of chatter lately about the S&P500 companies themselves being responsible for the upward trajectory of the market. Maybe because of the QE but not necessarily the QE money.

http://www.zerohedge.com/news/2014-...ely-indiscriminate-buyer-stocks-first-quarter

Whats your take on the S&P500 rising so much since the GFC?

Too much loose monetary policy, ie QE.

Im not sure what to make of it as the higher implied yields would generally see a rotation of funds from equities to cash for the interest.

However something like 73% of the market is not invested in the markets yet.

Interesting times and while ive not been in the game that long, im not sure theres been a time like this before.

Rimtas

Sorry if parts are just re-stating the obvious to you. It's just not obvious to me.

.

Today, the Treasury will not give anyone anything tangible in exchange for a dollar. Even though Federal Reserve notes are defined as “obligations of the United States,” they are not obligations to do anything. Although a dollar is labeled a “note,” which means a debt contract, it is not a note for anything.

Congress claims that the dollar is “legally” 1/42.22 of an ounce of gold. Can you buy gold for $42.22 an ounce? No. This definition is bogus, and everyone knows it. If you bring a dollar to the U.S. Treasury, you will not collect any tangible good, much less 1/42.22 of an ounce of gold. You will be sent home.

Some authorities were quietly amazed that when the government progressively removed the tangible backing for the dollar, the currency continued to function. If you bring a dollar to the marketplace, you can still buy goods with it because the government says (by “fiat”) that it is money and because its long history of use has lulled people into accepting it as such. The volume of goods you can buy with it fluctuates according to the total volume of dollars ”” in both cash and credit ”” and their holders’ level of confidence that those values will remain intact.

Let’s attempt to define what gives the dollar objective value. The dollar is “backed” primarily by government bonds, which are promises to pay dollars. So today, the dollar is a promise backed by a promise to pay an identical promise. What is the nature of each promise? If the Treasury will not give you anything tangible for your dollar, then the dollar is a promise to pay nothing. The Treasury should have no trouble keeping this promise.

I called the dollar “money.” By the definition given there, it is. I used that definition and explanation because it makes the whole picture comprehensible. But the truth is that since the dollar is backed by debt, it is actually a credit, not money. It is a credit against what the government owes, denoted in dollars and backed by nothing. So although we may use the term “money” in referring to dollars, there is no longer any real money in the U.S. financial system; there is nothing but credit and debt.

To determine what trend dominates the markets everyone can do this by monitoring the two most sensitive barometers of monetary trends. One is the currency market. If the price of the dollar against other currencies begins to plummet, it might mean that the market fears dollar inflation(the opposite is true). On the other hand, it might simply mean that credit denominated in other currencies is deflating faster than credit denominated in dollars or that foreign demand for dollars to buy U.S. stocks, property and products has waned.

The other monetary barometer, which is more important, is the gold market. If gold begins to soar in dollar terms, then the market almost surely fears inflation. As the gold is now in a downtrend, the opposite is obvious.

The bond market will not make the best barometer of inflation because much of it will fall under either scenario.

Hello and welcome to Aussie Stock Forums!

To gain full access you must register. Registration is free and takes only a few seconds to complete.

Already a member? Log in here.