DeepState

Multi-Strategy, Quant and Fundamental

- Joined

- 30 March 2014

- Posts

- 1,615

- Reactions

- 81

FYI.

Just rebuilding some stuff. Here's some basic results on one widely known strategy. Checking (confirming, really) for evidence of momentum in relative performance. Currencies over-react in the near term for various reasons. Over longer timeframes the behavior is different. Currency is not like other asset classes and does not impound information which is discounted far more quickly in other asset types.

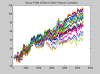

A very basic first step to checking if a concept works is to generate 'signal' and check to see if it has predictive power. That all sounds very obvious. However, the way this is done from the world I came from is not along the time dimension for a single currency. That is, not thinking in terms of a single currency pair and looking for turning points through time. Instead it compares their merits across a set of choices at a given time. The methods are different and so is the trading and portfolio management.

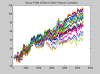

So here are some results on a very simple signal based on the returns of a set of currencies vs USD for one fixed period (eg. like 3 months). It doesn't get much simpler. The currencies are the majors per prior entry. To check for implementation we check for the decay profile (what happens if you are slow to implement). We split the time periods etc.. First, we check for rationale. The tests actually come much later.

There is strong evidence of a viable signal on just this simple idea alone. There are many steps to go from here before this baby is ready for the track. But, it has form.

Data is 20 years to today for six currency pairs alone (with more, you can expect even stronger outcomes). Daily data. Signal is just historical 3 month return vs USD. How simple! There are virtually no moving parts to fiddle and hence data mining risk is way down. You can write the formula on a pea by hand. A good test.

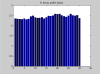

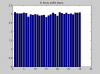

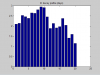

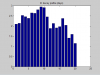

What is being analysed are the ranks of the signal and the ranks of the outcome. This controls for a lot of issues related to risk management or the time being. The decays show how the performance of the strategy varies as you delay implementation from overnight to 20 business days. Notice how it rises before falling...that's because currencies over-react in the near term. It is actually better to let things slide a bit. Perhaps there is room here for T/A type analysis to finesse it.

Results are strongly statistically significant. Analysis of the last 10 years is borderline statistically significant and the shape of the decay curve is basically the same.

WARNING: If you choose to build a portfolio on this idea without some very decent risk management ability any apparent insight will be strongly eroded. Also, this is not the same as saying just because a currency pair has moved in a direction that it will keep doing so.

Because there are no fundamentals used as a direct input, you could possibly label it as a form of T/A for this predictor. Generally, this type of process would not be called technical analysis in the industry. For me, if it (more likely something different) survives further refinements, it would form one part of a wider set of strategies so the whole suite would not be said to be pure T/A. A mix of ideas helps with robustness. Momentum can be slow to turn or, no surprise, overrun.

Here is an idea which has good rationale before examination of outcomes, is formed by a method that is almost impossible to simplify, is strongly statistically significant, easily covers frictions (what frictions?), and can be implemented due to adequate time allowance for trading prior to decay.

If there are others out there working on anything in this area....

Just rebuilding some stuff. Here's some basic results on one widely known strategy. Checking (confirming, really) for evidence of momentum in relative performance. Currencies over-react in the near term for various reasons. Over longer timeframes the behavior is different. Currency is not like other asset classes and does not impound information which is discounted far more quickly in other asset types.

A very basic first step to checking if a concept works is to generate 'signal' and check to see if it has predictive power. That all sounds very obvious. However, the way this is done from the world I came from is not along the time dimension for a single currency. That is, not thinking in terms of a single currency pair and looking for turning points through time. Instead it compares their merits across a set of choices at a given time. The methods are different and so is the trading and portfolio management.

So here are some results on a very simple signal based on the returns of a set of currencies vs USD for one fixed period (eg. like 3 months). It doesn't get much simpler. The currencies are the majors per prior entry. To check for implementation we check for the decay profile (what happens if you are slow to implement). We split the time periods etc.. First, we check for rationale. The tests actually come much later.

There is strong evidence of a viable signal on just this simple idea alone. There are many steps to go from here before this baby is ready for the track. But, it has form.

Data is 20 years to today for six currency pairs alone (with more, you can expect even stronger outcomes). Daily data. Signal is just historical 3 month return vs USD. How simple! There are virtually no moving parts to fiddle and hence data mining risk is way down. You can write the formula on a pea by hand. A good test.

What is being analysed are the ranks of the signal and the ranks of the outcome. This controls for a lot of issues related to risk management or the time being. The decays show how the performance of the strategy varies as you delay implementation from overnight to 20 business days. Notice how it rises before falling...that's because currencies over-react in the near term. It is actually better to let things slide a bit. Perhaps there is room here for T/A type analysis to finesse it.

Results are strongly statistically significant. Analysis of the last 10 years is borderline statistically significant and the shape of the decay curve is basically the same.

WARNING: If you choose to build a portfolio on this idea without some very decent risk management ability any apparent insight will be strongly eroded. Also, this is not the same as saying just because a currency pair has moved in a direction that it will keep doing so.

Because there are no fundamentals used as a direct input, you could possibly label it as a form of T/A for this predictor. Generally, this type of process would not be called technical analysis in the industry. For me, if it (more likely something different) survives further refinements, it would form one part of a wider set of strategies so the whole suite would not be said to be pure T/A. A mix of ideas helps with robustness. Momentum can be slow to turn or, no surprise, overrun.

Here is an idea which has good rationale before examination of outcomes, is formed by a method that is almost impossible to simplify, is strongly statistically significant, easily covers frictions (what frictions?), and can be implemented due to adequate time allowance for trading prior to decay.

If there are others out there working on anything in this area....