Guys,

I have a bad feeling about what is coming!

Not too relevant to this thread but today I exited my longs in EWH and FXI (international) and used the proceeds to long on IAU (ASX) and some more gold.

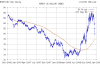

50 and 100 day MAs have been creamed. As I write this USDX sitting at 80.253 (with last trade at 79.825 and previous close of 77.736), with the 200-day MA beginning a downward turn at high 77s low 78s. Not a lot of room left to feel optimistic.

I can see both sides of the coin in terms of USD bull and bear, but fear the worst. It is worth noting some huge gapping down from 83 to 82 and smaller gaps just above 80, as gaps tend to be filled one way or another, so there is some hope for USD bulls.

I have a bad feeling about what is coming!

Not too relevant to this thread but today I exited my longs in EWH and FXI (international) and used the proceeds to long on IAU (ASX) and some more gold.

50 and 100 day MAs have been creamed. As I write this USDX sitting at 80.253 (with last trade at 79.825 and previous close of 77.736), with the 200-day MA beginning a downward turn at high 77s low 78s. Not a lot of room left to feel optimistic.

I can see both sides of the coin in terms of USD bull and bear, but fear the worst. It is worth noting some huge gapping down from 83 to 82 and smaller gaps just above 80, as gaps tend to be filled one way or another, so there is some hope for USD bulls.