tech/a

No Ordinary Duck

- Joined

- 14 October 2004

- Posts

- 20,447

- Reactions

- 6,477

But the really extraordinary part is how calm and focused Tech has remainedmust be tooo busy chatting up blonds, BTW tech / Boggo and others some nice charts and thanks.

An excellent pass time I can recommend it. Particularly if you can find one that makes sence. Fun all the same even if you cant!

Tech,

what are the three lines going though the price on the highs? (blue green and red)

do you think the 4 is complete now, in EW do you allow for minor thrusts?

Cheers

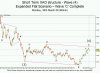

They are a proprietary indicator developed by AGET for their software.

They appear in Wave 4 moves only. Evidently they did extensive studies that showed that these 3 "timelines"

Blue Shortest

Green mid

Red longest

Display a characteristic which can be determinate on the severity of the wave 5 corrective move.

If the wave 5 starts from the Blue then there is an 80% chance (according to their studies which I cant verify) of the wave 5 being quick and severe.

60% at green and 40% at red.

The longer the wave 4 takes to play out the less Severe the wave 5 will be.

You will still get a wave 5 but its not likley to be a crash type move.

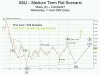

Looking at BHP then this is likely the scenerio.

A new low is unlikley and the final wave 5 is likley to be Slow and tedious.

This is the current analysis and until proven false you would be long expecting a wave 5 correction which will be as boring as hell and is likely

around now to the 8th Purple and Blue Make or Break lines (MOB).